Quantitative Easing has become heroin to the financial markets: Federal Reserve balance sheet hits $4 trillion this week.

- 1 Comment

Addiction is never an easy battle to overcome. This also applies to easy money addiction that is now part of the Quantitative Easing economy. The Fed’s extraordinary measures are now appearing to be more permanent measures. Every time the whispers of tapering are made the markets respond accordingly signifying that the stock market is fully addicted on easy money. There is really no backing out of QE without some sort of pain. Any addict pulling themselves away from a drug suffers some brief or long period of withdrawal. Yet the long-term benefits are obvious. In this case, the Fed is not only avoiding tapering but getting more aggressive in their QE heroin. This week, the Fed’s balance sheet crossed the $4 trillion barrier. Of course few people pay attention to the Fed’s balance sheet but the fact that the Fed has created a second housing mania fueled by investor money is startling.

QE forever

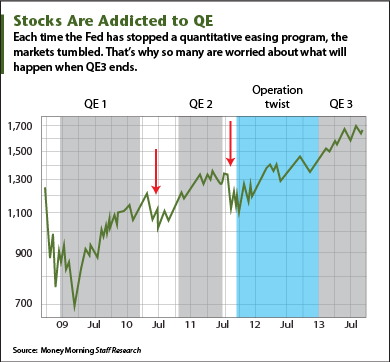

It is interesting that each time the hint of a taper was made the market responded by pulling back. The markets are fully addicted to this low rate environment brought on by the Fed buying up long-term MBS on the cheap. Who in the world would take on a 4 percent mortgage in this kind of market? Apparently only the Fed. So it is no surprise that the markets respond with pain each time the QE taper is announced:

Source:Â Money Morning

It is fairly clear that pulling back on QE will have an impact on stocks. The entire financial edifice is now building off of the assumption that QE will last forever. This has created deep distortions in wealth and has also created a secondary housing mania where big funds are rushing out to buy real assets with artificially low rates.

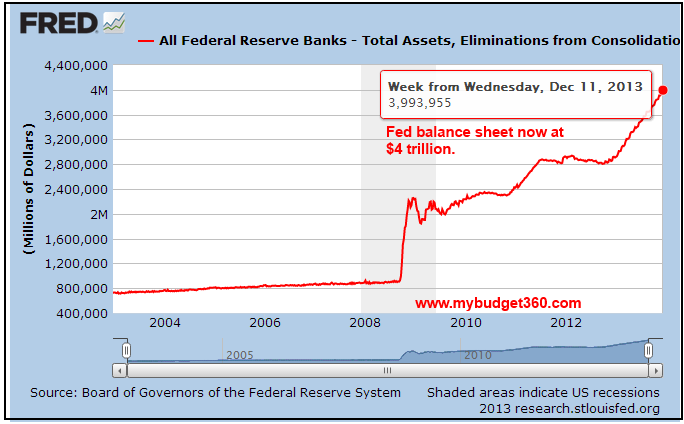

It is comical to hear that the Fed is tapering because looking at the Fed balance sheet we see absolutely no signs of any sort of tapering:

To the contrary, the Fed has become more aggressive in buying up MBS via their QE operations. The Fed is now essentially the mortgage market. In spite of this poor allocation of resources, wealth inequality in the US has only become more pronounced. As we have highlighted before most Americans have very little invested in the stock market so the gains here are of little consequence to the vast majority. Companies have used the economy to cut wages and also to slam employee benefits. Behind the scenes however high level executives especially in the financial industry have used easy money handouts from the Fed to lever up once again in the real economy.

Don’t forget the debt

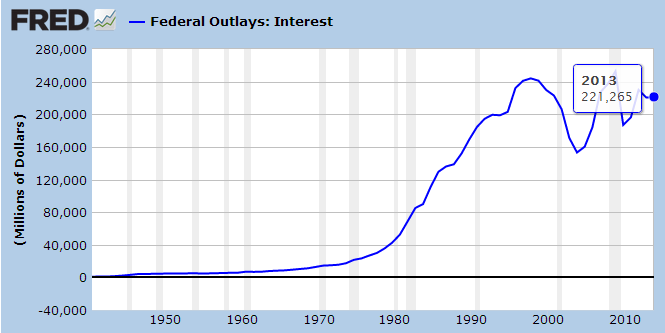

We are now paying a substantial sum in interest payments on our debt:

The only thing keeping things down is the low rate we are able to garner around the world. The Fed is aware of this and realizes any sizeable moves in interest rates will cause a dramatic rise in interest payments on debt. Better to inflate away our debt so long as we can find a market for this. Yet that is the problem with QE since the Fed is essentially the only player. There is virtually no market for 30 year mortgage rates at current price levels. The market is fully addicted on QE.

Getting off QE heroin does not look like it will happen. So why the constant discussions of tapering? The Fed is a giant confidence game and many are starting to realize this. Banks understand that any sort of unwind will impact the stock market so better to chase yields in real assets and crowd out regular households. This is why inequality keeps getting worse in the US in spite of the stock market being near a record high. The financial industry is fully addicted to this QE heroin and will say anything to keep their pusher providing this easy money. $4 trillion will not be the only milestone that is crossed even though the taper is always being mentioned.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Chris said:

Helicopter Ben is still flying and saving our economy!

December 19th, 2013 at 3:57 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!