Millennials Lead the Pack with Student Loan Debt: $1.71 Trillion in Student Debt and Millennials Continue to Struggle with Debt Overload. What Does it take to Purchase a Home and why Boomer Logic is so off?

- 2 Comment

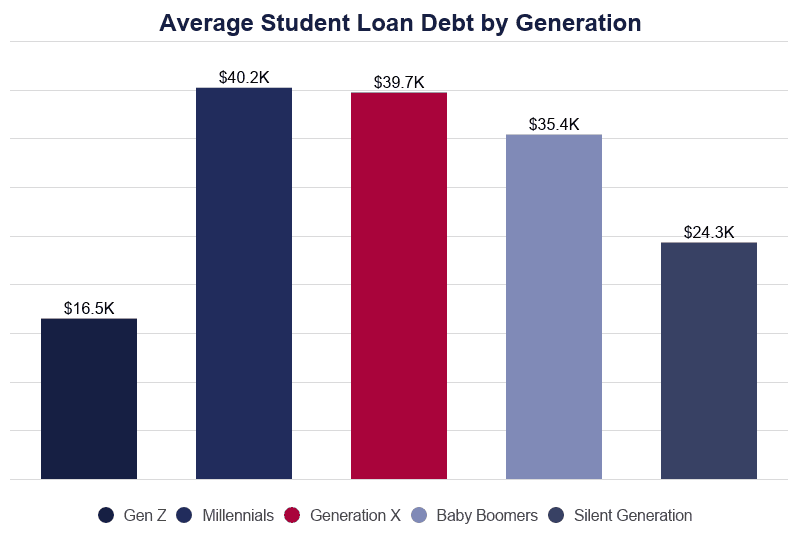

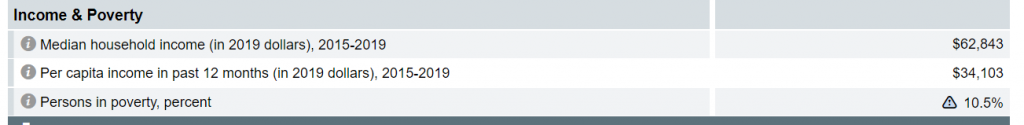

It should come as no surprise that Millennials continue to lead the pack in terms of student loan debt. The average debt carried by a Millennial is over $40,000. According to the US Census per capita income is $34,103 and the amount of student loan debt is deeply troubling since it is higher than one year of working income for a typical American. We hear the constant drum beat from older generations especially baby boomers that Millennials “need to suck it up†and save to purchase a home but that is largely nonsense. Why? Baby boomers in the US grew up at a time when one blue collar income was enough to buy a modest house in most metro areas. Today that is not the case. Minimum wage is $7.25 per hour and most good paying jobs require some form of education. It is important to highlight this because Millennial home buying is falling behind previous generations and each year that goes by creates one more year that wealth is not being built.

Student debt by generation

Here are the student debt figures by generation:

This data while not surprising also does not highlight the fact that “Geriatric Millennials†carry less student debt than younger Millennials. While these figures seem startling, it gets worse when you do the math to purchase a home.

Here are the figures:

The typical US household brings in $62,000 per year. The typical US home costs roughly $281,000:

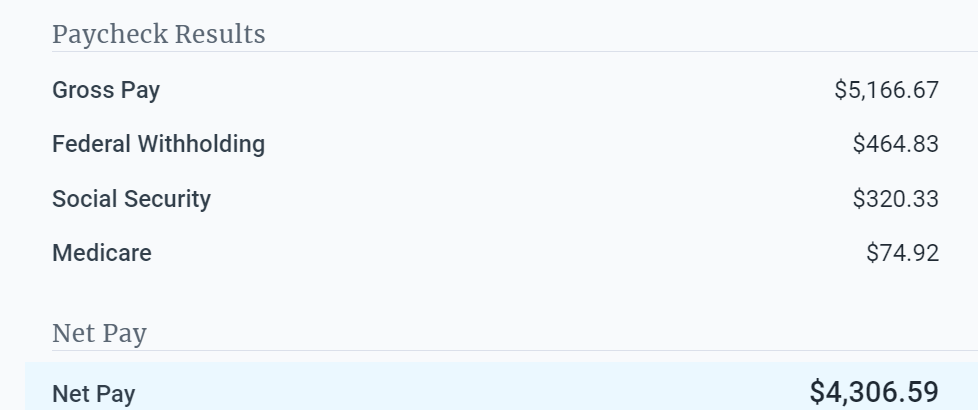

So let us assume this couple wants to purchase a home. What is their take home pay?

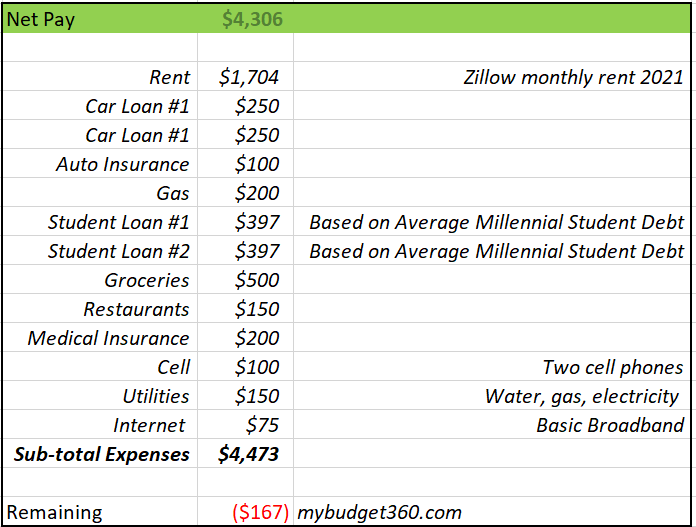

After taxes take home pay per month is $4,306. So that figure is clear. But what about student debt? Keep in mind the average of $40,000 of student debt is per person. So this household has $80,000 in student debt. And let us assume they rent and are trying to save up to buy a home. We will make the assumption that they are trying to save 10% of a typical home price ($28,100) before buying. Let us look at the budget here:

This budget is modest in many ways. Where is this couple going to save $28,100 from? Let us assume they cut back dramatically in many areas and can save $500 a month.

$28,100 / $500 = 56.2 months (4.6 years)

So it will take this couple 4.6 years to save for a down payment for a typical US home (assuming home prices also don’t inflate over this 4.6 years which they likely will with debt spending growing dramatically). Now we are not even looking at expensive metro areas like Seattle, Austin, Los Angeles, New York, or Denver where even though incomes are higher, the rate to save for a down payment is even more difficult.

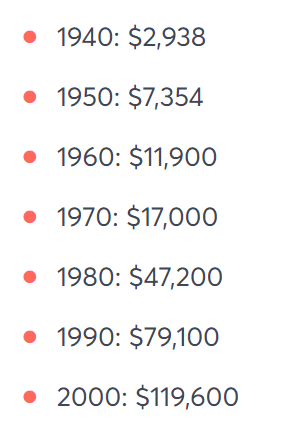

So let us take a trip down boomer lane. The typical home in the US in 1970 cost $11,700:

The median family income in 1971 was $9,870. Think about this for a second! A typical home cost essentially 1-year of a typical household income. Here is the ratio:

1970: $9,870 (income) / $11,700 (home) = 84% covered by one year of household income

Today: $62,000 (income) / $281,000 (home) = 22% covered by one year of household income

In other words, it has gotten multiple times over more challenging to purchase a home today than it was in 1970. It has little to do with Millennials eating avocado toast or buying Starbucks. And spare us the hedonic adaptation nonsense that “the typical home is larger and has more space†– that argument can be applied to cars as well but a home is the largest expense on a household balance sheet. Has the standard home gotten 24 times larger? No.

When you look at the math and inflation, Millennials have it tougher since they are having to fund entitlements of boomers today for an inflated lifestyle that many lived. Now, Millennials have to go into deeper debt to purchase a home today (if they can even make it).

And look at the typical college cost in 1970-1971 to today:

4-year public ($405 per year) – Typical income from 1970 could pay tuition for 24 kids per year

4-year private ($1,792 per year) – Typical income from 1970 could pay tuition for 5 kids per year

Today

4-year public ($11,171 per year) – Typical income from today could pay for 5 kids per year

4-year private ($41,411 per year) – Typical income from today could pay for 1 kid per year

Source: US News & World Report

Keep on blaming Millennials for made up personal flaws for their wealth building challenges instead of looking at the absurd math that is keeping many behind and the debt albatross many are carrying.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Sebastian De Bergerac said:

What a timely article for me. My friends and I were just discussing the out of touch Boomer Generation. The Boomers always say they have lived through so much. That they have seen everything, done everything, heard everything, smelled everything. They are always astounded why these younger generations are having such a difficult time with living costs. Well, let me tell you something. These Boomers haven’t done SH#T. They haven’t seen Sh@t. And, They don’t know SH#T. All they are good at is seeing the world through 1980’s monochrome glasses where prices and wages remain in that time. Its not surprising that these young people are living at home. Most jobs created in the USA are service sector jobs with poverty pay wages sans benefits. And don’t forget; our corporate leaders have worked hard at creating this service sector economy. To witness this boomdogle just watch Shark Tank on CNBC. The first thing these POS want to do is off shore production to China. And the American people eat it up and consider it astute business practice to do so. Unfortunately, America deserves this. We have demanded this as consumers!

July 10th, 2021 at 1:49 am -

Kathleen Shrum said:

No we dont deserve this. Al Gore actually won the election against Bush, 70% of Americans want Medicare for all, none of us wanted Trumps tax cuts for corporations. We are lied to daily by the elite and they killed our leaders in the 60’s. We ended the Vietnam war and the elite have made us pay for that ever since. The elite took down electric trolley everywhere so we would have to buy cars, Reagan cut elite taxes so student loans had to be invented since the government would no longer pay for educaiton. I tell my daughter all the time to move to Denmark with the $22 minimum wage, pensions the minute you start working, health care for all, free college you are paid to go to. The government needs to create a program to help kids get out of this country and to countries that care about young people like Denmark. Elite rule here so go to a country where they dont.

August 1st, 2021 at 8:00 am