Credit Card Companies Evolving Revenue Streams: Penalty for Paying on Time, 79.9% Annual Fee, Rising Charge Offs. The New Credit Card Revenue Streams.

- 14 Comment

The love hate relationship with credit cards for many Americans is probably leaning more in the hate stage at the moment. Americans have over $2 trillion in revolving debt – $1 trillion of that is plastic. The average American has come to rely on credit cards as a form of supplemental income, like retirees come to rely on Social Security. You would assume with the Federal Reserve flooding banks with easy money that credit card terms would ease up on consumers. They have not. If anything, terms have gotten more onerous in the last year. Credit card companies are battling with increasing default rates and trying to figure out how to maximize profits. As it turns out, they now have to cannibalize their good customers for their horrid lending practices during the debt bubble.

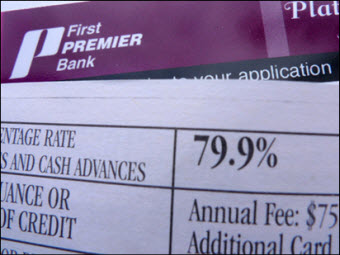

Take for example a report that NBC San Diego did. They found a credit card that was offering a 79.9% annual rate. Not bad enough? They also charge an annual fee:

Source:Â The Consumerist

Even the recent historic equities rally is in the 60 percent range. Yet these are common tactics. Some more troubling trends are going after customers that pay their bills on time:

“(USA Today) You floss regularly, yield to oncoming traffic and use your credit cards judiciously, dutifully paying off your balance every month.

You may believe that your exemplary behavior shields you from unexpected credit card fees. Sadly, that is no longer the case.

Starting next year, Bank of America will charge a small number of customers an annual fee, ranging from $29 to $99. The bank has characterized the fee as experimental. But card holders who have never carried a balance or paid late fees could be among those affected.”

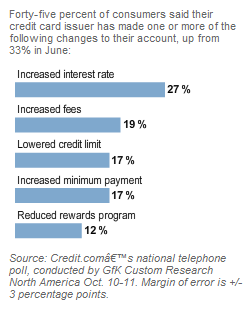

To show you how rampant this is, take a look at changes customers are seeing to their credit cards over the last few months even though the Fed and U.S. Treasury have rescued many of these companies:

Much of this is coming in a hurry trying to beat the 2010 new credit card legislation that will make it harder for credit card companies to milk consumers like nationwide loan sharks. At this point, they can’t squeeze blood out of a turnip or break kneecaps so they are now going after good paying customers since it would seem they are the only folks with money left. Even if you pay off your balance every month, you can expect some credit card companies to start charging an annual fee just for having the account. I would imagine that many accounts that have been open with no usage will also be shut down or have their lines decreased. This has occurred personally to me and I can verify the rate increases as well (nothing like 79.9% however).

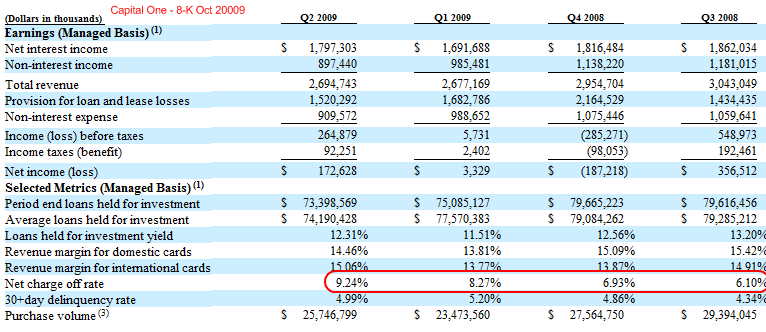

So why is this happening right now aside from the legislation? Credit card companies are bleeding money. Let us look at Capital One and Discover:

The current net charge off rate for Capital One is 9.24%. An astounding number that puts it into a historical level. This is up from the 6.1% of last year. A 30 percent increase in charge offs will hurt your bottom line. The average American is dealing with the realities of the recession and many have simply stopped paying. Others have gone through bankruptcy and credit card debt is wiped away during bankruptcy.

Discover is also seeing a similar trend:

I think you get an understanding of why credit card companies are starting to look at “innovative” ways to raise revenue. So much for asking “what’s in your wallet?”

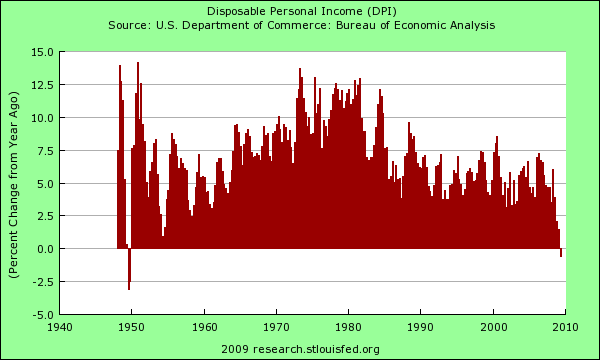

Yet why are Americans having such a hard time paying their debts? In a few words, people have less money. For the first time in 60 years has disposable income fallen on a year over year basis into negative territory:

Now think of all the recession since the 1950s. Not once did we see a negative year, until now that is. So with the deep recession, many are unable to keep the debt musical chairs going any longer. The trend of paying one credit card with another is coming to an end. How many 0 percent 12 month balance transfer offers have you seen in 2009? I used to get about 5 of these a week during the debt boom. Now? Zero.

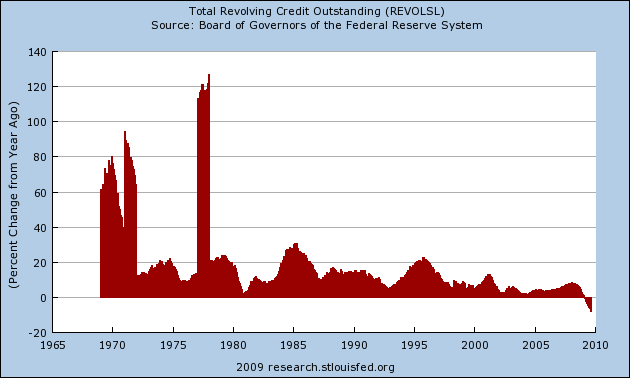

This isn’t just anecdotal. The credit card industry has yanked over 10 million credit cards from the market and overall revolving debt is declining:

The trouble here is that revolving debt has fallen while disposable income has also fallen. Since Americans have relied on credit cards so heavily, this is being felt in profound ways. The credit card companies are getting a chance to remedy their balance sheets on the back of consumers. The U.S. Treasury and Federal Reserve have extended what seems to be unlimited life lines to these companies, paid by the taxpayers, yet these companies are doing nothing to help the overall average American.

At a certain point people will wake up and realize that there is a war going on in our country in the financial world. A battle that threatens the financial security of millions. In fact, it may be the biggest battle we face. Yet many Americans seem okay with this or have become apathetic to the new financial serfdom. Why take to the streets for a few million bonus when we have trillions of dollars being yanked by our own government and Wall Street? We need to channel our energy to where the real money is at. Wall Street and the government are all too happy to slap a few hands with mid-level players while the top rung keeps on sucking the American taxpayer dry.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!14 Comments on this post

Trackbacks

-

WILDBILL said:

When they ask me to pay a fee for paying my bill in full , I will send it back along with the balance owed on my card and they can shove it directly up their ass.

October 22nd, 2009 at 12:56 pm -

Consumer One said:

What about all the suffering of credit card issuers? Those poor companies that have been forced to offer competitive rates for decades suffering from consumer abuse. We should allow credit card companies to charge whatever the consumer is willing to accept and allow the changes to federal regulations the card companies asked for in the Bush era bankruptcy bill.

Unlimited interest rates and fees.

Debtors prison.

Transfer of debts to surviving family members after death.It is only fair.

Oh yeah, if your a politician, movie star or have a net worth of more than ten million you don’t have to pay the Government should buy the debt and imprison a middle class taxpayer for you.

It is only fair.

Under the law a corporation has living rights just like you but because they are not alive they cannot be subject to criminal punishment. If you don’t like the system you can die and it will no longer affect you.

It is only fair.

Its the law and we are a Nation of laws promoting prosperity, without these changes to the system no credit will be available because there will be no profit incentives for companies to issue credit.

October 22nd, 2009 at 3:47 pm -

Luke Woolems said:

My bank charged me 50$ to have my house payoff “FAXED” to my realtor when I sold my house this week. They called it a “FAX FEE.” Then the law office handling the closing told the realtor that the payoff had to be faxed directly to their office. Needless to say, I was in a position to have to have that document faxed again.

October 22nd, 2009 at 7:04 pm -

DDearborn said:

Hmmm

lets see know, corporations have been ruled by the courts to have the same “rights” as humans but…of course they are granted many more legal and tax “rights” than us mere mortals. And of course you can’t send a corporation to jail. But in the current climate the very best “right” of a corporation is to just file bankrupcy and walk away from it’s financial and often times legal obligations. This of course means the “stockholders” are actually being allowed to walk away. However you and I cannot just walk away from our debts. In particular we cannot walk away from our credit card debt. Hmmm how is it just that corporations have more rights than humans?October 22nd, 2009 at 7:37 pm -

RefreshTheTree said:

My card company did this. No missed or late payments in 10 years, and they raised my rate by 5%. Thank god I was so responsible, it is really paying off. They get bail outs from the tax payer, and raise rates on the tax payer. Bottom line, the banks are financially raping the average American. Who owns America? China, and the banks. God help us all.

October 22nd, 2009 at 9:00 pm -

Al said:

This article hits the nail on the head. I’ve been out of work since December ’08. I cashed out my pension and liquidated my 401k as unemployment insurance did not cover my bills. I’m now out of money and have watched almost every credit card that my wife and I have get hit with the issues mentioned in this article. In some cases, I was surprised to see an interest rate hike just suddenly appear on my account. When I questioned it, I was told a seperate notice was sent (that I never received) or that the notification was included in my paper statement (which I rarely opened because I track purchases/pay bills online.) For the notices that I did receive and catch, I notified the credit card company that I was not accepting the changes. The result? The account is closed and I pay off with the existing terms. On the ones I did not see notification, the rates jumped (in a couple of cases the rates went from ~12% to 19.99%) and therefore the minimum payment jumped significantly, too.

My mom has excellent credit. A couple of months ago, she received a notice that her credit limit was being slashed from $12k to $3k. She usually pays her cards off monthly, but the debt on this account is mine and I have been paying the bill. The payments are always more than the minimum and always on-time. Her credit score is 795. The bank, however, slashed the limit nonetheless. A few weeks ago, she got a new notice advising the interest rate was jumping, too.

On my credit cards that did not have interest rate hikes, I received notices showing that the credit limits were slashed. On one of my wife’s store-branded cards, the limit went from about $1200 to $800. The balance at the time was $794.xx. The account had been paid on-time and had not been used in months. But they cut the limit and left a whopping $5 available credit on the account.

I looked at all of my credit cards, and out of all the accounts, I had 1 store card that has actually increased my limit in the last 6 months or so, and 1 that has not changed terms at all. The rest? Maxed because of slashed limits, closed because I did not accept changes or closed out of frustration with the issuer. The final result: CONSUMER BAIL OUT. How, you mak ask? Because I have taken it upon myself to stop paying. I’m walking away from the debt. I completely liquidated all of my retirement funds in an effort to keep my credit intact, but instead my FICO score is dropping because my credit utilization has been impacted by the issuers lowering limits.

The more I thought about my bills, the more I realized that the credit card bank needs me more than I need to worry about my credit score. I have a mortgage, 1 vehicle paid off and another that will be paid off within 6 months. I have no major purchases in the forseeable future, so my credit score isn’t pertinent right now. My wife was worried about the need for a card in case of an emergency, but I pointed out that we don’t have any credit available, anyway!

The fact is, I really don’t have the means to pay these accounts since I’m out of work. But even if I find gainful employment in the near future, unsecured debt is the last thing I’m going to be paying as I get caught up on everything else. Hopefully, the bank just writes it off as uncollectible. Let’s face it–Bankruptcy last 10 years. A charged off debt only lasts 7.

I feel no sympathy for them since our tax dollars paid them to not fail, but they paid out huge bonuses, bought other banks, etc. The banks that were too big to fail are now even bigger and still crying about losing money to defaulting accounts.

You know what? It feels kinda nice to stick it to the credit card banks after they have stuck it to me with higher rates, fees, etc for several years. As far as I’m concerned, I quit.

October 23rd, 2009 at 12:01 pm -

Joe said:

In February 2009, I got my Chase credit card statement. The payment due was more twice what it was the previous month. The balance on my Chase card was a balance transer from a B of A card where I had a fixed 7.99. B of A changed that to 23.99; I always paid on time. I said screw B of A and applied for a Chase card with a balance transfer of 3.99 for the life of the balance transfer. This was in 2007 I did this transfer.

So in February 2009 when I saw mt staement, I called Chase and they what they had done was take my minimum monthly payment from 2% of the balance to 5%, as well as a $10/month transaction fee. Chase said I could go back to 2% minimum monthly and forego the $10 transaction fee if I let them jack my rate up to 7.99.

After three calls, I finally found out the reason was that it’s because I don’t use the card for purchases… the only balance was the transfer at 3.99%.

I filed a complaint with the U.S. Comtroller of Currency. Chase’s Executive Customer Service got in touch with me and they offered the same great deal as stated 2 paragraphs above. I asked if they would wave the $10 transaction fee, and they can keep me at 5% minimum monthly. They said no. I declined their gratious offer above and told them I am just going to willingly default on the account. Of course they babbled on about my credit rating and court. I told them I don’t give a crap about my credit rating and as for them taking me to court for a few thousand dollars, I told them the way I see this playing out is that it will go to collections. I also let them know that I would gladly settle with collections just so Chase doesn’t get the full amount.

A few days after my next staement, I get a letter from Chase stating they reviewed my account and they made a mistake. Everything went back to the way it was….. for now at least ;).

Screw these C.C. companies…. people are defaulting left and right, and then they are going to mess with the people paying them as they should? If I get another greedy change of terms, I’ll default.

October 23rd, 2009 at 1:14 pm -

Webe Phuqued said:

typical corporatist, fascist Amerika. wake up!!! WAKE UP!!!!

October 24th, 2009 at 12:37 am -

an american said:

It is known what everyone is doing. Personal responsibility is hard to accept. We will all suffer the consequences for what some people are doing and so will the people doing it. Enjoy it while it lasts. We have had it too good for too long. Suffering will abound because we are not in shape to weather the coming difficulties, assuming we live long enough.

October 24th, 2009 at 5:18 pm -

Chuck said:

—To everyone who needs to walk away from debt: Declare bankruptcy. Otherwise, you will be sued. They may even wait until you have suffered with bad credit for years before they sue. Judgments basically last forever. They will win the lawsuit. I have looked at hundreds of online court dockets. The defendant loses every time. Mostly by default. You may never even know you are being sued until it is too late. The lawyer for the plaintiff only has to submit an affidavit saying that he served you with a summons. Lawyers don’t always tell the truth. The banks fought to make it more difficult to declare bankruptcy because they know that is the only way insolvent debtors can free themselves.

October 25th, 2009 at 2:52 pm -

Johnny said:

I-agree-with-Consumer-One.

Hey,its-only-fair!October 26th, 2009 at 4:56 pm -

Holly said:

CREDIT CARDS = BAD NEWS!!!!!!!!! This is why I don’t have any, and I never will!!!!!!!!!! If I can’t afford to pay cash for it, then I don’t need to be buying it!!!!!!!!!!! This country is GREEDY and it is being run by GREEDY people!!!! Money is the root of all evil, no doubt about it!!! People need to get their priorities straight!!!!!

October 27th, 2009 at 7:04 pm -

Carol Price said:

I know of a friend who racked up $ 18,000 on a credit card that he had used for many years. He stopped paying and was sued by the company (American Express, I believe). In discovery, he demanded to see proof of the original agreement that he had signed, to prove that he did, indeed, have an agreement and what the terms were back then.

It was so long ago, that the credit card issuer could not produce the agreement, and the case was dismissed for lack of this verification. He walked away from all that credit card debt, and the company could not collect by getting a judgment. A good strategy to keep in mind for those who have had a credit card for a very long time.

Note- many foreclosures are being set aside by judges precisely because the bank suing the homeowner cannot produce the original promissory note. The note is necessary to prove that the bank is the present holder of the note, and therefore has standing to bring a lawsuit for repossession of the property.

Especially see the opinion of federal district Judge Christopher Boyko in a 2007 case entitled In Re Foreclosure Cases. This opinion is posted on the website of the Northern District of Ohio federal court website. The Lexis number is 84011. It is a very instructive case, and a hilarious read.

This strategy is being used successfully by lawyers all across the country. Mortgages have been sold and resold, even carved up between numerous investors, who then resold parts of a mortgage, so the original promissory note is long gone, and unobtainable. No note, no right to sue for foreclosure.

I hope this post helps someone who is about to lose their home, or is being sued by a credit card issuer.November 1st, 2009 at 1:31 am -

Thomas said:

I just got a letter from Visa and they tell me that my “new yearly fee is now 30 euros”, which, considering the minimal credit limit (800 euros) is quite high. But the point, which they don’t tell, is that raise from current fee is mind blowing 87%!

So I went and returned my credit card(s), I don’t need them that much.

(I have bank’s own debit card which allows me to buy food & gas but it has no credit (just on-line transactions) and even that costs about the same than Visa now. Operating on cash only is quite hard when you can’t even buy gas on most stations as they are cold stations, fully automated.)

November 23rd, 2009 at 9:56 pm