Financial trends of the new American economy – Higher educated workforce with harder time finding and keeping jobs, median retirement account for Americans at $2,000, global stock market growth, and housing bust covering up inflation in other areas.

- 2 Comment

The Great Recession is revealing some fundamental challenges in our economy. One of those challenges revolves around the exceedingly expensive college degree and its ability to translate into employment. As a percent many more American’s have a bachelor’s degree today than say in 1992 yet unemployment for college educated Americans is at modern record highs. Another profound challenge facing American families is retirement savings (or lack thereof which is more likely the case). Retirement is largely becoming a luxury that only a handful of families can count on. As we look back at the last decade not all global stock markets were created equal and this is evident when we compare the US stock market to those abroad. Finally we will examine what areas are seeing major price increases all the while overall inflation appears to be muted to average Americans.

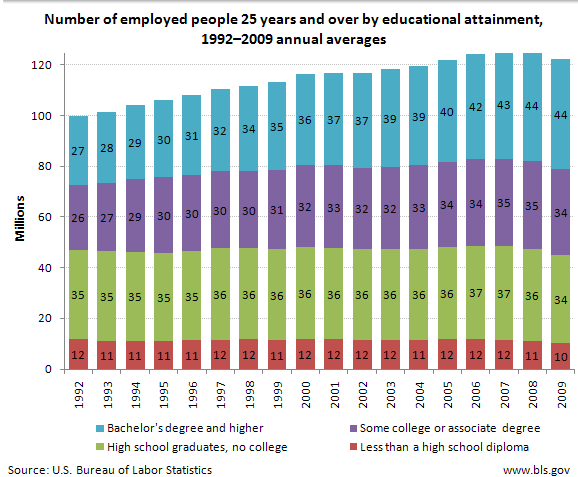

College educated rise but less employment

Source:Â BLS

In 1992 27 percent of those employed and 25 years of age or older had a bachelor’s degree or higher. Today that figure is up to 36 percent. However back in 1992 during another recessionary time those with bachelor’s degrees or higher had an unemployment rate of 3.5 percent while today it is up inching closer to 5.5 percent.

“In other words as a nation our employed workforce is more educated but it is also having a harder time gaining or maintaining employment. At the same time college costs have far outpaced the overall inflation rate.”

This may seem counterintuitive because in terms of career aspiration a college degree is less likely today to secure you a job compared to 1992 but it is much more expensive in real terms. So what are you really paying for? Of course college is not merely a means to a job but a place where students develop into well rounded citizens. Yet many for-profit institutions sell themselves as job factories and are all the willing to take federal financial aid without any statistics to back up their career placement rates.

What has occurred is a bubble in higher education. Obviously becoming an educated citizen is important. However we are facing a stratified market. You have private institutions charging $50,000 a year or more catering to many of the financially well off in the country. This group continues to get a solid education. Next you have a public education system with very good schools but competition for admission is getting exponentially harder and students are dealing with bigger classes and more expensive tuition. Finally you have the for-profit sector that merely operates to generate revenues by sucking in federal financial aid and not being accountable to their students and many operating only one step above diploma mills.

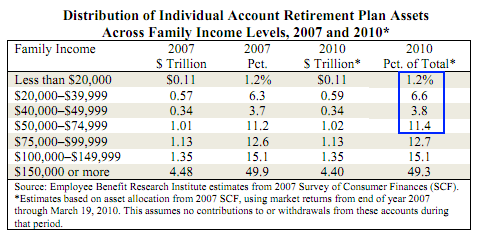

Retirement accounts largely a concern for top households

A BLS report done a few years ago showed that the median amount in retirement accounts for Americans was $2,000. This makes sense given that half of Americans make $25,000 a year or less. Many are looking at Social Security as their retirement account. If you look at where the money is aggregated you will start to realize that retirement accounts are largely becoming a luxury for a small fragment of American society:

Keep in mind that only 15 percent of US households make more than $100,000 or more a year. However 64 percent of all retirement assets are in the hands of the top 15 percent. The median household income in the US is $50,000. So we can even average out this amount here:

$1.04 trillion / 55 million US households = Â Â Â Â $18,909

Now this may seem higher than the BLS figures but keep in mind this is because of the $20,000 to $49,999 cohort that holds the bulk of this amount. In reality 1 out of 3 Americans have zero in savings. Even here the data is skewed. But think about the $18,909. How long would that last you in retirement? Say you draw down $1,000 per month and you are out of money within 18 months.

For many saving for retirement has become a harder and more trying exercise. If we look at the domestic stock market we can see why.

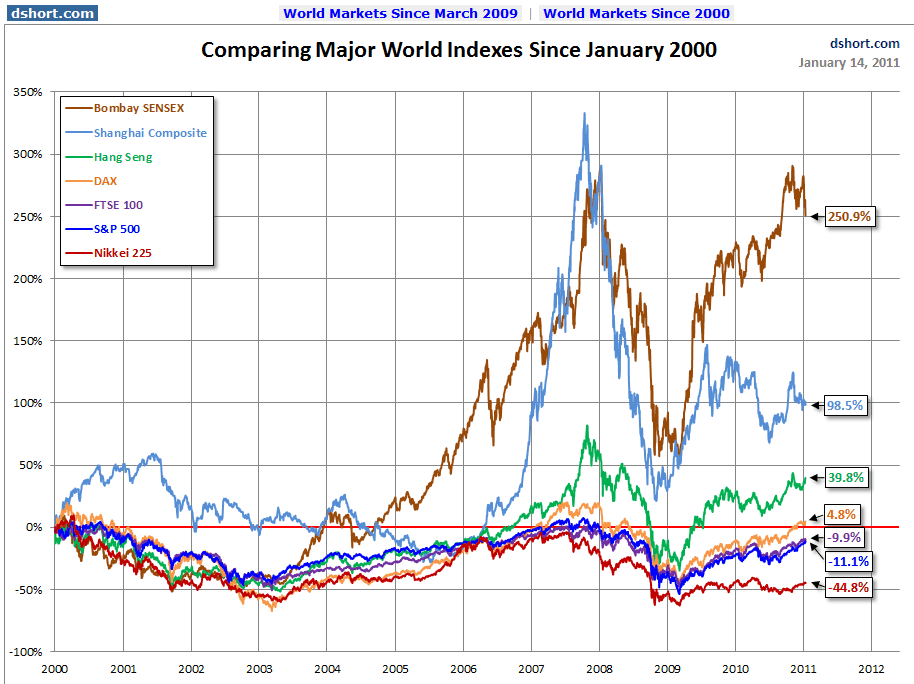

Global stock market growth

Even after the amazing 90 percent stock market recovery from the 2009 lows the S&P 500 is still off by 11 percent from where it was in January of 2000. In other words someone investing in boring and plain bank CDs actually performed better than the overall stock market for the decade. The Wall Street mystique has been lost on many. 60 Minutes featured a story of a famed gambler that made millions betting on sports yet was taken for a ride with Wall Street. In his own words, he did not trust Wall Street. This coming from a professional gambler and hustler. Wall Street has largely become one giant casino.

What is fascinating is markets that have benefitted from outsourcing such as India and China have boomed exponentially. In exchange for cheap goods many Americans are now struggling to keep a hold on to what they once thought of as the middle class. Why would a global multinational corporation want to pay someone in the US $10 an hour when they can pay someone overseas $10 per day for the same work? That is the profound question many now have to wrestle with and no politician is willing to tackle.

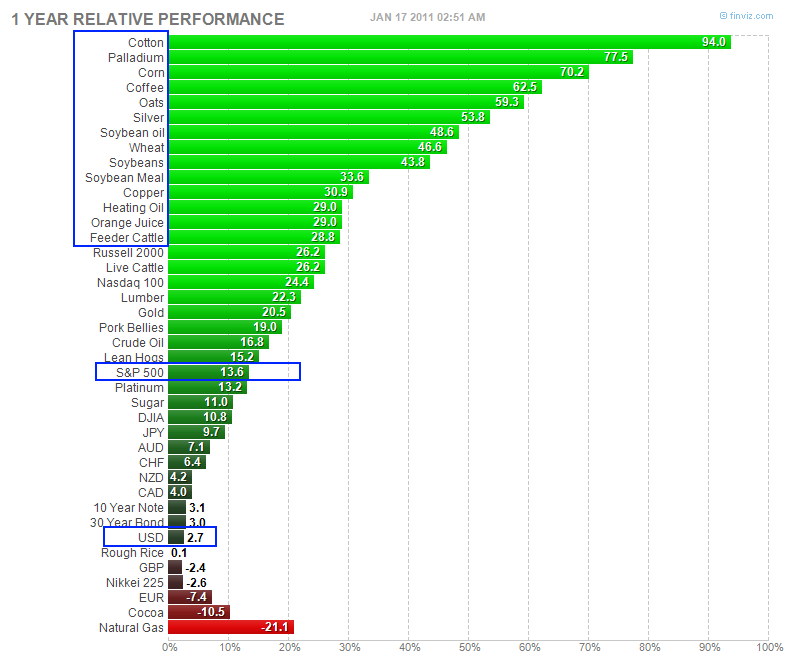

Inflation is where?

The BLS CPI has shown virtually no movement over the last few years. Much of this is due to the bursting of the housing market. The BLS heavily weights housing as it should. Most Americans spend the most on their housing costs each month. Yet the housing crash has hidden some major inflation in certain items. For example, oil is back up and you need only look at gas prices. For those who shop the cost of food items has gone up last year. Yet retailers have gotten creative with packaging so prices stay the same yet the amount you are receiving has gone down.

Take a look at the price of coffee, wheat, soybeans, orange juice, and other items over the last year. The S&P 500 went up by 13.6 percent but this pales in comparison to other sectors.

What can we conclude from the above? It is safe to say that there is a bubble in higher education. The costs are outstripping the benefits in many cases depending on what schools you go to. This is similar to the housing bubble. Some homes should have never tripled in value yet many homes are nice and built with quality in good areas. Others are not but when banks get involved you are likely to find speculation and gambling inflating costs.  Students need to be extremely careful in choosing their institution and not falling into too much debt. Another conclusion you can draw is that the housing bust has hidden the inflation of many daily items. The CPI is muted because of the implosion of the housing market and this covers up rising costs in other sectors. For example college tuition, healthcare, gas, and food have all gone up significantly over the decade yet this hardly shows up while wages have gone stagnant or declined. Ultimately American families have to be cognizant of these changes since they will impact their daily lives.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

MG123 said:

The NYT had a really good article on the expense and financial ruin of earning a law degree.

http://www.nytimes.com/2011/01/09/business/09law.html?_r=1&pagewanted=all

For many corporations, its not just cheap labor that sends them overseas.

Its the unending enviro requirements, planning commissions, environmental impact reports, EPA rules and regulations, Air Quality Management District regulations (CA-AQMD), Labor Dept rules and regulations, tax credits for offshore manufacturing, IRS regulations and taxation rules, endless paperwork, Worker’s Compensation taxes (CA), frivolous lawsuits, health care costs and taxes, and Dept of Commerce restrictions on inter-State commerce. Not to mention Affirmative Action, EOC programs and requirements and federal requirements for the same for all federal contractors.

So its not just a matter of low wage-seeking companies. Its the whole ball of wax. China doesn’t have to worry about Affirmative Action – its basically a one race country. Same with all of Asia.

India is one race generally, however there is ethnic and religious strife: Indians vs. Sikhs, Hindu vs. Muslim….nevertheless, they do not have the enforced diversity of the U.S., hence, they do not have the tremendously destructive political forces present to divide the nation.

Interesting how its cheaper and more efficient for a business to get going overseas in spite of the bribery culture and poor infrastructure. Its STILL better than dealing with all of the above-listed U.S. requirements.

January 17th, 2011 at 5:15 pm -

JeremiadJones said:

@MG: I beg to differ. The problem is that American labor is priced out the global marketplace. I applaud your Reaganesque analysis but doubt its validity. Most people would agree with me, I suspect, that there is way too much corporate control of government — not the opposite. The EPA? Whose idea was that? (Hint: He was a Republican backed by Big Oil.)

Environmental regulations are merely one of a myriad techniques that corporations use to suppress competition. Then they whine about over-regulation, and blame the government for their decision to export jobs. Yeah, right. For them, it’s a win-win deal!

February 1st, 2011 at 4:11 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!