California Mortgage Rates Still High: Examining Actual Mortgage Products in Today’s Market and the Family Budget Impact.

- 9 Comment

As the housing market continues to slump forward, there are many unintended consequences cropping up all over the country. For one, the intent of the Federal Reserve to inject liquidity into the markets was to bring back confidence in an environment that is cautious about credit. As we are approaching another 1 percent interest rate policy ala Alan Greenspan, the only difference this time is that mortgage rates are not responding like they did during the earlier easing during the Greenspan tenure. There is a couple of reasons for this including the secondary market which was buying up all kinds of new and creative mortgage products that have now turned on the market. Yet your bread and butter 30 year fixed products are still high priced even after the Fed is attempting to induce lenders to be more willing to lend.

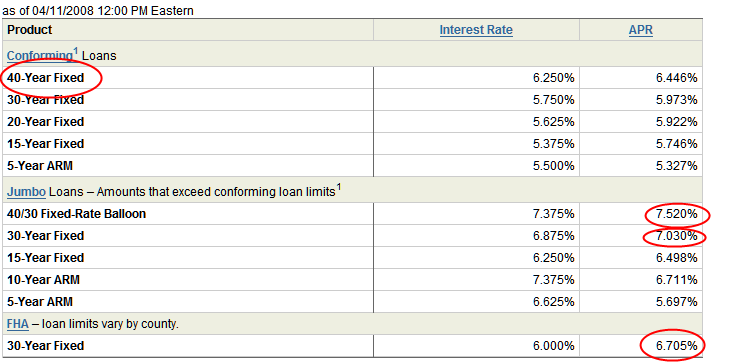

The reason that rates are going up across the board on credit is because there is a legitimate reason to be concerned. For one, all indicators are pointing to a recession. In years past, housing has always fallen during these times. Next, we need to explore the nuanced fact that much of our economy this past decade was built on real estate and all things surround the housing market. Let us take a quick look at some rates for a $500,000 home here in California with a 5 percent downpayment from one of the larger lenders:

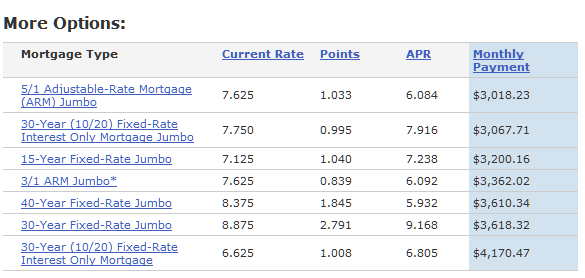

Incredibly, the menu is still full of loans that got us into this mess in the first place. The pricing range is anywhere from $3,018 for a 5/1 ARM to $4,170 30 year (10/20) mortgage. Our mainstay 30 year fixed will come in at $3,618 for principal and interest only. Keep in mind that the taxes and insurance on a $500,000 place will run you anywhere from $500 to $650 per month. If we are to assume that a person buying in today’s market will go with a 30 year fixed, the monthly payments work out as follows:

PITI: $4,118

Now how does this factor into the budget of an overall family? First, let us look at some key monthly expenses with national averages:

Healthcare: $500

Gas/fuel: $300

Auto Payments: $400

Food: $500

Utilities: $200

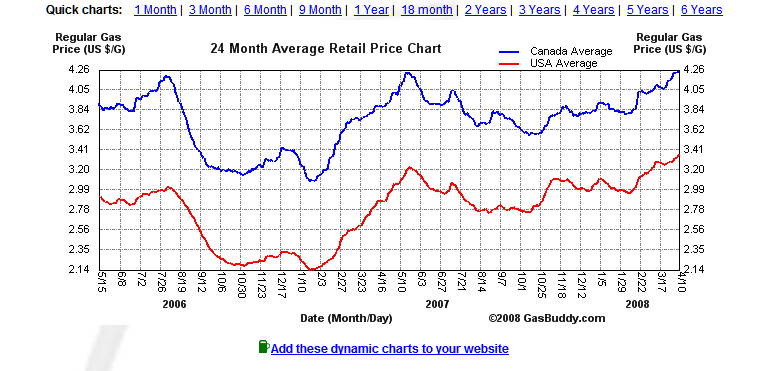

Now the subtotal including the above items is $6,018 or $72,216 per year. Keep in mind that $500,000 does not buy you as much as you think in California although prices are falling drastically across the board. Now you see why such a rapid market correction is occurring. In the above, for essentially basic necessities and a starter home the average family will spend $72,000 per year; which is much higher than the median gross pay for the entire state of California. That is why when prices reached a peak of $550,000 in Los Angeles County it simply was not sustainable. For those of you who don’t think fuel is expensive simply look at this chart:

Regular gas in the United States since November of 2006, less than two years ago is now up by a whopping 58 percent. With oil staying over $100 a barrel and the summer driving season coming up, the only place fuel can go is up. Now why is this a bigger factor in California? For one, many people live driving distances away from their work. One need only look at the congested freeways for this data point. Also, fuel cost in California are higher than national averages. So it is a double hit here. We also did not factor in automobile insurance in the above budget which can cost anywhere from $150 to $300 a month depending on the cars one may have.

As we discussed in the previous article that the current system is setup to punish savers, we are also seeing a system that understates inflation and forces consumers into debt. After all, the elasticity of your driving to work is nearly vertical. You have to get to work. California is notoriously bad in the public transportation market. And just to show you that the previous rate sheet from a large bank isn’t unique, take a look at another rate sheet:

The reason rates are holding steady and not moving downward in the same fashion as when Alan Greenspan took rates to 1 percent historical lows is that many of these products are simply reflecting the actual risk inherent in the market. What is now out, is the teaser intro rates of 1 to 2 percent. Also, we are not seeing the 5 percent mortgages either. Yet we may be seeing more of those 40 year fixed products but they do very little in really denting the monthly payment. I’ve also noticed a trend in some of the auto commercials that when you read the fine print at the bottom of the screen, they are now offering 84 month terms. Absolutely insane and financially imprudent. You’ll be paying a loan for years after the asset is no longer worth much. And how do you think that higher fuel cost is impacting auto sales? Everything is interconnected and nothing is contained. When credit is ubiquitous a contraction in this market hurts everything. When you spend more than you earn, you eventually have to pay the bill and it is coming due quickly.

9 Comments on this post

Trackbacks

-

Rich said:

It sounds astounishing! But it’s very true.

It’ll take more than 2-3 years to go back to where it started from.April 11th, 2008 at 10:30 am -

mybudget360 said:

I think 2 to 3 years for California is a good guess. Many of the option ARM mortgages do not recast until 2010 and 2011.

April 11th, 2008 at 11:14 am -

Wayne Hobbs said:

I could not help but notice that your monthly pmt calculations were wrong on all but two of your examples which harmed the financial credibility of the rest of your article.

I personally can’t disagree with your logic but I would advise having your assistants double check their work.

April 11th, 2008 at 11:22 am -

mybudget360 said:

The monthly payment calculations were based from the online calculators of the financial institutions. You also may need to factor in that they are based with a 5 percent down payment. Which item is in questions and we can work through it?

April 11th, 2008 at 11:33 am -

chip said:

Interesting article, except that why did you assume only 5% downpayment?

Instead use the traditional 20% downpayment.You wanted to make the figures worse right?

April 14th, 2008 at 12:33 pm -

mybudget360 said:

Chip,

You do realize that in 2006, 21 percent of California buyers went in with zero down? 5 percent is generous. And 20 percent in California has not been a traditional standard for many years.

http://www.burbed.com/wp-content/uploads/16-homes1embeddedprod_affiliate4.gif

No need to make the figures look worse. They look bad on their own.

April 14th, 2008 at 1:09 pm -

Red said:

Numbers are wrong on 15 and 30 year Fixed IO payments. Simply: 30 year interest only at 6.625% does not generate a higher payment than 15 year amortizing loan at 7.125%. Don’t need calculator to know that. The payment on the 30 year interest only loan should be somewhere around $2623.

However, the 15 year loan should have a lower rate than the 30 year, not higher. Is the 30 year rate wrong? And the payments on the 15 year loan are too low, not enough amortization – Bankrate.com calculator gives $4300+ for 15 year, 7.13% amortizing loan. And $3043. for a 30 year, amortizing loan.

Some of those online calculators fail to refresh some of the input values when you do a recalc…April 16th, 2008 at 12:08 pm -

Carolina Mortgage Makers said:

The good news is that most mortgage companies and brokers will give you a copy of the Good Faith Estimate simply by requesting one. This allows you to collect Good Faith Estimates for each mortgage offer you consider and do a line-by-line comparison when mortgage refinancing. It is important to realize that the Good Faith Estimate is just an estimate

May 25th, 2008 at 12:01 pm -

Santos Houchen said:

I am a property finance loan underwriter and PMI is for conentional loans only. FHA loans have MIP. This seriously isn’t new. No, home loan insurance plan is just not essential on a traditional mortgage when 20% is down. If much less than 20% PMI is expected. The 3% mortgage he speaks of is now 3.5% now in todays market is definitely an FHA mortgage. Most persons that do not speak on that sort of mortgage is just not approved? to do FHA financial loans. Not too many businesses do 2nd liens any more. The lender may be the finest loan to perform simply because the costs are less.

August 28th, 2010 at 7:04 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!