58% of Modified Mortgages Re-default after 8 Months: Why are Loan Modifications not Working?

- 1 Comment

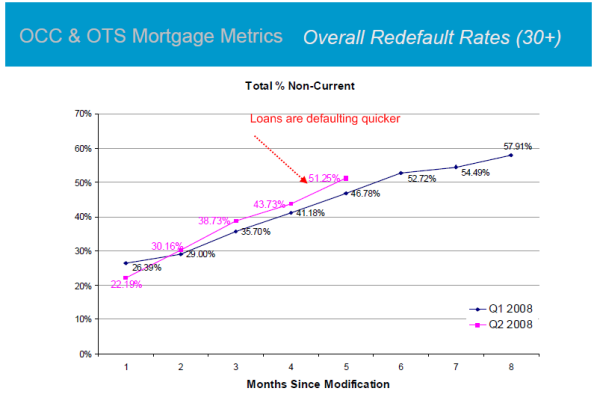

The Office of the Comptroller of the Currency released data today showing that over half of modified mortgages are back in default after only 6 months. More startling data is that 36 percent of the borrowers re-defaulted after only 3 months. What this is telling us is that modifications are not helping to buffer the housing market in any significant measure.

Now I have talked about why the housing market which started expanding in an unhealthy way in 1979 is simply operating under different rules in this climate. The information released today is telling because it covers 35 million loans with a market value of over $6 trillion. In other words it is a good market sample of the mortgage market.

Before we move on, let us first look at a graph of the data released today:

What we see on the chart is troubling. Obviously any loans modified in the first quarter have a window of 6 months to 9 months so the data is more full. Even then, we already see that loans are defaulting at stunning rates. Now why is that? First, we need to look at where foreclosures are occurring. 4 states, California, Florida, Nevada, and Arizona make up over 50% of all foreclosure filings for the year. This is extremely centralized. These states had the biggest bubbles and prices have fallen drastically here.

California has fallen off a cliff and doesn’t show any signs of returning anytime soon. The problem with this idea of loan modifications is you are using nationwide ideals of trying to keep people in their homes when many of the borrowers in these 4 states, really don’t want to stay in their homes. Even if they wanted to stay in their home, there is no way you are going to be able to modify a loan sufficiently where a home bought for $550,000 is now selling for $300,000. This is happening all across states like California.

The core of the problem is you have loans made with no diligence now having standards being applied. Take for example IndyMac Bank which is under the auspice of the FDIC. They have tried this experiment with many loans here in California:

“(FDIC)Â What modification options will be available to borrowers?

Under the IndyMac Federal program, eligible mortgages would be modified into sustainable mortgages permanently capped at the current Freddie Mac survey rate for conforming mortgages (now about 6.5%). Modifications would be designed to achieve sustainable payments at a 38 percent debt-to-income (DTI) ratio of principal, interest, taxes and insurance. To reach this metric for affordable payments, modifications could adopt a combination of interest rate reductions, extended amortization, and principal forbearance.”

So how has this gone for IndyMac? Not that well. They have mailed out 23,000 loan modifications and this is what they have to show:

“On average, the modifications have cut each borrower’s monthly payment by more than $380, or 23% of the monthly payment on principal and interest, she reported.”

Even just a month ago this is what analyst were saying:

“(MarketPlace)Â For the industry in general, after mortgages are modified roughly 25% go delinquent again after just one post-modification payment and more than half end up delinquent after several post-modification payments, Lender Processing Services told the analysts.

The FDIC’s broader modification proposal assumes a re-default rate of roughly 33% — about 2.22 million mortgages would be altered to avoid 1.5 million foreclosures, according to the plan. The government would share up to half of the losses from re-defaults with lenders and investors.”

Simply incredible. This above report was released on November 18, 2008. So in less than one month the FDIC has underestimated loan defaults by approximately 100%. Out of 100 loans they thought 25 would re-default when in reality it is closer to 58.

Again, this is happening because in states like California a $380 savings is not enough to keep you in a home that is underwater by $100,000 or $200,000. In addition, the unemployment rate in California is now at 8.2%, the third highest in the nation. So even if rates are reduced, this may have worked in a solid economy but we are now in a full blown recession.

These loan modifications were never setup to work. They assume borrowers will be willing to carry the burden of a mortgage that doesn’t reduce the principal. That is absurd. Borrowers are smarter than that. I was looking at some of the modifications that have initial 2 year payments which adjust after that to a cap and then balloon at the end yet the principal was never reduced! Why would anyone agree to this? It essentially forces borrowers into renting for life. In addition, the median household income in California is approximately $50,000 so how are they going to support a $300,000 mortgage which is the current median and the loan mods are trying to keep the original principal of $400,000 to $500,000? The math doesn’t work. Take a look at a $46,000 budget and you tell me how the modifications ever stood a chance of working.

And many of these loans are re-defaulting because of economic factors. The perception was these loans were simply bad and borrowers needed “good” loans. Well now they got the so-called good loans and re-defaulted. It doesn’t make sense because from the beginning the loan was flawed.

What we need is a brutal assessment and triage in these states. Those that can’t make a loan realistically need to be helped and found a decent rental. The home can be taken back and then sold forcing the current lender to eat the loss. That is what is problematic with the notion of loan modifications as they stand. They place the burden on tax payers and borrowers with no stringent write-downs from the lenders. That is why with the TARP they fought so hard to oppose cram-downs from judges. This ironically, is something that would work and keep borrowers in their homes but of course, why would we want to help homeowners here?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

Tashi said:

I know why we will probably default after our loan mod…the modification was a joke. The term of our loan went from 30 years to 43 years! There was no principal reduction of any kind, and our payments are only lower for 5 years. We are way underwater on our home – since our credit is already shot why should we play ball on this?

July 7th, 2010 at 2:00 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!