Inflation is all around us if you know where to look: Spiking food costs, rising home prices and rents, and more expensive energy.

- 1 Comment

Inflation is accepted as a normal part of our economy similar to how we take it for granted that the sky is blue. It is close to a religion where people simply believe that inflation is part of the economic fabric of our nation. Yet inflation with no subsequent rise in wages is tantamount to a loss in living standards like a lumberjack slowly chopping away at a big pine tree. Inflation is a slow process and erodes purchasing power through a variety of avenues. We sometimes need to step out one generation to see how massive the changes are in the system. Even today inflation is hitting the pocketbooks of most Americans. First, inflation adjusted wages are simply not keeping up. You spend more at the grocery store and get the same or even less amount of goods. Sending your kids to college? More of your money is being allocated to this purchase compared to the previous generation. Housing? The large push of investors in the market has caused housing prices and rents to go up. What this means for most Americans is that more income is being siphoned away into housing. All of these are very tangible impacts of inflation so why is it that central banking policy is practically ignoring all forms of this erosion of living standards to continue monetary easing?

Spiking food costs

Food costs are certainly up in price. Families spend a good portion on food each month. Just think of the typical American family making $50,000 a year. If you are spending $500 to $750 a month that is a good portion of your disposable income. One needs to eat. We’ve seen disinflation hit in this market were producers are repackaging items with less content but for the same price. These are sneakier ways of hiding inflation since consumers feel they are purchasing the same amount of goods but in reality, they are paying more for the same item. For example, smaller tuna cans or repackaged cereal boxes.

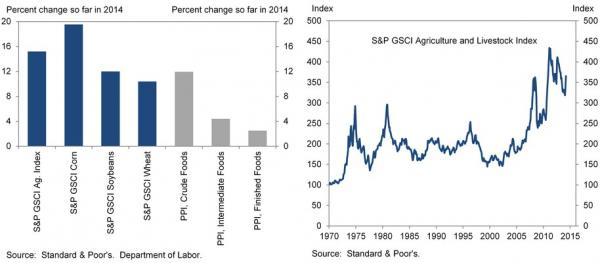

If we look at the S&P GSCI Agriculture and Livestock Index the change in prices are very visible. Most of the changes started in 2000:

The index is up more than 133 percent since 2000. You see that corn, soybeans, and wheat are all up in the double-digits this year alone. All of these items are large staples in our food supply. While this may cause pain domestically it will surely cause major changes abroad where more disposable income is allocated to food compared to here in the US.

Rising home prices and rents

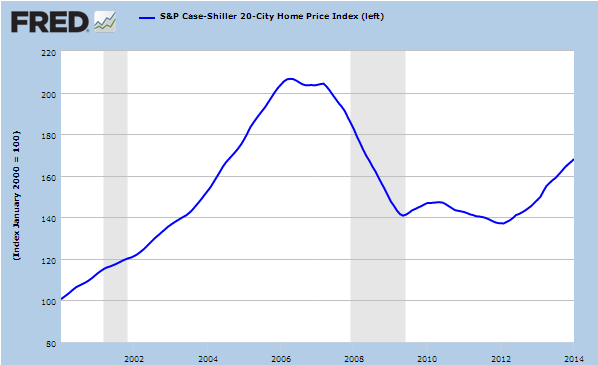

The Case Shiller Index is showing home prices are up 13 percent year-over-year and more than 20 percent from their trough after the housing bubble popped:

The problem here is that a big part of the push up in price has been from big investors buying up properties with artificially low rates crowding out regular home buyers. The market was already low in inventory and since the recession officially ended in 2009, nearly 1 out of 3 home purchases has gone to investors. That is, people not looking to live in the home which was the traditional method for middle class families to build up their wealth. Inventory was already low in the market thus the push up in prices. Many of these investors were seeking to rent places out and we have seen rents go up as well:

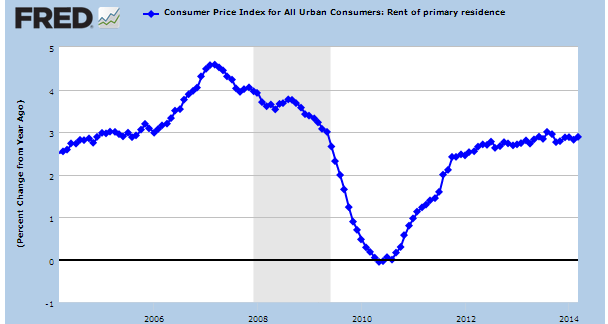

Rents have been going up steadily since the recession ended. The big problem of course is that household wages are stagnant. How this plays out is that more money is going into a necessity of shelter. If you buy or rent, prices are up.

More expensive energy

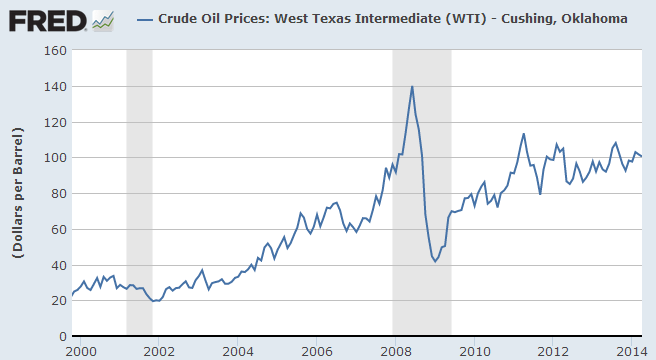

I doubt you will find someone disputing the rise in energy costs. Take a look at this chart:

Back in 2000, a barrel of West Texas Intermediate crude went for $30 a barrel. Today, it is going for $100 (an increase of 233 percent). Of course this filters down into every aspect of the economy. How does food get from the field to the store? Energy. What about farming the food? Energy. How do you heat or cool your home? Energy. What about our car dependent culture? Energy. And the cost of the most basic energy source is up 233 percent since 2000.

We’ve already discussed the massive rise in college tuition causing this nation to carry $1.2 trillion in student debt as of today. Yet there is no inflation to be seen if we are to believe major bankers. I would disagree on that assumption and that is why we are seeing a disappearing middle class. Inflation is eroding the standard of living and the status quo seems to be okay with this.

Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

michael said:

this is the 1st time i have seen talk about how cos. are hiding inflation with there smaller packageing! what are they getting from goverment a tax brake for doing this? all i know it pi—- me off! they should be jailed! i think its outragios that the media keeps reporting no inflation! must be a way to screw me on my social security raise!

April 19th, 2014 at 5:36 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â