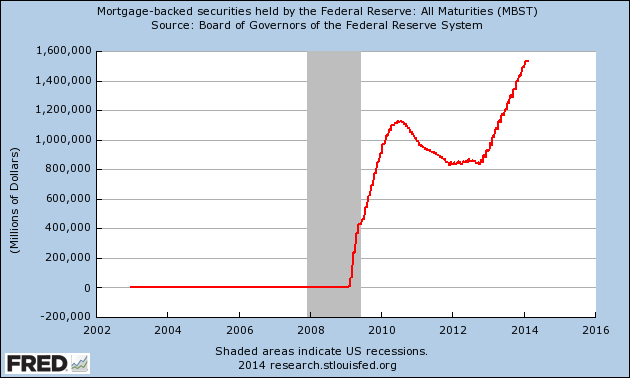

When the housing market is owned by Fed banks: Federal Reserve went from holding zero in mortgage-backed securities to over $1.5 trillion.

- 1 Comment

There are significant consequences with the Fed continuing on course with Quantitative Easing. On paper, it may seem that all is fine on the home front. However, many regular Americans are finding it harder to purchase a home in spite of a low interest rate environment. The Fed has created perverse incentives where big banks are leveraging low rates to invest in single family homes. This used to be a staple of asset growth for Americans but that is now waning. American households are cash strapped and having a lower rate does very little if incomes are not growing. Yet banks suddenly have a giant interest in being involved in the housing market. Why stop at being satisfied with an inflated stock market?  The ability to access debt has been key to the re-inflation of this bubble. If you look at the mortgage-backed securities (MBS) market you will clearly see that the Fed is now the major player in this segment of the market.

Fed is the housing market

Simply put, the Fed is the housing market. They are driving the biggest asset class in America by their manipulation of interest rates but also the amount of MBS they own. The results have been to increase the massive inequality in the nation. Sure, most Americans don’t own stocks but housing was one area where most Americans did own. And many Americans did not have to worry about competing with investors or big banks in their neighborhoods when trying to purchase a home.

The market, if we can even call it that, is now dominated by the Fed and big banks are using this crony system to buy up large pieces of American real estate. Take a look at the growth of MBS on the Fed’s balance sheet:

The Fed went from owning zero in MBS all the way to the current $1.5 trillion. The Fed is a massive portion of the market and is buying up nearly 100 percent of all issued MBS. This has also caused massive volatility in the bond market. Yet the end result is that homeownership overall is actually down for Americans because a large portion of the buying is going to Wall Street and big banks.

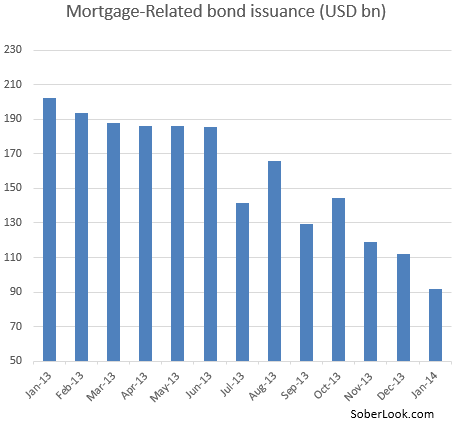

You can even see this on the private side with MBS issuances:

What need is there to grow this portion of the market if the Fed is dominating it so dramatically? There is little incentive to make this more competitive when banks instead of helping American homeowners are actually buying up massive amounts of homes with the corporate financial welfare of the Fed. Driving up prices with no subsequent growth in incomes is not a healthy policy.

Since the Fed has intervened we have seen roughly 30 percent of all home purchase going to investors:

“(NAR) All-cash sales comprised 32 percent of transactions in December, unchanged from November; they were 29 percent in December 2012. Individual investors, who account for many cash sales, purchased 21 percent of homes in December, up from 19 percent in November, but are unchanged from December 2012.â€

This has created a new form of a Gilded Age society because inequality continues to rise and home prices rising with no real substantive growth in income is not useful. What does it matter if a regular home buyer has access to a mortgage at a 4 percent interest rate when connected banks can leverage debt at close to zero percent?

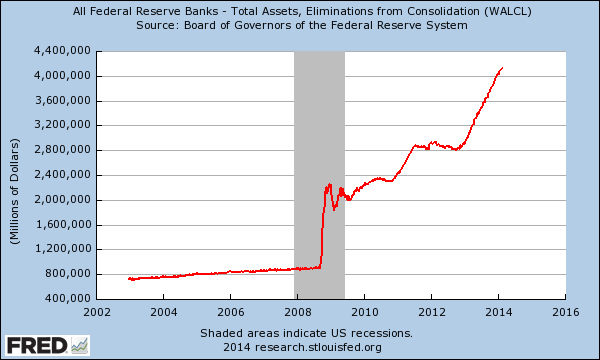

The Fed’s balance sheet continues to grow out of control because this entire market is built on access to cheap debt, debt that is largely going to a select few:

A drop in homeownership, massive investor buying, a re-inflation of the housing bubble. Glad the Fed is looking out for regular Americans.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

LiberatedCitizen (@LiberatedCit) said:

The Mortgage Backed Securities were a back door bailout for the banks by way of Fannie/Freddie. Since this is being held on the Fed’s books and we taxpayers are the US in the U.S. Government any depreciation in value will be added to the national debt so far it’s looking like that amount ($1,5 + Trillion) is our loss. The Fed covered itself with an accounting trick so the debt would go to the treasury – meaning YOU.

There was originally $6.3 Trillion Dollars worth of this sub-prime Crap dumped onto taxpayers. The government sued lol likely for show purposes only because taxpayers only got pennies back on the dollar from the banks. Since the majority of the ones sold went for less than the loans the taxpayers also took a hit on all of those. The remaining homes still owned by taxpayers through the GSE’s (Fannie/Freddie) are rotting away foreclosed homes.

Bernanke Leaves Fed with Record Balance Sheet of $4.1 Trillion

As of Feb. 1, 2006, when Bernanke took over as chairman, the Fed’s balance sheet indicated it owned $748,840,000,000 in U.S. Treasury securities. At that time, the balance sheet listed no mortgage-backed securities. As of Jan. 29, 2013, the balance sheet indicated the Fed owned $2,243,176,000,000 in U.S. Treasury securities and $1,532,224,000,000 in mortgage-backed securities.

Flashbacks

Accounting tweak could save Fed from losses

The change essentially allows the Fed to denote losses by the various regional reserve banks that make up the Fed system as a liability to the Treasury rather than a hit to its capital. It would then simply direct future profits from Fed operations toward that liability.

http://www.reuters.com/article/2011/01/21/us-usa-fed-accounting-idUSTRE70K6OK20110121

Since the Fed by law already gives profits to the treasury the part about directing future profits toward the bill really means the losses will be eaten by the taxpayers.

Fed sent record $88.4 billion profit to Treasury last year

The Fed regularly transfers its profits, known as remittances, to the Treasury in what amounts to payments to U.S. taxpayers. Those profits could turn to losses in the years ahead, however, if the Fed sells assets as interest rates rise.

Central bank researchers warned in January that the Fed could miss payments to the Treasury for up to four years, and that the loss could spike as high as $125 billion in 2019, under a scenario in which securities were sold and rates were higher than expected.

While the Fed has never missed an annual payment, some policymakers fear portfolio losses in the years ahead could expose it to attacks from critics in Congress and could possibly harm its independence. The Fed could decide not to sell the assets and simply let them mature, allowing it to avoid realizing the losses.

http://www.reuters.com/article/2013/03/15/us-usa-fed-financials-idUSBRE92E0QV20130315

BUT WHY WOULD THE FED HOLD THEM IF THEY WEREN’T FORCED? REMEMBER THE ACCOUNTING TRICK ABOVE.

Unlimited credit for GSEs seen as backdoor bailout (snip)

On December 24, the Obama administration announced it was extending an unlimited credit line to mortgage finance agencies Fannie Mae FNM.N and FRE.N Freddie Mac, which would keep them afloat no matter how high their losses

more

http://www.reuters.com/article/2010/01/05/us-usa-housing-bailout-idUSTRE6044YU20100105

Selling them to investors was planned long ago.

08/18/11 A Huge Housing Bargain — but Not for You

NEW YORK (RealMoney) — The largest transfer of wealth from the public to private sector is about to begin. The federal government will be bulk-selling the massive portfolio of foreclosed homes now owned by HUD, Fannie Mae and Freddie Mac to private investors — vulture funds.

more

http://www.thestreet.com/story/11224917/1/a-huge-housing-bargain–but-not-for-you.html

Obama’s Budget Has One Small, Missing Piece…. For $6.3 Trillion Dollars

http://www.zerohedge.com/article/obamas-budget-has-one-small-missing-piece-63-trillion-dollars

Republicans Pushing To Count GSE Debt Toward Statutory Debt Limit (Never happened though wasn’t passed)

Is Fannie bailing out the banks?

snip

But how sharp is Freddie if all it can do is squeeze a $1.28 billion payment out of a giant customer in exchange for relinquishing fraud claims on $117 billion worth of outstanding loans? The very best its million-dollar executives can do is claw back a penny on each bubbly subprime dollar?

http://finance.fortune.cnn.com/2011/01/03/is-fannie-bailing-out-the-banks/

GSEs Remain Backdoor Bailouts for Banks

http://www.ritholtz.com/blog/2012/09/gses-remain-backdoor-bailouts-for-banks/

Gundlach Counting Rotting Homes Makes Subprime Bear

snip…

“These properties are rotting away,†Gundlach, 54, said last week on a conference call with investors, about homes stuck in foreclosure pipelines, adding that it could take six years to resolve defaulted loans made to the least creditworthy borrowers before the real-estate crash.

February 17th, 2014 at 2:14 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!