The housing gamble: What if home prices remained stagnant until 2020? 6 charts laying out the argument for stagnant or declining home prices for another 10 years. Peak in dual income households, home prices still inflated relative to incomes, Federal Reserve unable to hold mortgage rates low forever.

- 7 Comment

What would happen if home prices remain stagnant for another decade? It is hard to imagine that the cornerstone of the American dream would somehow become a bad investment for the next decade. For decades every generation was conditioned into believing that housing was the best investment a family could make. For many it provided a stable home for retirement once the mortgage was paid off. One third of all homes in the United States that are owner occupied have no mortgage. Yet this mindset of buying and paying off a mortgage has largely been lost. No mortgage burning parties in the digital age. It may be making a comeback not because people want this but because there is no other financial choice. Given the current domestic and global trends, it is likely that housing will be suffering another troubled decade from 2011 to 2020 just like it experienced from 2001 to 2010. I want to lay out six charts as to why I believe housing will have difficulty moving up in price in the next ten years.

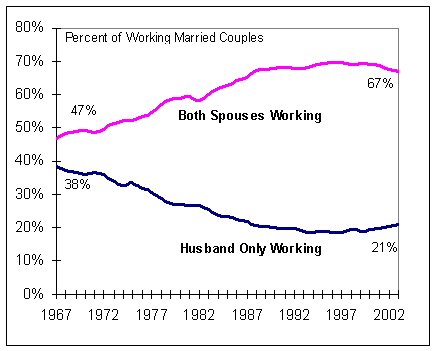

Chart #1 – Dual income households peaking

One of the big reasons many families did not feel the deep pinch from 1970 to 2000 was because of the rise of the dual income household becoming the standard. It should be obvious that with more incomes under one roof purchasing power would increase. Yet this is really where we start seeing the loss of the middle class. What used to be a path accomplished with one blue collar income now required two incomes. Yet as the chart above highlights we may have hit a plateau in terms of dual income households as a percentage. In the late 1960s 47 percent of households had both spouses working. In the early 2000s it was up to 67 percent.

The biggest line item for a family is housing. Household income growth has peaked and over the last decade it has gone stagnant. It is hard to envision where the boost in income will come from. Short of having your kids work and also live with you this does not seem like a likely option. The market really shifted in 2000 and the only way the growth in housing prices continued was by the introduction of exotic mortgages that allowed incredible leverage and created the fertile ground for a bubble. Now that incomes are being verified and the only game in town is government backed mortgages, the only way home prices on a national level will increase is simply if real income growth is generated.

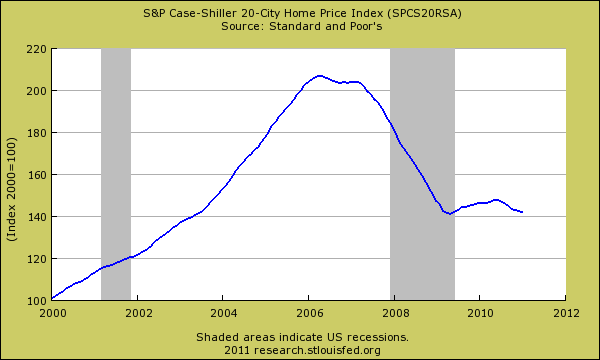

Chart #2 – Case-Shiller 20 City Index

As measured by the Case-Shiller Index home prices are now back to levels last seen in 2003. We are seeing a lost decade in many areas. The bubble is rather clear in the chart above. But with no household income growth why would home prices go up? The Federal Reserve is trying to keep mortgage rates low via artificial means by buying up mortgage backed securities but how long can this go on? At some point a market equilibrium is needed and the above chart shows that home prices are still inflated if we look at incomes.

Markets in Nevada and Arizona are seeing big sales jumps because prices have fallen 50, 60, and even 70 percent in some cities. People will buy if the price moves low enough. Can you imagine the above chart moving sideways for another 10 years? In the short run, prices are still going lower.

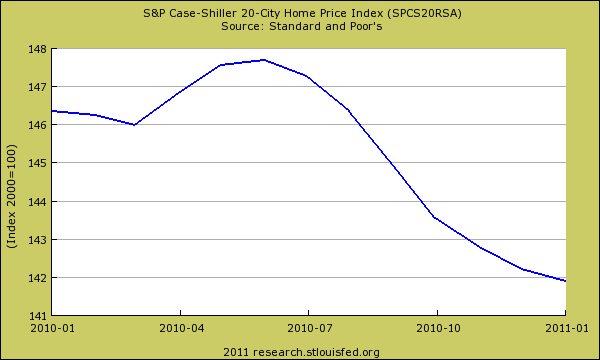

Chart #3 – Case-Shiller last 12 months

Home prices over the last 12 months have fallen by 3 percent. This may not sound like a lot to you but this is an asset that typically never moves lower even by a fraction of a percent. The reason for this movement is the pressure of the large number of distressed properties out in the market. You have to ask yourself why would a property become distressed? It is likely, and the most common case, that many people simply cannot pay their mortgage with the household income that is coming in. The middle class is shrinking and this is measurable by looking at household income and buying power. As this power decreases, why would the biggest purchase of households keep moving up in price? It simply cannot and that is why we still see home values moving lower.

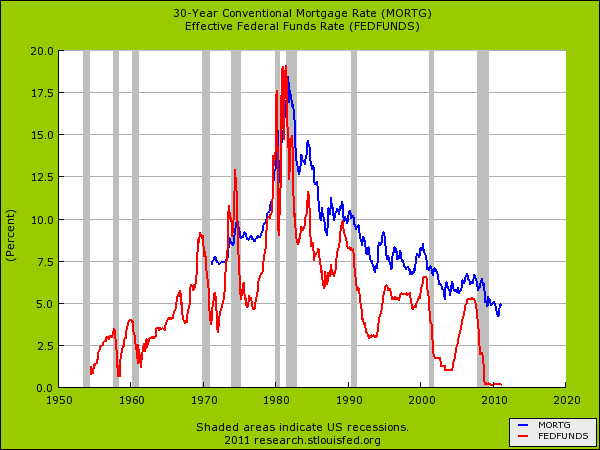

Chart #4 – Federal Reserve holding prices high

Expensive home prices simply to have prices inflated is not a good strategy. It seems counterintuitive but home prices should reflect actual buying power by American households, not an artificial floor set by the Federal Reserve. The Federal Reserve has purchased trillions of dollars in mortgage backed securities simply to keep the 30 year fixed mortgage rate low. The reason it does this is because a lower interest rate increases buying power since most households only focus on their monthly net payment for housing. Yet this is the wrong side of the equation. When we had more prosperous times in the nation home prices went up because household incomes went up, not the other way around.

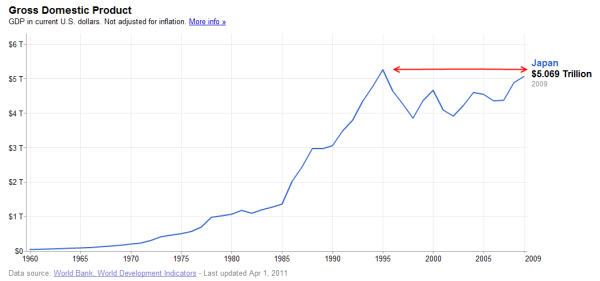

This strategy isn’t new and was tried by Japan. They lived through a real estate bubble and quantitative easing and what happened to the Japanese economy?

Chart #5 – Japanese real estate bubble lessons

Japan has had two lost decades in their economy because of the real estate bubble that burst but also the large banking bailouts that were conducted by their central bank. What this did is that it kept the market price of housing from being realized and served as an albatross for the rest of the nation. With an aging population problems are creeping in their system even with low interest rates. This real world example serves as a lesson for the United States if we wish to hear it.

So far we have gone down the path of ignoring reality. Yet you can only pretend so long and ultimately home prices have to reflect what local area families can afford without massive subsidies. This redirects investments from more productive sectors and that is why it is dragging our economy down just like it did to Japan.

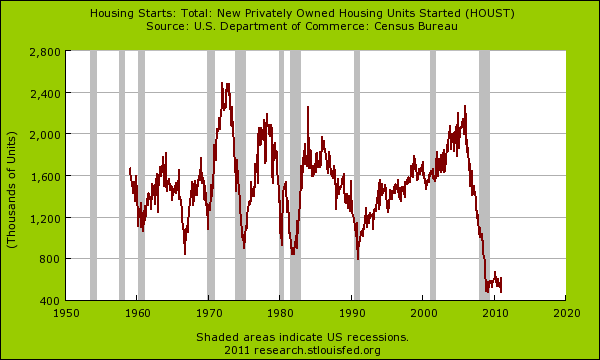

Chart #6 – Housing starts

Finally those who actually build homes have not felt the need to add more housing units onto the market. Why? We probably have enough housing supply to last us a decade at the current pace. Keep in mind you have many baby boomers that will want to sell and move into smaller homes. This will add supply for younger families. You also have many new homes that were built to over capacity and this too has added to supply. Another factor is the large rental units on the market. Ultimately there is a lot of housing to work through. We have millions of homes that will be foreclosed on in the next few years. More units of housing. The above chart shows how devastating this bubble was.

Will home prices remain stagnant until 2020? I would change my mind if we saw real household income growth for middle class families. This I hope is the actual case here. Yet there is little indication that this is happening. Hard to imagine the American Dream icon being a drag for another 10 years but there you go.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

7 Comments on this post

Trackbacks

-

Grant Hammond said:

This is a great post. I do like to look at the flip side of the coin, it helps when assessing my own predictions. The one factor missing from the above scenarios is the college educated population increase coming from Generation Y between 2012 and 2015. Keep in mind that Generation Y is the largest generation ever, beating the Baby Boomer generation by over 6 million. I cannot foresee an overall housing decline during the entire decade, perhaps for the next 2 years, but not for an entire decade. It may be the death of the ‘burbs, but not of cities.

April 9th, 2011 at 7:15 pm -

Donnie said:

From 1964 thru 1973 I was a working husband. We “owned” our own home – no equity loans here. My wife stayed at home with our daughter. She drove a 2-year old Ford Galaxy – I drove a corporate car.

Our home had all we needed; new kitchen appliances; furniture; wall-to-wall carpeting, and in the garage my restored 1934 Ford 3-window coupe, a new Triumph motorcycle, and at Lake Mead we kept a ski-boat. Toward the end of our 7-year marriage I also bought a Piper aircraft.

Now bear in mind, I dropped out of college in California to work – I did a bit of side business, but my wife stayed at home. Also, I was never a type-A personality. Employees said I wouldn’t ever get a heart attack because I gave them out without prejudice..

No, the people in power have destroyed the American Dream. I lived it – but with the wisdom of years, I tell you, it couldn’t be done again. Not in this world.April 10th, 2011 at 5:10 am -

LawrenceHomesForSale said:

Very nice analysis , I think you have put fourth a likely argument for price stagnation over the next handful of years. I wanted to share with you a site where you can compare a home appreciation over the years to other cities, it uses the HPI data. I think you and your blog readers might find it useful.

Here is a graph relevant to your blog that shows the appreciation/depreciation of Las Vagas, NV compared to Prescott, AZ:

Hope you find the graphs fun and interesting.

April 10th, 2011 at 12:07 pm -

Alex said:

Yeah. What if we all just went back to living in the trees? Where would the demand for houses go then.

April 11th, 2011 at 10:26 am -

afrost said:

The primary reason why housing prices should go nowhere over the next 10 years is because 1) The credit MANIA is over and 2) The typical prospective house debtor (“homeowner”) is flat out broke or nearly so.

“The biggest line item for a family is housing.”

My biggest expense is income and payroll taxes and no, I am not rich. One of the primary reasons why housing is such a big expense in many (not all) household budgets is because most (yes, most) households buy homes they cannot afford. And it is the same reason why so many are going into foreclosure in the last few years.

Most people look at the payments in relation to their income and assume that if it is below a taget of say 28%, that they can afford the home. Then an “unexpected’ event like job losss happens and with little to no reserves, they are in dire straights in almost no time.

“It is hard to imagine that the cornerstone of the American dream would somehow become a bad investment for the next decade.”

This statement of yours pepetuates the MYTH that the house you live in is or ever was an “investment”. A home (the structure) that you live in is a long lived consumer durable, just a like a car or a piece of furniture. The land it is built on is a SPECULATIVE asset.

One of the “secrets” to long term wealth accumulation is to limit your housing CONSUMPTION. Yet most people have been duped into believing that housing is an “investment” which is how they were (and still are) able to rationalize buying more house than they can actually afford.

Now that housing has fallen substantially from the peak in many or most markets and is likely to do so for years to come, many people are seeing what a deadweight it is on their financial well being.

This should be obvious from the numbers you provided in your article. With a median home price of $180,000 (I thought it was $160,000 but no matter), a 3% loss represents $5,400. That is a big hit if it lasts for years to come given a median household net worth of less than $100,000 and a persoanl savings rate of less than 5%. Good luck on retirement and financial security with those numbers.

April 11th, 2011 at 5:43 pm -

Geoff said:

Not to mention declining birthrate of people demoralized by their economic future.

And the strong likelihood that someone will do something about illegal immigration in the next five years if unemployment continues (and it will). House prices are going to drop even further into the basement than they are now.

April 12th, 2011 at 12:43 pm -

GeekGirl said:

Nice to see some rational analysis of this subject. We see this all over California – ‘discounted’ prices are still far above anything like median income levels for the communities where the ‘discounted’ prices are touted… How long can ‘call cash investors’ continue to create the only viable purchasing pool for all of California? And how many millions in CA are still living in homes they are not paying for as the grinding foreclosure system slides further behind the reality of lost incomes and employment…

April 14th, 2011 at 2:45 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!