How the Fed bluffs the financial system – Labor force participation back to levels last seen over three decades ago. Fed policy aims at pushing US dollar lower.

- 2 Comment

The US is facing a long trend of aging Americans entering into retirement or what can be viewed as life post-work. The vision of sitting on the sand in some resort villa is largely a dream. Nearly half of American when they leave this world go out broke like a country western song. Today as the stock market is nearing peak levels, one out of three Americans has no savings. Yet the headline unemployment figures have moved lower giving the impression that things are better but a large part of this is happening because we have less Americans in the labor force. In fact, our labor force participation rate is as low as it was over 30 years ago. So of course if you shrink the labor pool you have more room to play with the headline figures. It is crucial to understand this because the economy is operating under a false sense of success. The housing market is now being propped up via the Fed and QE3 but this is at a cost of a multi-trillion dollar Fed balance sheet. Plus, why do you want to increase home values when Americans are facing falling income? The unemployment rate is a poor proxy of what is really going on in the overall economy.

Labor force participation

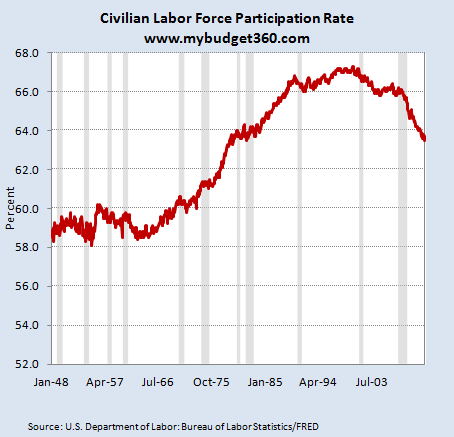

We have a multi-decade trend hitting in labor force participation:

This problem has only gotten worse recently because many of the jobs being lost are not being replaced. We are even seeing this with the structural unemployment occurring in the market. Many of those that lost jobs did not find work in similar fields when the market picked back up. They either switch fields or took what they could in the low wage sectors which have dominated since the recession began.

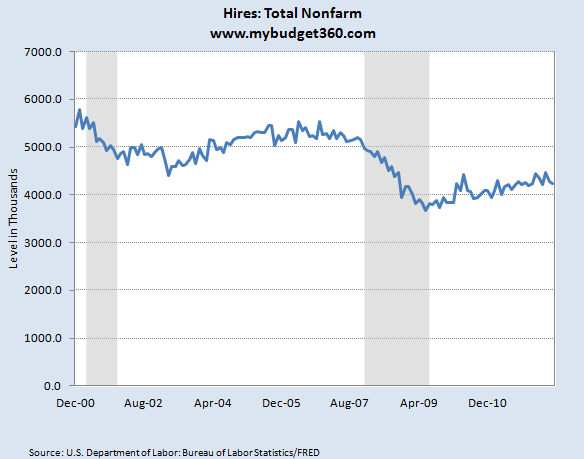

The above chart is critical in understanding how headlines can be manipulated. This is why even total hiring is lagging what we once had well over a decade ago:

In 2000 we had over 5.2 million hires while today we are down at 4.2 million hires with the population going from 281 million to 314 million (an increase of 33 million people). So it is obvious why so many in the economy looking for work feel the pinch of finding work. It also is the case that household income has fallen back to levels last seen back in 1995. All in all the economy is really not doing well for middle class Americans.

Going back to manipulating figures, the Fed is essentially undergoing a full fledge action plan of manipulating the housing market. To get mortgage rates to lower levels the Federal Reserve is going to purchase $40 billion of mortgage backed securities each month to keep rates low. First of all, the Fed is diving deep into the market to essentially own the financing of housing simply to aid their banking allies to unload properties at inflated levels to Americans that are now facing a shrinking balance sheet. Do not make the mistake to think these things are separate. They are connected.

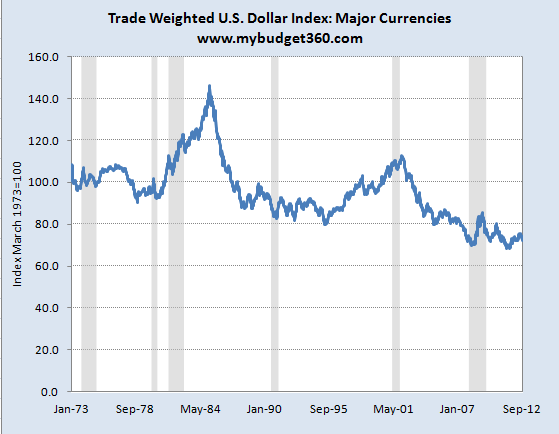

The Fed will never admit to this but their policy is one of pushing the value of the dollar much lower. Of course this has had the impact of pushing the quality of life of many Americans lower. This is easily measured by looking at a variety of items. Just look at your balance sheet and you will see this. Trying to send your kid to a good school? Look at those prices. Gone to the hospital recently? Prices are not exactly going down. Filling up your car? That sure isn’t cheap. All these come at a cost and the Fed’s efforts have worked at pushing the dollar lower:

Of course the rhetoric is to aid working Americans but a few percentage points on mortgages is really not going to change the balance sheet of most households especially when the collateral cost will impact other segments of the economy. People need to dig deeper and read beyond the headline figures and find out that they are facing a bluff at the poker table.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Rachel said:

This certainly is good reading. More people in this county need to do much more than read beyond the headlines. People need to vote with their money, get their priorities straight, and practice a little planning for rainy days. Millions of people in this country are making multi-million and multi-million dollar companies rich (and themselves poorer) by buying things that are simply wants, not needs.

Many middle and lower class people in this country should be cutting back on non-essentials whether it be entertainment, clothing, sports, etc. The iphone is just one of many millions of examples. I have personally seen several minimum-wage workers of varying ages with the Iphone 5 yet they have no savings, college education, car, home, or apt and two of these people have children to raise and no other source of income.

How in the world can they afford an expensive phone that also offers expensive plans while working for $7.25 and hour while they have kids? I think that they could save a lot of money by going with a cheaper phone and banking that money or putting it towards real NEEDS. Then again, that’s just my two cents.

Many people in this country should take their money out of banks that pay them little or nothing on their deposits (while making as much as double digit interest off their loans) and save their money elsewhere or inform themselves about investing opportunities that suit them. No one can create a positive change for themselves by doing the same thing over again when it hasn’t ever produced good results.

September 28th, 2012 at 8:07 am -

ManAboutDallas said:

@Rachel, who wrote : ” More people in this county need to do much more than read beyond the headlines.”

Rachel ? In case you haven’t noticed, America has devolved into a nation of ignorant, functionally-illiterate savages incapable of anything resembling critical thought. I won’t vote for either candidate in the upcoming election, but I applaud Mr. Romney for having had the courage to say out loud that most of America is intellectually and morally naked. People hate the truth when it isn’t what they want to hear, though, so down in flames he will go, just as Mr. Goldwater did in 1964 for trying to tell America the truth back then.September 30th, 2012 at 6:39 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!