California Median Home Price, $373,000: Maximum federal government loan limit of $729,500. Does that Make Sense?

- 2 Comment

One of the flip sides of the major reversal in housing fortune is how quickly the market deteriorated. As many of you know, the new federal government loan limit enacted in March of this year raising loan caps to a new $729,500 ceiling was designed to help jolt the market in higher priced areas including California. The problem with this strategy is that it did not take into account the rapid decline in the market. The speed in which the market reversed is astounding. The argument for raising caps was also to allow homeowners in bad mortgages to refinance into a more typical government loan. The caveat of course is that people have positive equity in their home and now that California is down statewide 21 percent from peaks reached not too long ago, many of these mortgages no longer qualify for refinancing options.

Negative equity limits the options homeowners have. For one, they no longer qualify for many of the best government refinancing options. Second, if they were to sell they would need to come to the table with money or get the lender to pre-approve a short sale. Given the current state of the market short sales are being granted on a more rapid basis given the more costly and lengthy foreclosure ordeal many lenders would undergo. Take a look at this DataQuick release regarding California sales:

“A total of 20,513 new and resale houses and condos were sold statewide last month. That makes it the slowest February in DataQuick’s records, which go back to 1988. Sales were up 7.1 percent from 19,145 in January and down 34.3 percent from 31,228 for February last year.

The median price paid for a home last month was $373,000, down 2.6 percent from $383,000 for the month before, and down 21.0 percent from $472,000 for February a year ago. The median peaked last March/April/May at $484,000.

Around half the drop in median is due to shifts in the types of homes selling, and how those homes are financed. Last month 15.5 percent of the state’s financed home purchases were purchased with “jumbo” loans over $417,000. A year ago it was 37.3 percent.

The typical mortgage payment that home buyers committed themselves to paying last month was $1,665. That was down from $1,743 in January, and down from $2,196 for February a year ago. Adjusted for inflation, mortgage payments are back to where they were four years ago. They are 22.2 percent below the spring 1989 peak of the prior real estate cycle. They are 32.8 percent below the current cycle’s peak in June 2006.”

We should carefully examine each paragraph to see what is occurring. First, sales are down by 34.3 percent from last year on a statewide basis. Early market indicators such as pending sales and inventory are pointing toward a very lackluster spring performance. We need to remember that in good and bad housing cycles, real estate has its own internal cycles. That is, fall and winter sales typically slow down and perk up during the spring and summer. Last year, we knew that the market was in for a challenge even before the credit crunch simply by looking at the invisible spring and summer bounce.

The next item we should examine is the median home price. The median home price on a statewide basis is down by $111,000 from the peak reached last spring. This is an incredible figure considering that in many states you can purchase a starter home for this price or slightly higher. Incredibly, the previous conforming loan caps were at $417,000 which made sense when the median was $484,000 and some areas were much higher but now, we are below the old standards. Amazingly, they are not planning on revising the caps lower which makes no sense at all and if anything, tries to create an artificial bottom. Of course the massive bubble in California was fueled by ARMs in particular the 2/28 mortgages and the pay Option products. How good were these products? Well Wachovia just took a beating today because of these loans and in particular, to the loans here in California:

“The most compelling reading, however, concerns the former Golden West Financial, which Wachovia acquired in 2006 for $24.6 billion. And by “compelling,” we mean cringe-inducing.

Golden West was a leading issuer of so-called option adjusted rate mortgages (ARMs) – loans that give borrowers the right to pay less than the full bill – with a portfolio now valued at roughly $120 billion. Wachovia’s holdings of those loans are getting painful: Wachovia said its reserve for possible loan losses on Golden West’s portfolio of Pick-a-Pay variable rate mortgages surged in the latest quarter to $1.1 billion, while late payments nearly doubled to 3.1% of the portfolio.

While a possible $1.1 billion loss hardly seems newsworthy in this era of multibillion writedowns, the fact that 58% of Wachovia’s option ARM portfolio is based in California is problematic. Independent research boutique CreditSights argues that a new computer model put into use for Wachovia’s risk management is implying losses of between 7% and 8% for the Pick-a-Pay portfolio. That could mean another $2 billion of potential losses. The bank estimated that 14% of the loans appeared to have negative equity, or loan-to-value percentages of greater than 100.”

58% of their option ARM portfolio in a state that has dropped 21 percent in one year! They are being incredibly optimistic if they think this is the end of their write downs. Inventory is still at record levels here in California. You’ll also notice the massive drop in the monthly payment borrowers are now committing to:

Current (02/2008): $1,665

January of 2008: $1,743

February of 2007: $2,196

Of course buyers are now being more cautious and conservative on the amount of a loan they decide to chew off. Let us now take that median home price of $373,000 and run a few scenarios with various interest rates for the principal and the interest:

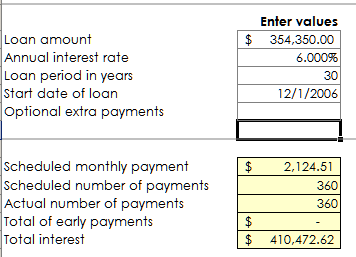

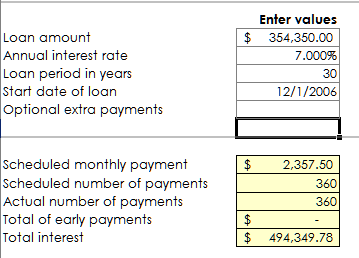

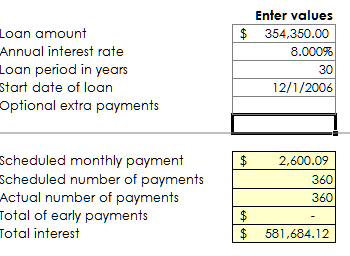

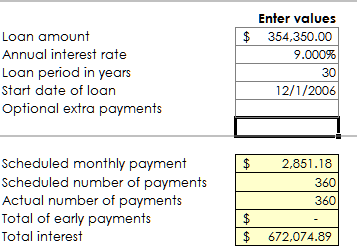

This is assuming a 5 percent down payment and 30 year fixed:

Amazingly, you notice that from a low of $2,124 for principal and interest the payment shoots up to $2,851 with a 9 percent interest rate (which in the past has not been uncommon). This is the problem with trying to keep rates artificially low. We don’t have much room to go but up. The difference in payment from a 6 percent to a 9 percent rate is 34 percent. That tiny 3 percent sure makes a big difference.

One thing that has been lost in all of this quick money pyramid is how much money people will pay in interest over the life of the loan. Let us take a look at the above scenarios again. Let us look at the total interest over the life of the loan:

6 percent

Total interest paid: $410,472

7 percent:

Total interest paid: $494,349

8 percent:

Total interest paid: $581,684

9 percent:

Total interest paid: $672,074

So from the lowest payment to the highest, we are talking about a difference of $261,602 in interest! This assumption that people will keep flipping houses will go away in down markets and these numbers start playing a factor in buying a home. Keep in mind we did not factor in maintenance, insurance, or taxes above. The point is that we are at rock bottom rates and we have pushed ourselves into a corner. By looking at the above scenarios, you realize that even a slight move of rates up to 7 or 8 percent will mean billions in extra money diverted to interest payments. Raising caps while the data is showing borrowers are committing to smaller payments. Wall Street and Washington are simply operating under different assumptions from most Americans.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

2 Comments on this post

Trackbacks

-

timjowers said:

Its not too amazing consider the entire mortgage credit system is build on fractional banking. This means no party along the way actually has enough money to pay for their outstanding loans. That’s like a house of cards. When an economic contraction comes then loans are called; but each party never really was able to pay what it loaned. In the basic case you might think about people buying houses they could not afford. They might hope the government will let them continue to live a lavish lifestyle they did not earn. In the important case you have to realize the banks and mortgage companies simply loaned out fiat or fractional money. Sure, they have some money and can pay for some houses but if we see 20% drops in values or more then times will be very tough. It’s simple math. If a government funded mortgage backer puts down only 5% cash then if the house drops 10% they are in trouble. They are working their spreadsheets and see many people have 20% or 30% equity so they are OK. But what we see now such as the most recent mega-bank is they are now revisiting their spreadsheets and finding out the numbers are not as rosy. Imagine a 20% drop in home values. Now a much larger portion of the mortgaged public will justwalkaway. The bank was given a very profitable spread and the privilege of loaning money they did not have (fractional banking) in exchange for managing the risk, In the case of Bear, we see congress willing to steal from the taxpayers to give to bankers who already were given very profitable and special privileges. A similar thing is happening with the homebuilders.

The big question now is how much money Congress can steal from the [future] taxpayers and give to the banks, homebuilders, reckless mcmansion holders, and such before the responsible middle class has had enough. Can Congress restore the housing bubble? They are trying and are slowing the pop but the reality is the average American is worse and worse off each year so the housing bubble in not sustainable. Down she goes. Only now she’ll take the US economy with her.April 15th, 2008 at 10:36 am -

Jeff said:

While the amount may not seem high in the high-cost Northern California areas $730K doesn’t buy too much. I rent a house that would sell for around that- the problem is I rent for $2K/mo- so why on earth would I buy for $5K/mo after all expenses (albeit before tax deductions)?

April 17th, 2008 at 12:06 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!