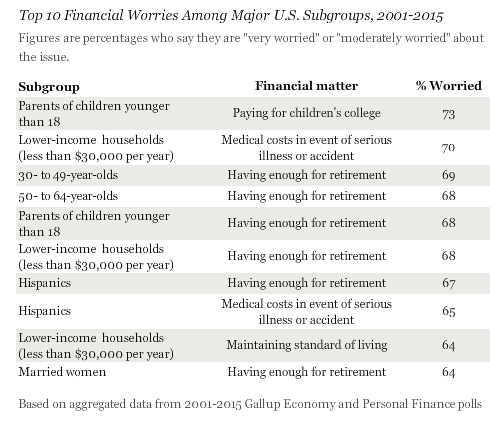

What are the top 10 financial worries of Americans? Two of the most common themes include paying for children’s college and saving enough for retirement.

- 1 Comment

Financial worries are a big concern for many American families. In spite of a booming stock market and a resurgent real estate market, most Americans don’t seem to be feeling financially better. A large reason is that many Americans did not partake in the rise in the investor driven real estate boom and also, many Americans own very little to no stocks at all. Is it their fault? For some, yes. But for many the growing low wage economy simply leaves little left to save after paying for daily expenses. Having enough for retirement is becoming a growing issue since 10,000 Americans per day are hitting retirement age. Are they fully retiring in the traditional sense? No because many will have to work deep into old age. Many retirees are fully reliant on Social Security as their main source of income. With this as the backdrop it is no surprise that the big political theme for 2016 is going to revolve on financial and economic inequality. Gallup conducted a survey and asked different subgroups of Americans what their biggest financial worries were at the moment. Let us look at the data.

Top financial worries among different American subgroups    Â

It is useful to look at multiple sources to find a broader trend. Looking at Census data, various surveys, and also tax data is useful. All of these point to a shrinking middle class. It is interesting to see that for most Americans, their biggest worries revolve around lack of income (retirement) and our new debt bubble (paying for college).

Let us take a look at the breakdown from the survey provided by Gallup:

Source:Â Gallup

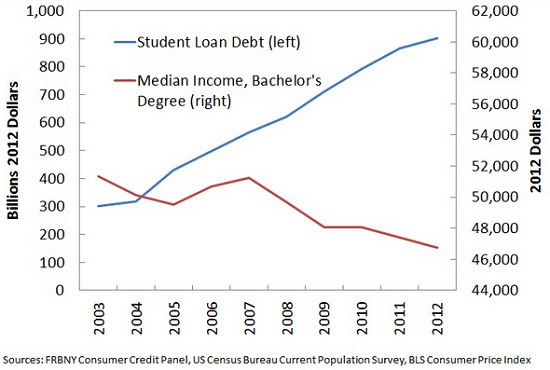

For parents of children younger than 18 the biggest worry is about paying for college. That shouldn’t come as a shock as tuition rises, student loan debt hits $1.3 trillion, and the benefits of going to college on income are taking a bit of a hit:

Charts seem to have a tough time keeping up with the growth in student debt. Student debt is now well over $1.3 trillion and is now the biggest non-housing debt sector. So it is no surprise that parents are worrying about financing their children’s college education. For poorer Americans the biggest concern is paying for a medical expense in the light of a serious illness or injury. Frankly, this should be a worry for anyone without adequate insurance coverage, poor or middle class.

However, it is very clear that the biggest financial worry for most Americans is having enough for retirement. With this as a top worry, it correlates with the fact that half the country is living paycheck to paycheck. Most are going to use Social Security as their default retirement plan. Are Americans in a position to change this?  For college costs the large student debt market seems to make the inflation process of tuition all too easy. So debt is very likely going to be the only way many Americans finance their college education.

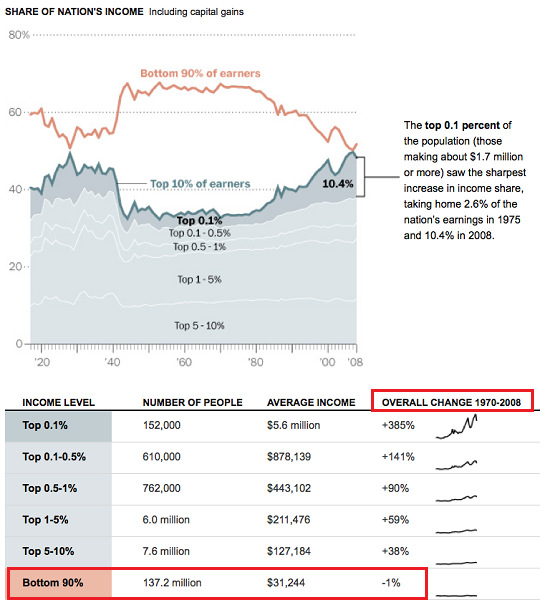

Income growth has been stagnant for most Americans:

For a generation, adjusting for inflation the bottom 90 percent in the United States actually saw incomes fall. That is a big problem when you look at the rising cost of housing, college tuition, food, and healthcare costs all soaring beyond the rate of income growth. It is baffling when we hear that inflation is not occurring. Inflation is absolutely occurring if you simply take a quick look at a few items.

So the top 10 financial worries seems to revolve around 3 major topics: having enough for retirement, paying for college, and paying for medical expenses. You can expect that all politicians will be talking about this in 2016. Just look beyond the rhetoric and see what is actually being done to solve any of this.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

GW said:

HEY – Worried about paying for your kids College tuition??

Here is a novel idea – DITCH THE “KEEPING” UP WITH THE JONES” MENTALITY – don’t feel beholden to ruin your future for the “children” (yes – dripping with sarcasm here). College has a marginal ROI anyway if you are not one of the ultra-privileged rich s.o.b.’s.

Trade schools are probably a better option – you cannot outsource a car repair or plumbing or electrical problem to China. The world has enough do nothing MBA Leaches, Banking Fucks, and Sales/Marketing Jerks that just drain resources with out producing anything tangible.

Given the state of the world in this day and age, everyone needs to re-evaluate what they learned when they were young (i.e. – it is not your daddy’s Oldsmobile anymore) and START DEALING WITH REALITY AS IT IS!

As some one once said – IF YOUR NOT MAD ABOUT WHAT’S GOING ON THEN YOU ARE NOT PAYING ATTENTION.

April 29th, 2015 at 5:23 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â