Can You Live on $60,000 a Year in California? Yes You Can!

- 5 Comment

California is facing some troubling times. It has one of the highest unemployment rates at 9.3% and families are trying to figure out ways to stretch their dollar as far as it can go. Now I thought in the middle of all the troubling news out there, I would offer a post that examines how a family making $60,000 a year can survive in California. When I wrote an article about a family living on $46,000 a year in California some people took objection to this nitpicking the budget as if we had developed a budget for someone making $100,000. This is merely a suggestion since most mainstream articles although will highlight the challenges of our current economy, they rarely provide Americans and actual budget to implement. I will try to do that in this article.

For 2007 with the most recent data from the American Community Survey the median household income for California was $59,948. Given the state has 12,200,672 households that means this article should apply in some shape or form to over 6 million homes in the state. As we’ve passed our one year of blogging, I have received e-mails from people asking about a hypothetical budget for getting by. The one thing I quickly realize is that in our society, we have some people that are completely financially competent and need very little help with budgeting and a larger portion who really have no idea where to even begin. This budget is your starting point. Hopefully this budget can provide someone that is completely in the dark some help in balancing their household finances to get through tough times.

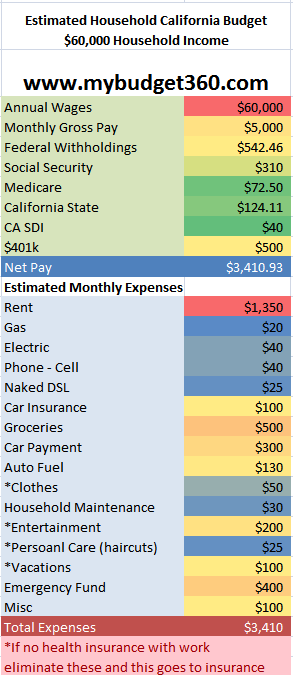

The first thing I want to provide you is the actual budget and then we’ll go line by line on each item:

Annual Wages/Monthly Gross Pay: The first line item is your household annual wage. As I have mentioned the median household income in California is $59,948 so this budget should look familiar to millions. At this rate, your home is generating $5,000 a month. Keep in mind this is only the starting point here.

Federal Withholdings: This is the amount of your income withheld each month for Federal tax purposes. In this scenario, we are using a hypothetical married couple with no kids. Of course this pushes up the tax liability higher.

Social Security/Medicare: This is your standard deduction. If you are working for an employer you will have a rate of 7.65% which is the current rate.

California State: California is one of the states with higher income taxes and unfortunately relies heavily on state income taxes to balance its budget. The rate varies. But for our purposes above, you will pay 1 percent on your first $6,827, 2 percent on income between $6,826 and $16,186, 4 percent on income between $16,187 and $25,547, 6 percent on income between $25,547 and $35,463, 8 percent on income between $35,464 and $44,818, and 9.3 percent on income of $44,819. Keep in mind this is on taxable income but it can get high relatively quickly.

CA SDI (disability): This is the California state disability insurance. This money goes into a state fund which is then paid out to those who can’t work because of a medical condition, leave due to a pregnancy, or take time off to take care of a sick relative.

401k: In the above, we are putting away 10% of our income into a pre-tax retirement account. This will help lower your tax liability at the end of the year since the money is first taken before taxes are paid. This helps given the above tax structure. Plus, it is good to have a rainy day fund if possible. Even though this fund is setup not to be touched until retirement, there are ways to access the money for short term loans which you then pay back to yourself. In terms of where you put your money in the fund, I would suggest you leave it initially in the money market fund. After you do some research regarding various investment options, then and only then should you allocate this money. Many people who didn’t do their due diligence last year saw that the market can be very unforgiving at times. You may want to consider various approaches including some I talked about with precious metals and foreign currencies simply as a tiny hedge to the overall market.

Net Pay: This is the amount you are left over with each month. In our case, we now have $3,410.93 to get down to business with.

Okay, so that covers the revenue side of the equation. Let us now focus on the more tricky side of the equation, that of expenses. And one more thing before I move on, you need to realize that no matter how much or how little you make, if you spend more than you make you are screwed. I’m not sure how much more bluntly I can put it. I’ve know people that make $40,000 a year living comfortably and many who make $150,000+ but spend more than they earn and go into massive debt. This is a critical point to understand.

Rent: Many people in California think that rent is impossible to find at this level. That is false. Normally most of these writers are looking to live in Santa Monica, San Francisco, Downtown LA, or some other niche market which pertains to a tiny fraction of the population. I can assure you that safe housing is available in the $1,300 to $1,500 range. This most likely means that you will be living in an apartment but this is a good time to be in that spot. Many condo projects are going bust and are being converted to apartments. The nice thing is that these places are designed to be home like and have that feel.

To search for these places you should use

This can provide you a good starting point. Once you pick a general area, try to gather 10 to 20 homes and map them on Google Maps and go on an exploration. Check out the homes. See the areas. Are you comfortable there? Who do you see living there? This should help you in picking a nice place to live.

Gas: In this above scenario we are assuming you live in an apartment because honestly, thinking about buying a home in California with a $60,000 income is insanity given the massive 30 year bubble we experienced in housing and the collapsing market in the state. So my suggestion is hold off on buying a home or condo for that matter. I believe in the 3 times your income rule. That is, don’t buy a home that is 3 times your annual gross income. In this case, $180,000 should be an upper limit and with prices falling, this is happening in certain areas already (i.e., the Inland Empire or Central Valley).

Back to gas, your gas costs should be minimal living in an apartment. Most come furnished with their own stoves and many newer apartments now come with electric stoves. So this cost should be low for you.

Electric: Electric will also be lower for you given the structure of your living. Unless you run the electric stove 24/7 or have the TV on even when you’re not home, then this cost should not pass $40 a month.

Phone – Cell: Many people are giving up their land line so you can make do with your cell phone. You are living frugally so one phone is enough. You can get monthly plans either through T-Mobil or AT&T or other service providers. If you want to go on the cheap you can get a prepaid phone through Virgin Mobil and cut your cost even lower.

Naked DSL: This is basically getting DSL without the land line feature. The internet is a useful tool and I see this less of an expense and more of a necessity if you use it wisely. You can find deals and keep in touch with others which is all free assuming you have a connection.

Car Insurance: The State recently announced a big push to cut rates which should save California drivers millions of dollars. California is a driving state and as such, I wouldn’t suspect that you would not have a car. So in this case, both you and your spouse have a car and this should run you about $100 a month with modest coverage. You can look at AIS and other brokers that offer lower rates. If you go with more prime names, expect to pay more but again, you aren’t insuring your Mercedes otherwise you wouldn’t be reading this article.

Groceries: California has a wonderful assortment of stores to shop from. You can buy great food at more regional supermarkets and save a boat load of money especially on vegetables and fruits. I’m sorry, this isn’t organic stuff but then again you won’t be spending $1,000 a month. You can find toothbrushes and other trinkets at dollar stores that would cost you $5 or $6 at a larger chain store.

Car payment: We’ll assume you have one car payment and one paid off used car. With one car payment of $300, you can have a nice relatively new Civic for this payment. That car with upkeep will last you ages.Â

Auto Fuel: The one minor silver lining in this crisis is that fuel has been cut in half for many Americans. This has added a few extra hundred bucks for many. Consider this a small stimulus package for many. In this above scenario I’m assuming you are driving a fuel economical car like a Civic, Focus, or Corolla. If you are driving a Hummer you might have your budget all screwed up.

*Clothes: I’ll assume that you may need some clothes per year like shoes, shirts, maybe a suit for work so we’ll allocate $50 a month.

Household Maintenance: Even an apartment will have household costs. You need light bulbs. Cleaning supplies. A vacuum. This stuff will cost you some money.

*Entertainment: We are giving you $200 a month for entertainment. This should be enough for a dinner out, a movie, and a NetFlix subscriptions which will run you $10 a month. Or, you can forego the dinner and go to a museum or something to that effect.

*Personal Care: If you are looking for haircuts and other items, you can factor that in here.

*Vacations: You can stash away $100 a month for a nice vacation once a year. This won’t be a trip to Monte Carlo but you can get away to many places in the U.S.

Emergency Fund: You need to have  at a minimum 3 months of living expenses stashed away. At this rate in one year, you should have 2 months stashed away and after 2 years, you will have 4 months stashed away.  This should not be looted for other expense (i.e., gambling etc).

Misc: Things come up and this fund accounts for that. Gifts or other items can fall under here.

*Finally, I want to make a point with health insurance. Over 50% of Californians have health insurance with their employer. If you have it with your employer, many times your cost is minimal or more market rate. You will need to eliminate each * until you meet your contribution. That is, if you kick in $200 per month, you can kiss entertainment good bye or that vacation fund. You have to find that money to make it up. Health insurance is a must since one illness can bankrupt you and it is the number one reason for bankruptcy (ironically in this crisis we rarely hear about this issue since it impact lower to middle income families).

This list isn’t exhaustive but hopefully it gives you a comprehensive look at a budget that should hold up relatively well in tough times. I know it is hard to focus on some things when times get tough but there is no use in sitting back and being passive. You need to get proactive and do the best you can. The Fed and U.S. Treasury might be trying to sink the dollar but that doesn’t mean you should follow in their path and sink your own dollar.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Nicole said:

Where is daycare, tithing, and debt accomodated in this budegt?

February 11th, 2009 at 1:33 am -

Financial Tales said:

Great Article. I also think your readers will benefit from “An Unexpected Tale” amongst others.

February 11th, 2009 at 9:59 am -

Are you Crazy said:

this is the most unrealistic budget I have ever seen – here is the reality —

Rent is $1600

Health Insurance (employer based – so this is only your employee contribution) for a family plan its $800 per month – thats what am ducked every month a basic family plan. and the rates keep going up and the salary is not changingChildcare – Afterschool care only – $370 a month, Before School care $120

Car Insurance – I have a stellar driving record and I pay comprehensive (which is mandatory if you are still financing the car) I pat $180.00 a month………

The rest is history so NOW do the math!!!

March 9th, 2012 at 1:52 pm -

Bryan Martinez said:

Move to Arizona, it’s cheaper.

August 8th, 2013 at 5:43 pm -

ann said:

this budget is far too low on various things. Rent and utilities are too low. Water and sewer are huge expenses. There is no budget for growth to a more robust condition like for education. There is no budget for sociocultural expectations when staying bonded and connected to a social group, like life events. The financial industry treats people like robots and makes this developed nation of isolated people. But thanks for the justification to tell my bitchy mom I don’t have a budget to give her gifts on every holiday and birthday of the year. signed bitterer

March 25th, 2017 at 6:32 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!