Sheltered banks do not trust broke American public: Too big to fail securely in place while business inventories surge to record levels.

- 0 Comments

Tracking consumer spending we find that industries subsidized by easy debt are growing at dramatic levels. These include student debt and auto loans since most Americans simply do not have enough saved up. Many have nothing to their name. The student debt market has grown dramatically this year again largely due to the reality that this debt is fully backed by the government and ability to pay the debt back is fully ignored. How else can someone get $30,000 or more a year to go to a for-profit paper mill? Beyond this, we now hear that household net worth has risen to record levels. However, since most Americans have no wealth in the stock market and are quickly losing home ownership in real estate, these gains are largely going to the top 10 percent in the nation that control roughly 75 percent of all wealth. This is not based on speculation but on multiple points of data. Banks do not trust the public because many are broke and do not have the funds to support massive debt growth. Ironically, these banks would not be around without the big bailout check that was required from the public.

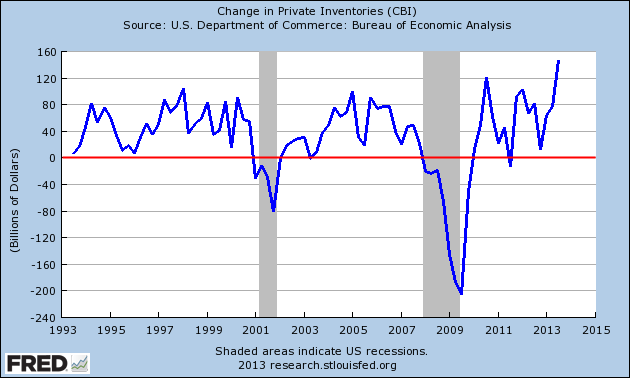

Inventories

Business inventories are expanding at a record level:

This can be seen as a good thing or that businesses are projecting too high of consumer spending in the months to come. Whatever the case may be, businesses are betting on robust consumer spending. However, looking at recent consumer spending habits we realize that many are simply doing the same song and dance by going into debt to purchase things they cannot afford.

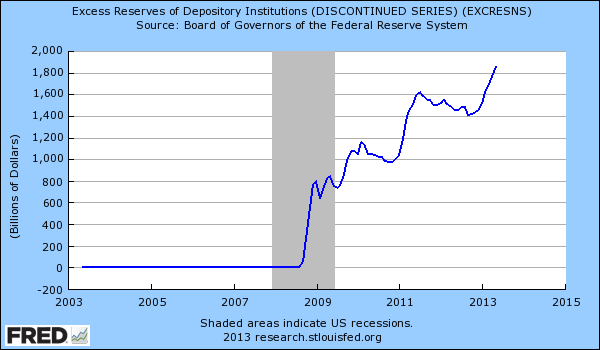

Excess Reserves

We keep hearing about the record in the stock market and the so-called recovery yet banks are still reluctant to lend to Americans in spite of the recession ending officially in the summer of 2009:

These are funds available from banks to put into action. Since debt equals money in our country, banks have the full power to create money out of thin air. How so? Walk into a bank and try to qualify for a personal loan. This money does not currently exist. The bank can bring it out of thin air simply by making the loan. This applies to student debt, auto loans, mortgages, credit cards, and all other forms of debt. However, banks are fully content with keeping their reserves high earning near zero interest instead of taking the risk of lending out to the public. After all, once money is “created†it can be destroyed if someone cannot pay it back.

The Fed has succeeded in making the too big to fail even bigger without really fixing the underlying financialziation of our society.

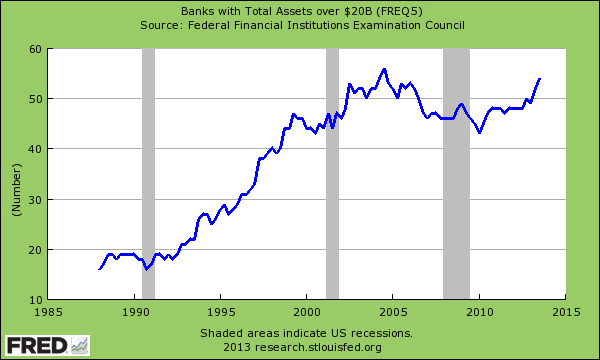

Too Big to Fail

Too big to fail was largely a reason our system melted down so epically in 2007 and 2008. Yet nothing has been done to fix this. Instead, the too big to fail have gotten even bigger in fewer hands:

A few banks control most financial assets in the nation. These banks are now funding and providing loans to the top percent of society to buy up real estate as investments driving up real estate value while US household incomes go stagnant. Now that banks are as profitable as ever, they rather not lend to the US public.

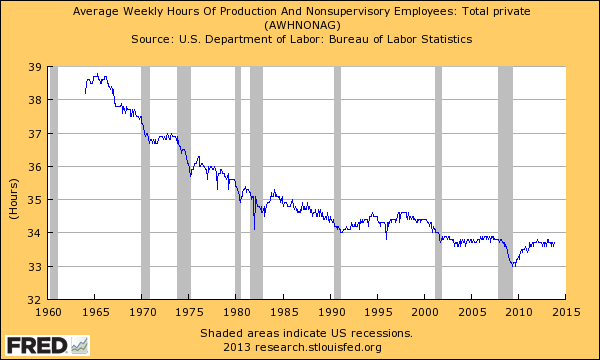

Not working enough

Banks have a lifeline to the Fed and government. The public does not. This is why the middle class continues to shrink. Just look at average hours worked:

The trend has gone from nearly 40 hours a week worked back in the 1960s to closer to 34 hours today. That is a big fall largely due to a massive surge in part-time work. We also have many working in low wage service work. The animal spirits are out again and many are simply trying to pretend they are middle class again by going into massive debt to spend on things they truly cannot afford. Auto loans are one major industry that exposes this trend. Yet these are not wealth building assets. The wealth is aggregated in very few hands and the public feels this at some level but it is yet to be seen what will come from this. We’ll see in the next election cycle if the status quo continues to roll along.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!