Commercial Real Estate and Tishman and Blackrock Walking Away from a $4.4 Billion CRE Deal. How to Lose 66 Percent on an 11,000 Unit Property. Why Walking Away from CRE is no different from Walking Away from Residential Real Estate.

- 3 Comment

It is becoming more of a preferred strategy to systematically walk away from commercial real estate debt. We have now had two large Wall Street organizations in Morgan Stanley and Tishman and Blackrock Inc. deciding, by voluntary choice, to walk away from their contractual obligations on commercial real estate. Now much has been made regarding the commercial real estate debacle because some $3.5 trillion in commercial real estate debt is outstanding. This number is enormous and many of the bank failures that we’ll be seeing on Fridays this year will come from bad loans in the commercial sector.

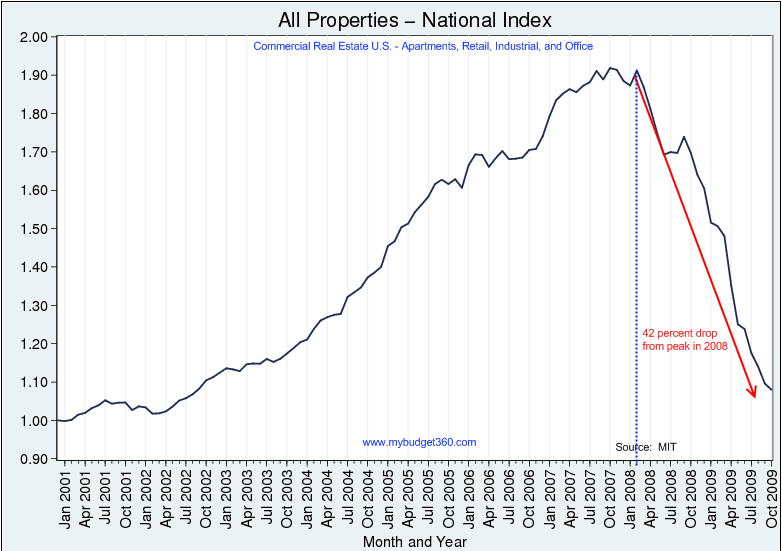

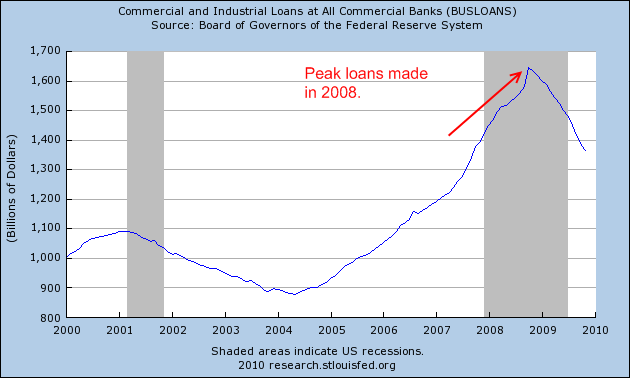

Part of the problem with commercial real estate is the way deals got financed. Many of the loans are made under 5 to 10 year terms and unlike a 30 year loan, need to be refinanced at the end of the deal. Well this is a problem when the property securitizing the loan is now valued at 30, 40, or even 50 percent lower. Unlike residential real estate that saw loan and home values peak in 2005 and 2006, commercial real estate loans saw volume peak in 2008:

So what we have is a similar situation as in residential real estate except it is delayed by two to three years. In other words, the major problems start this year. Bad commercial real estate deals are not something new. But this time the amount of bad loans made is astronomical because of the way the banking system securitized the loans. Just think for a minute how a loan is usually made. A careful evaluation of the property is made assuring the loan is actually reflecting the value of the underlying asset. The loan is then made under the assumption the borrower will pay the loan back under the contractual terms. If the borrower doesn’t pay the amount back, then you as a responsible lender will be able to take back a property that ideally would be valued at terms that would make a sale to recoup some money realistic. At least this was the older system of doing business.

This time, property values were never realistically assessed and banks never had in their equation the possibility of taking the property back:

“(WSJ) The decision comes after the venture between Tishman and BlackRock Inc. defaulted on the $4.4 billion debt used to help finance the deal. The venture acquired the 56-building, 11,000-unit property for $5.4 billion in 2006-the most ever paid for a single residential property in the U.S. The venture had been struggling for months to restructure the debt but capitulated facing a massive debt load and a weak New York City economy that has undercut rents and demand for high-priced apartments.

The property’s owners signaled they would be unable to reach a deal with lenders and instead decided to allow creditors to proceed with what amounts to an orderly deed-in-lieu of foreclosure, which means a borrower voluntarily gives the property back to lenders to avoid a foreclosure proceeding.

“It has become clear to us through this process that the only viable alternative to bankruptcy would be to transfer control and operation of the property, in an orderly manner, to the lenders and their representatives,” the venture said in a statement to The Wall Street Journal. “We make this decision as we feel a battle over the property or a contested bankruptcy proceeding is not in the long-term interest of the property, its residents, our partnership or the city.”

Now you might be asking yourself, this is a rather significant deal and certainly anyone loaning out $4.4 billion is going to make sure that they place some kind of conservative valuation on this commercial real estate deal. So how much is the property currently worth?

“By some accounts, Stuyvesant Town is only valued at $1.8 billion now, less than half the purchase price. By that measure, all the equity investors-including the California Public Employees’ Retirement System, a Florida pension fund and the Church of England-and many of the debtholders, including Government of Singapore Investment Corp., or GIC, and Hartford Financial Services Group, are in danger of seeing most, if not all, of their investments wiped out.”

Now walk through this deal. The place was purchased at $5.4 billion. It was financed with $4.4 billion in commercial real estate loans. The place is now estimated to be valued at $1.8 billion. This is a $3.6 billion loss. Now the first buyers are making a conscious business decision to walk away from their obligation to pay on this property. Clearly Tishman and Blackrock have the money to make the payment if they wanted to but they don’t. But who is the big loser here? Those that they sold the securities to. This is how the banking industry is setup. It is designed to punish those who really have little knowledge of the interworking of Wall Street finance yet the current system is designed to use taxpayer money to gamble on these sorts of deals. This is what we are bailing out and why there is such outraged geared towards Wall Street.

The reason this is important is because there has been this moralizing of walking away. There has been this guilt trip put on average Americans that they need to put every penny to their house payment even if it means starving. Yet here we have Wall Street organizations with billions in funds making a conscious business decision to walk away from billion dollar deals. This isn’t some homeowner unable to make a $100,000 mortgage payment on a home valued at $70,000. The bank will technically lose $30,000 in this case by taking the home back. Here, someone somewhere is going to lose billions. As John Getty once said, “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.”

And that is the core of the commercial real estate problem. Values have collapsed:

By most estimates, commercial real estate values are down over 40 percent from their peak. Many loans that are now coming due for refinancing will simply fail. In fact, there are claims that many borrowers have already stopped making payments but banks simply keep rolling over the loans like some debt snowball as to avoid writing down the real value of the underlying asset.

This is an enormous problem. It is amazing so little is discussed about this in the open. My guess is the government and Wall Street realize that bailing out the commercial real estate market would garner little to no sympathy from the American public. After all, these were big banks that supposedly knew a thing or two about financing big deals. So for them to come out publicly and say they had no idea, which is really the reality, would not play well in bailing out a $3.5 trillion industry. The bottom line is someone is going to pay and so far most of the paying has come from the American taxpayer through bailouts to the corporatacracy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

harry canary said:

What happened to a contract is a contract and sacred, not to be interfered with like they said when the government talked about cutting these thieves excessive pay packages? Or does that only work one way? Once upon a time businessmen were expected to have integrity. Today the only thing lower than a businessman is a salesboy. They both are even lower than lawyers, who are four steps below slime mold.

January 26th, 2010 at 4:21 pm -

Fred Quimby said:

Any idea how much the Church of England is in for??

January 27th, 2010 at 10:29 am -

OC House Hunter said:

If Obama allows the banks to be bailed out of this one after the promises he made in his speech tonight, we need to start recalls on him and on our representatives in congress. Come to think of it, we should recall those traitorous Supreme Court Justices that overturned nearly 100 years of precedance to unfetter corporate coffers from their limitations on campaign contributions.

**

One can only dream . . .January 27th, 2010 at 9:56 pm