The old get wealthier and the young get poorer.

- 3 Comment

This recession has been unmercifully brutal on younger Americans. Many are entering the most difficult employment market in generations with a flood of low wage jobs saddled with record levels of student debt. Many have never even witnessed how it is to live in a bull stock market.   Of course this is assuming they had money to invest since 37 percent have no net worth or even worse, a negative net worth. Even for the cautious minded, they are only able to garner a 0 percent savings rate as the Federal Reserve continues to implement a quantitative easing policy to rescue the banking sector. The data on net worth for US households is disturbing since it highlights a deterioration of the middle class. It is no surprise that this recession has caused many younger Americans to move back home with parents primarily because of the inability to find work and many that do find work find that it is part of the low wage growth sectors.

The young get dramatically poorer

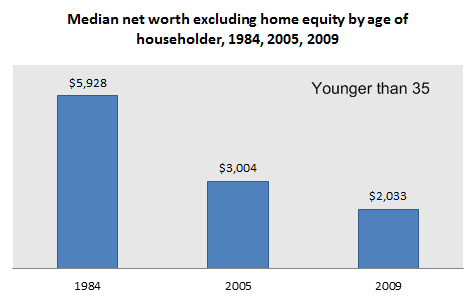

This recession has been particularly tough for younger Americans. Adjusting for inflation, those under 35 are worse off today financially than those in 1984:

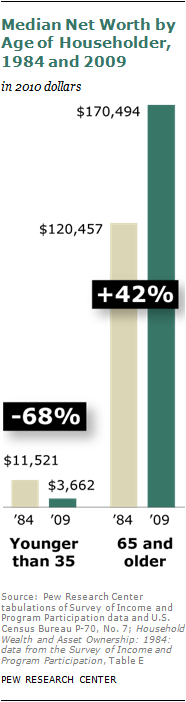

From 1984 to 2009, the median net worth of younger households declined by 68%. Older households did better seeing their net worth rise by 42%:

Source: Pew   Â

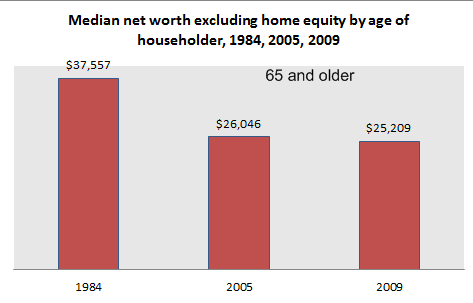

The above is somewhat skewed however because it includes home equity. The first chart we highlighted excludes home equity. What this shows is that many younger Americans don’t own homes and for those that do, many have zero to negative equity. So not only did they enter the worse employment market in a generation, they entered the worst housing market ever. Yet excluding home equity for older Americans we see that they didn’t do as well either:

This is an interesting point to the 42 percent rise. What we find is that excluding housing, many are doing worse off. It just happens that they bought at the right time during a boom and even with the bust, they have netted out a gain. Yet removing housing from the equation, net worth has fallen by 32 percent for those 65 and older as well. What does this mean for the middle class? What we can gather is that most Americans that bought in say the 1970s and 1980s (and even 1990s) still benefitted from the home equity they built over the years. Younger Americans that likely bought in the 2000s have seen no equity gains and in fact, might have seen their equity disappear.

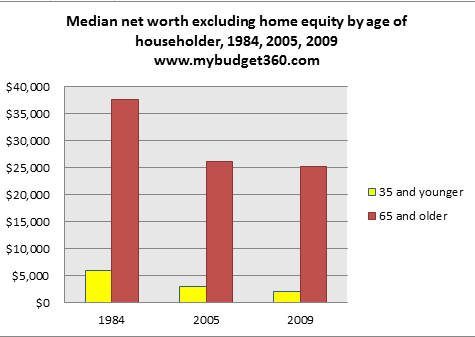

Side by side excluding home equity, both groups were hurt:

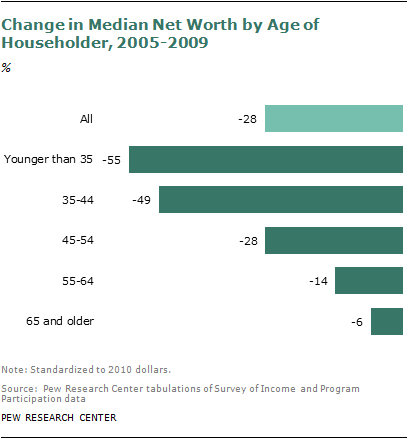

What this chart reflects is a major hit to the bottom line of every working and middle class family in the United States. One needs to ask, what really did we accomplish with all those trillion dollar bailouts administered by the Federal Reserve? Yet the pain experienced by younger households during the recession has been devastating:

Those 35 and younger have seen their net worth fall by a stunning 55 percent between 2005 and 2009. Compare this to 6 percent for households of 65 and older. Ultimately this has been painful across all working class and middle class age groups except for a very tiny group of households.

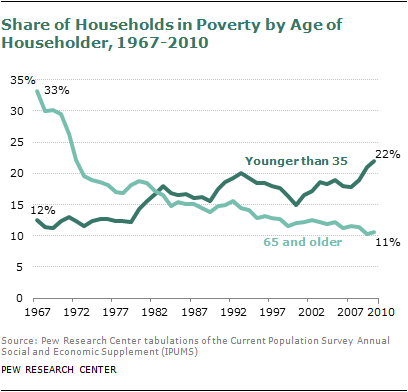

Younger households are now in poverty at a much higher rate than older households. It is hard to believe but those 35 and younger are now in higher levels of poverty than those 65 and older:

This trend has only accelerated recently. Now think about why this is happening. Even with an older home owner with a modest or no home mortgage, the $1,000 typical Social Security check will keep them moving along. But what of the young American worker competing for those growing low wage jobs that pay $10 an hour or less? Many cannot afford to live on this and this is why the rate at which younger Americans have moved back home has boomed. Is this the kind of recovery we had in mind? Where every other job is basically a Wal-Mart position?

The above facts paint a very troubling picture for the middle class in this country. The data shows that the traditional method of building wealth via housing has been a no-go for younger Americans. Also, when in the early 1980s some 60 percent of workers had some sort of pension, today it is down to 20 percent and going even lower. The stock market is back to where it was in 1999. How is that for growth?

Young Americans are saddled with proportionally larger student debt, have not experienced any home equity growth, and are living in a stock market where values are back to 1999 levels. Is it any wonder why many have a zero net worth or a negative net worth? This is not exactly the clear path to creating a stronger and healthier middle class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Chris said:

This is a picture for the 44 and younger crowd. Note, the 35-44 age group is not far behind the 35 and younger crowd. This is what happens when young people are kept from participating in politics via party gate keepers. All 44 and younger Americans need to max out credit cards and walk out of the country. Force them to actually fix this Corporatist-Fascist and Corporatist-Fabian nightmare.

March 14th, 2012 at 1:51 am -

JB said:

This is no surprise at all. We have been victims of the current socioeconomic trend for the last four years. More and more young people are entering to the labor market without any possibilities of finding a good, stable and prosperous job. These statistics are showing some new trends in the evolution of the american society. But they still doesn´t show the percentage of people who are doing part-time jobs.

We can just say thanks to the government, that it systematically uses the public budget on war and bailouts for big corporations, while the post-crisis job growth is slowing down. As Nobel prize winner prof. Stiglitz said, the government is Privatizing Profits, Socializing Losses. Without creating more sustainable public projects, the recuperation of the labor market in the near future is not probable.March 20th, 2012 at 11:18 am -

Hillary said:

It is hard being in the younger generation, especially seeing how things were before I got out of school. I am fortunate not to have student loans but also followed a path less traveled and less often rewarded. I worked hard to get where I am and it is still a struggle. I can say I am doing better than many people I know. Many friends have degrees and not doing anything with them and now have debt to pay for it.

June 15th, 2012 at 12:18 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!