How Wall Street and the media forgot about the middle class – 10 incredible charts highlighting the problems facing the middle class. China labor costs, debt ratios, Euro-zone finances, and balance sheet disequilibrium.

- 5 Comment

The mainstream press and ego driven politicians have completely forgotten about the middle class in this country, pretending as if ignoring the cacophony of discontent would simply make it go away. Both parties are simply doing the bidding of the financial upper-crust and that is why you rarely hear about household income being discussed in any television show. Yet as we are seeing with record low consumer sentiment to accompany a broken balance sheet and empty savings accounts, the public can get a dose of reality by simply examining their own life. Are things really better? What Americans should now fully realize is that the bailout schemes were nothing more than a wicked robbery and transfer of wealth from the majority to a slim connected plutocracy. Those who write and advocate for our laws, the politicians, have made sure a national thievery would go unpunished courtesy of campaign contributions. The system is completely broken and the disappearing middle class is merely a consequence of this financial plundering. Since the tech crash, the housing crash, or the energy debacles were completely missed by the media do not expect to have any guidance coming from the paid spokesmen of Wall Street. When did Wall Street and the media decide the middle class was irrelevant?

The country that debt built

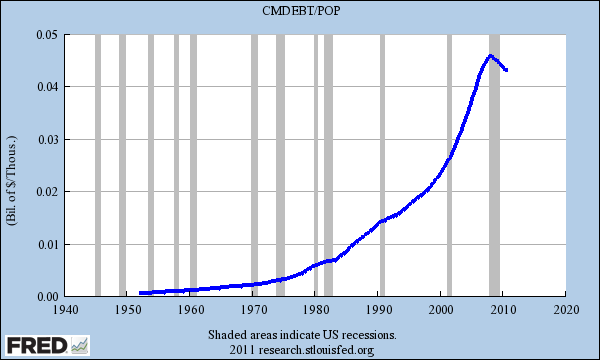

The collapse of the middle class can be traced back to the 1970s. For the last 40 years this contraction has largely been hidden under the rug thanks to a large helping of deep fried debt:

The above chart is rather illuminating. What we have done is taken all the household debt in the United States and divided it by the population. Even accounting for this growth the trajectory is rather obvious. The middle class has felt less of the contraction because of access to debt. Of course this peaked in 2007 which is the first reversal in this trend since data started being gathered way back in the 1950s. Debt is not always a bad thing but when it is not accompanied by real income growth then problems start to boil to the top. The mainstream media is concerned with selling you goods and banks are more than happy to finance your buying even if you don’t have the money today. Banks got bored counting small shopping trips for clothes and decided to turn the biggest asset in housing into one giant speculative casino.

Population growth

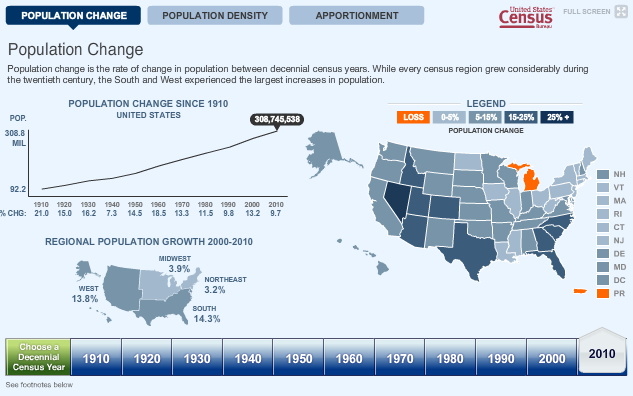

The last decade has seen an interesting shift in population growth:

The United States population grew at the slowest rate since the 1940s and this was largely due to World War II. From 2000 to 2010 most of the growth occurred in the West and South. Only one state in the nation, Michigan actually saw their population decline. What is fascinating is that these regions are heavily reliant on automobile travel. How will high energy costs impact growth moving into the future? Just another cost that will eat away at those stagnant paychecks.

Wealth inequality

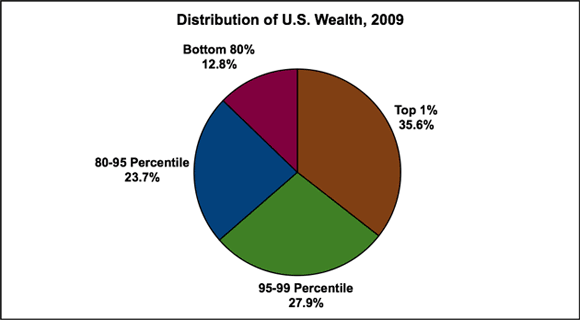

In no time in our history has wealth inequality been this pronounced. We would have to go back to the days before the Great Crash of 1929 to find similar levels of inequality:

The bottom 80 percent of Americans control 12 percent of all U.S. wealth. This fact should flash time and time again in the media yet this chart never hits the airwaves. After all, the media would like to keep you going like a little hamster, where every penny you earned is spent. If you don’t have the money some big bank will be willing to make you a loan and if you default, you will end up paying anyway with big giant bank bailouts. This kind of inequality crushes the fabric of what was once a vibrant middle class and has given rise to a financial plutocracy.

Structural unemployment

This is not your typical recession. This is the biggest economic disaster since the Great Depression. The banks have largely infiltrated every angle of our political system and now do as they wish including controlling the media. We have never had so many unemployed for so long:

Over 6,000,000 of those unemployed have been without work for at least six months. Millions have been unemployed for years. These are deep structural changes in our economy. The question we have to ask ourselves is whether we want to make it a priority to protect the middle class? As the last few decades have shown, graft and bank robbery has been legalized to transfer wealth from average Americans to the top one percent. A system like this cannot go on.

Europe faces dramatic challenges

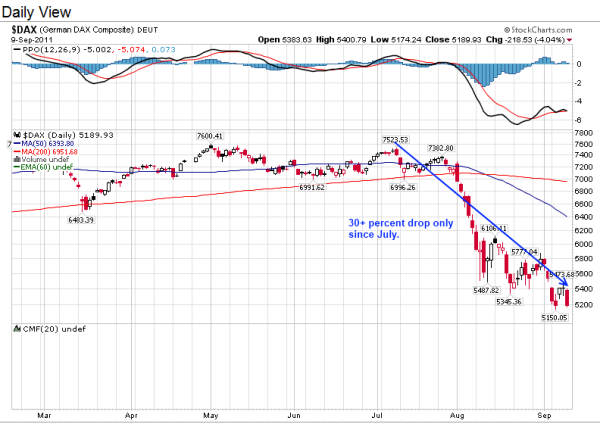

If you thought there was little coverage on the decade long assault on the middle class in the media, you would be surprised as to how little coverage is given to the dramatic events happening in Europe. The European Union has a GDP larger than that of the United States yet the media seems to pretend like nothing is wrong. How bad are things? The Greece two-year bond yield is up over 55 percent and the German DAX is down over 30 percent just since July. Germany is the largest Euro-zone economy:

The global banking syndicate has bets all over the place and the notion of decoupling is largely a myth since every market is largely interwoven into the fiat central banking system we now have. Trillions of dollars in derivatives bets are placed all around the world chasing odd games like a wild gambler. Yet this can only go on for so long. Debt can only go so far before banks have to realize their mistakes. Here in the U.S. banks still want to pretend residential and commercial real estate is still valued near peak levels.

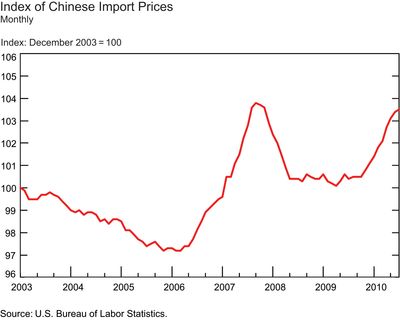

Chinese import costs will rise

Americans are accustomed to cheap goods from abroad now more than ever because of economic necessity. Wal-Mart has seen some of its profits cut by even lower priced retailers like Family Dollar and the 99 Cents Store. This is expected when the average per capita income is $25,000. That party may be coming to an end as Chinese import prices rise:

At some point, a U.S. dollar that is being digitally printed into oblivion carries less buying power, Americans are going to find that their dollar purchases less and less to a point where dollar stores become one of the large growth industries. This isn’t the only place costs are rising.

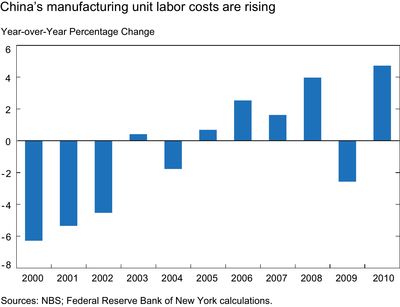

Chinese labor costs rising

A pegged currency still can’t keep labor cheap forever. These trade deficits need to balance over time but the cost of labor for China’s manufacturing sector is ever increasing:

Now how is this going to play out with a U.S. economy where paychecks are getting smaller yet consumer goods are getting more expensive?

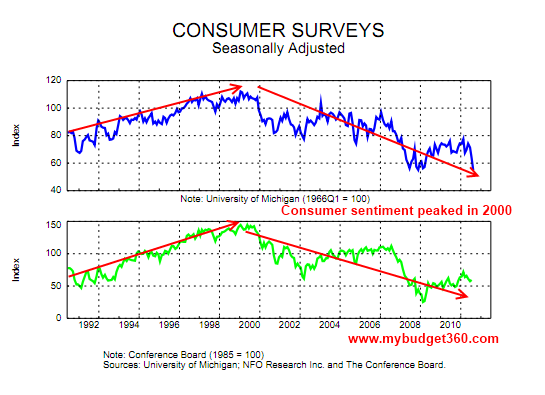

Sentiment peaked in 2000

To highlight that the last decade was largely a debt based charade, take a look at consumer sentiment:

Consumer sentiment actually peaked in 2000 even though housing values went into a full-fledged bubble mode for the good part of the decade. Why? Because people knew deep down that they weren’t getting richer and had to commit to ever increasing mortgages just to play the Ponzi game known as the U.S. housing market. Since incomes weren’t going up and the media was in full selling mode, nearly every other advertisement had something to do with banking, housing, or getting deeper into debt. Keep buying the television screamed even though your paycheck is stuck or going down! Why do you need money from work when you can just charge it all?

Yet psychologically, people knew that something was wrong as the middle class kept on shrinking. This is why sentiment fell from 2000 onward. Big money is the large player in advertising buys. The banking system to increase profits simply gamed the system even more by turning one of the safest purchases, a home, into another commodity to bet against.

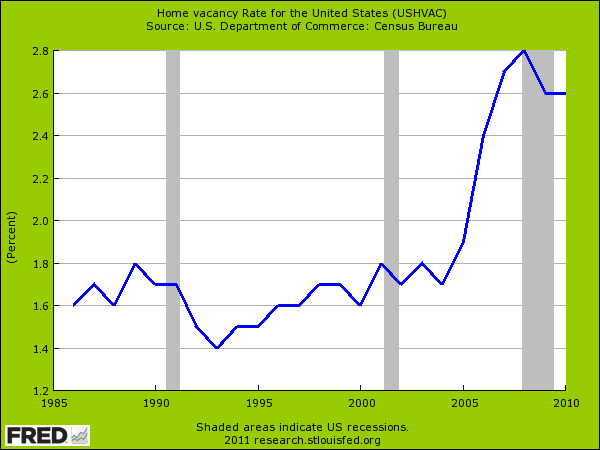

The housing vacancy issue

Construction is a big player in our economic growth. Most recession see a spike in construction right before a turnaround in the economy. We have yet to see that because of the excess housing units floating in the market. The housing vacancy rate is still near record highs:

What the above chart translates into is a giant amount of slack in the housing market. Even with mortgage rates at all time lows people aren’t buying because they are worried first about keeping their jobs. Access to debt has tightened up. And as we have highlighted, debt was the only thing keeping things going on the surface. The spiral was set in motion years ago. The only difference is that 95 percent of the American population does not have the wealth or political clout to make a positive change for their balance sheet when the overall economy is contracting.

We wish this was not some zero sum game but bailouts are zero sum games. The trillions of dollars that went to the banking system is trillions of dollars that did not go to shore up the middle class or put people back to work. Of course the media doesn’t talk about the questionable dealings of the Federal Reserve or the fact that they now have over $2.8 trillion in “assets†from their banking allies.

Real household income falling

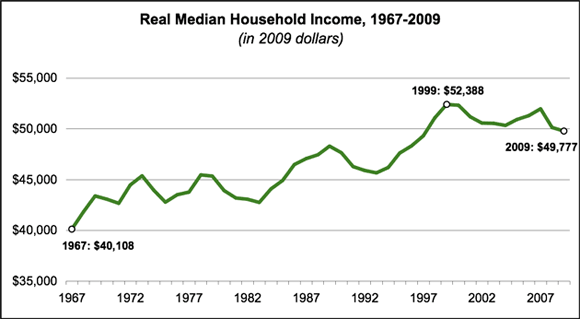

It is fascinating to see that consumer sentiment actually peaked with household income in 1999 and 2000:

Real household income peaked in 1999. The public lives this on a daily basis and has a good sense as to what is really happening with their intimate balance sheet. During the biggest housing bubble ever, real household income actually fell because banks siphoned off the froth profits through fees, commissions, derivatives, and other casino like instruments.

The current trajectory is not positive for the middle class. Americans need to realize that both parties are bought out by lobbyists for the plutocracy. When the system doesn’t work, the nation has a right to demand a change. How many more years need to go by before things do change? However long it takes, it is doubtful it will be televised.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

5 Comments on this post

Trackbacks

-

Donnie said:

Some say this scale of distribution disturbs and upsets the equilibrium of the 80 / 20% rule. The law of equilibrium states that as long as 80% of the proles get their share of the pie, there will be, begrudgingly, a semblence of social acceptance. After all, the general populace is happy shopping at Nordstrom (on credit) and Walmart in cash.

But many feel that we have arrived at sign-post – a signal event, that may herald some Un-American thoughts in the minds of the have-not’s, as opposed to Bush’s “Haves, and have mores.”

Stay tuned. The fat’s in the fire.September 10th, 2011 at 4:35 am -

Richard Evans said:

You write great articles. Have you written a piece that I may have missed with suggestions on how to reverse this problem?

September 10th, 2011 at 6:38 am -

L. Sutherland said:

Draft Herman van Rumpoy.

September 10th, 2011 at 4:55 pm -

truthbetold said:

When the smoke clears it will be the rich and the broke…….this is objective of the band of crooks running our country………get ready for a Cuban lifstyle……..we will be to hungry to revolt.

September 11th, 2011 at 4:54 pm -

james said:

Your chart of top 1% is actually going down from what 42% in 2007, also the bottom 80% use to control just 7% so that is up quite a bit. Hopefully this continues. Spending needs to be cut and taxes raised on the top 1%.

September 11th, 2011 at 6:33 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!