Banks gone wild – The temporarily embarrassed millionaire syndrome. Bailout recipient JP Morgan Chase pays CEO what amounts to 843 times the median US household income.

- 8 Comment

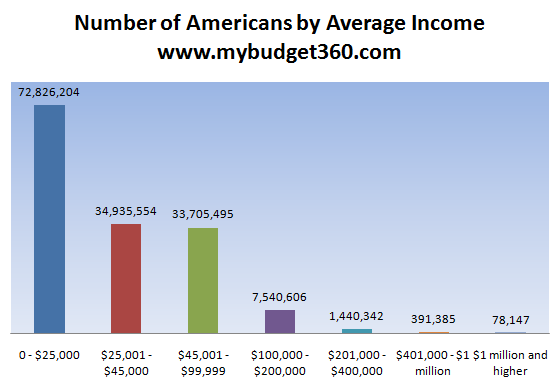

It is a fascinating case study in human psychology that one of the top contenders for President is Donald Trump, a man who makes a living at least on his show by firing people. You would think that many Americans would want someone that hires people given our current economic predicament. Put aside the antics and showmanship, many Americans (the average per capita income being $25,000) somehow admire a person who grew up with a silver spoon and has made his public persona revolve around firing people and speculating in real estate (a sector that has led us into this mess because of speculation). Usually when I get asked why we have very few protests against the trillions of dollars handed out to the banking and investment class, I usually point to this mentality. Many feel that they are only one step away from being the next Trump. This perception might explain the growth in massive banks and why it is even allowed. Having giant banks is not a normal part of our economy. In fact, I went ahead and gathered banking data going back to 1934 showing that the growth of too big to fail really started in the 1980s.

Too big to succeed

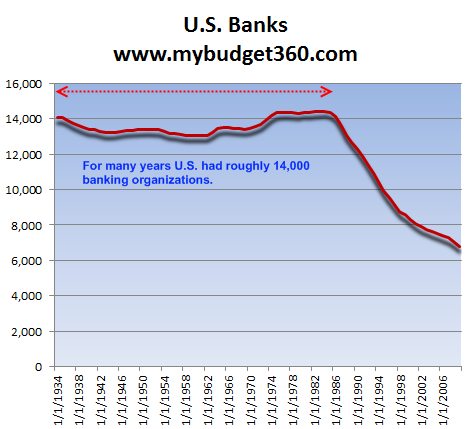

Source: Â FDIC

The above data is gathered from the FDIC and reflects the number of institutions measured by the organization. I found it interesting that from 1934 to 1986 the United States always had roughly 14,000 banking institutions. Keep in mind that during this time we did not have a banking crisis like the one we are currently experiencing. The Great Depression came about because of the massive speculator nature of Wall Street during the 1920s. Whenever banks are allowed to go off and do their own thing it usually means that the country will either have a depression or a massive recession. The spoils go to the top while the public cleans up the mess. Ultimately having good competition even in the capital markets is important but the above chart shows the contrary is happening.

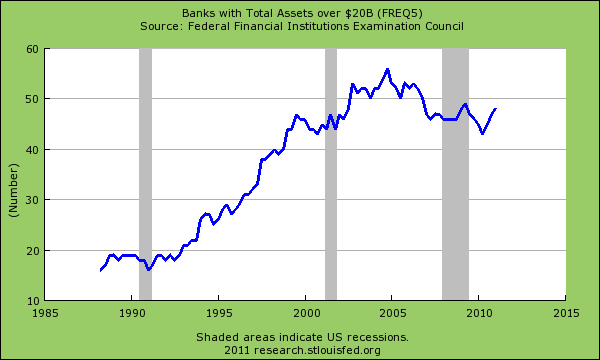

If we look at the growth of massive institutions it usually coincides with the above:

The correlation is near perfect. During the mid-1980s the growth of too big to fail banks started moving in earnest. This might have been perceived as a positive but keep in mind that only a few years later we had the S&L crisis. What led to the S&L crisis? Imprudent real estate lending. After 747 S&L institutions failed we still did not learn our lesson and that is why we had the mother of all real estate bubbles in the 2000s. The too big to fail had their hands deep in this mess and they are rewarded with growth:

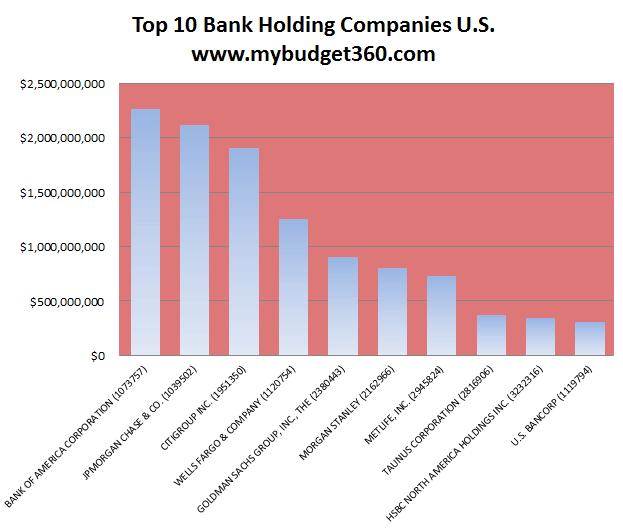

The top 19 banks hold over 50 percent of all banking assets. 105 banks hold close to 80 percent of all banking assets. So that leaves nearly 7,000 banking institutions to fight for the last 20 percent piece of the pie. Now keep in mind why this happened. This was organized and setup by the Federal Reserve and the U.S. Treasury. The Federal Reserve was the brainchild of the big banking powers of the early 1900s. Their goal was to reduce competition and allow for the aggregation of power in the hands of the few. It is no surprise that even a century later one of the people instrumental in this move, J.P. Morgan has the number two bank with his name on it and the bank has over $2 trillion in assets. How well has this accumulation of banking assets in the hands of the few helped most Americans? It hasn’t and in fact we just had the worst recession since the Great Depression. 45 million Americans on food stamps would argue we are still in a recession.

Does the average American realize where he or she stands?

I think the above chart shows the reality between aspirations and reality. Many Americans aspire at being the next Donald Trump but in reality, many are simply trying to pay their bills. 1 out of 3 Americans has no savings so it is unlikely they will have a Hotel in Manhattan with their name on it. Someone once said many Americans simply feel like temporarily embarrassed millionaires. This is why many times they vote for policies that actually hurt their own bottom line. I can see that. The mythology of being massively wealthy, even if it means accumulating wealth through oligarch ways that don’t even have a basis in actual capitalism. That is right, the captains of financial industry are largely politicians since many of these banks would be gone if the free-market did its jobs and they didn’t have politicians bailing them out (remember the $700 billion Paulson 3 page save me memo?). They were rescued and protected by the average American making $25,000 per year. And as you are aware, your tax dollars are going to good use:

“(Reuters) Dimon’s total compensation jumped nearly 1,500 percent to $20.8 million in 2010 from $1.3 million a year earlier, based on the U.S. Securities and Exchange Commission’s compensation formula, a regulatory filing showed.

Dimon did even better in terms of the value of money and shares actually received: his salary, bonus and stock and options from grants made largely in previous years that were actually exercised in 2010 were worth around $42 million.

By way of comparison, real median U.S. household income was just $49,777 in 2009, according to the U.S. Census Bureau.â€

The CEO of JP Morgan, one of the big beneficiaries of the bailouts, received in his total compensation 843 times the median household income of the United States. This is where things stand. And how many people is JP Morgan kicking out of homes this year? How about the WaMu portfolio with all those toxic loans. What about the service fees now charged to customers in onerous ways? This is what we reward in America. There is nothing wrong with rewarding say Apple for providing iPods or iPhones that people choose to buy without governmental coercion. But here we have a bank that is largely benefitting simply by its connections to Washington D.C. and their service is gouging average Americans even further. Where is the benefit of the too big to fail for the public?

Until Americans realize that many of these CEOs and organizations really do not represent their best interest, they are going to lionize individuals and companies that would love nothing more than to fire them and take every last cent that they have. In fact, some are even considering electing a person like this as President.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!8 Comments on this post

Trackbacks

-

j r said:

it’s true that a lot of Americans favor policies that protect the wealthy because they truly believe that they stand a good chance of becoming wealthy by winning the lottery, or something.

Someone once said, “You’ll never loose money by over-estimating the stupidity of the American people.”

April 12th, 2011 at 11:41 am -

Harry Johnson said:

There were a huge number of protests against the bankster bailout. There were people parading all over New York with signs saying things like “Jump F^(%(rs. Senators and congressmen received letters, phone calls and e mails in unprecedented volume running as high as 10 to 1 against the bailout. The news media buried it and our so called representatives ignored what the people were telling them. Even yet there is mass resentment from all sides of the political debate against the bankster bailout. Yet no one has been able to affect the decision. Many people have given up. It is much like the old Soviet Union, where people would just do their daily routine putting in minimum effort knowing they would not benefit from their work. Todays capitalists are the same as yesterdays communist dictators. If if anything even sleazier and more corrupt.

April 12th, 2011 at 12:56 pm -

Elizabeth said:

I really enjoy your post so much. Always can’t wait for them to reach my mail box. Most Americans though are asleep. They are too busy making a living instead of a life. As a foriegner I recognize the value of not just working hard, but being extremely aware of what i process and put in my subconcious mind. Change is not a very easy thing. The big banks know that, the multimillionaires know that, the billionaires know that. Just look at the way people eat themselves to death, work themselves to death, wallow in not learning something new and always

complaining about change. If one wants change, then we must realize that we have to be prepared to be unpopular and even be ridiculed that is “UNTIL AT THE END OF OUR PERSEVERANCE, WE TRIUMPH” and then the ridiculers comes and say. I knew you were right all along. “LIARS”. They just did not have enough guts to fight like hell. In closing one never get what they ask for, they get what they fight for. Thank you, keep on sending information for itsApril 13th, 2011 at 4:57 am -

robertsgt40 said:

Any first year accounting student that knows what a “T” account is can figure this out. This is a transfer of wealth(taxpayer) to the creditor(bankster). And the taxpayer is way in the red.

April 13th, 2011 at 6:54 am -

peter said:

FOR WHAT HE ACCOMPLISHED DEALING WITH THE FED. RESERVE AND BEATING THEM AT THEIR GAME HE DESERVES IT. TO BAD HE WAS NOT RUNNING BANK AMERICA THAT DUMMY KEN LEWIS COST ITS STOCKHOLDERS BILLIONS. REMEMBER THEY ARE ALL CROOKS BUT THIS CROOK DID BETTER THAN MOST IN BEHALF OF ITS STOCKHOLDERS.

April 13th, 2011 at 7:07 am -

Stephanie said:

I agree with you regarding Dimon and many CEOs such as Immelt; however, I disagree on your characterization of Trump. He wasn’t born into wealth. He earned it. He’s also filed multiple Chapter 11s which left the bankers holding very large bags of garbage. Trump is no friend to banks.

But it is certainly true most people do not understand the massive welfare being handed out to bankers and wealthy CEOs who employ lobbyists – and this welfare comes from THEIR taxes, where the common man earns, on average, less than $40k per year. Really ironic that it takes a large group of small earners to support the likes of JPMorgan.

April 13th, 2011 at 9:02 am -

JP Merzetti said:

Interesting: I’ve long suspected that the real reason America (and to a lesser extent, Canada) do not have any serious implementation of a truly egalitarian domestic economic policy, is that the common citizen has absorbed so much cultural, social, religious, academic and otherwise popularly sanctified custom and belief that the real answer to their individual (financial) problem – is to just get rich enough to solve it.

This completely evades the issue of what things really cost and what “wages” actually pay.

Reflected in this is the absolute mania connected to what drags young people through an expensive educational system whose primary function is to satify the equation that has been drilled into their heads: degrees = $.Dropouts will starve in the gutter, not wind up as imbiciles, fools, or otherwise indigent non-citizens, through lack of knowledge, wisdom, foresight, cognitive ability, reasoning, good judgement, or the ability to think deep (as opposed to thinking “big”.)

They will now starve for no other reason than the fact they cannot claim ownership of a (sometimes highly leveraged) document that proves they paid for their academic lottery ticket which supposedly allows them to participate in the gainful employment game.

Quote: “I will NOT read that book, if it does not aid and abet academic accomplishment, directly and as per course material.”

– hell of a quote, and all too true.Way down deep in the national psyche, Trump becomes the Pop Star of unquiet dreams…a new tinkerbell fairy dispensing pixie dust that marvellously silences the howling of the wolves of debt, insolvency and terrible, terrible trouble.

Used to be you could feel like a millionaire just by crossing over to the sunny side of the street…(a time perhaps, when the populace had a more realistic take on life’s liklihoods, causes and effects, minus embarrassment.) Riches are as insidious as any other addiction, I suppose – especially when they’re desired, imagined, craved, but beyond mortal human scope, for most (as they always were.)

April 13th, 2011 at 3:54 pm -

David said:

The concentration of banking is a result of restrictions put in place after the Savings & Loan crisis.

Also, many banks were allowed to fail then which reduced their numbers and led the survivors to seek protection by becoming too big to fail.

April 15th, 2011 at 8:22 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!