The oncoming disaster in public pensions: The $4 trillion retirement savings deficit and the bill of payouts for pensioners.

- 5 Comment

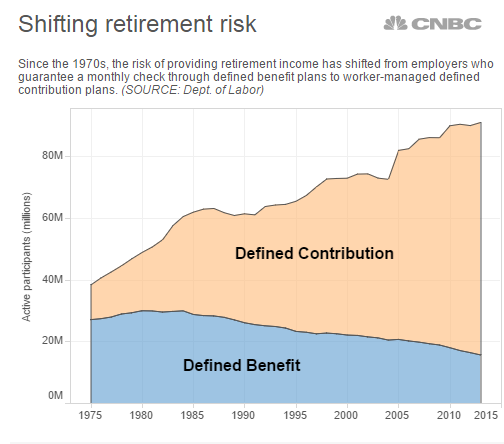

Americans have done a very poor job saving for retirement. In many cases, families simply have very little left over each month to save after monthly expenses chomp away at their net take home pay. Pensions used to be common. In 1975 you had 88 percent of private sector workers and 98 percent of state and local sector workers covered by defined benefit plans (that is a pension). By 2011 only 1 in 5 private sector workers had access to a pension. Public sector workers still have access to pensions for the large part but the math is not working out. Glorious stock market gains have not made up for big pension shortfalls as retirees start pulling in payouts. The numbers just don’t work. Greece is an extreme example of public spending gone awry and pensions are a part of the math. You have weak tax collection and massive payouts. How does that math work? It isn’t a question of pensions being bad but the underlying assumptions that are flawed. If you want healthy pensions, expect to pay. Yet people want it all with little coming in and politicians promise the world leaving future problems to predecessors to deal with. In the US, many pensions are relying on future stock market gains that seem very optimistic to meet their liabilities.

The pension challenge

The public sector still provides access to pensions for the most part. Starting in 2000 the math just stopped working. Even in light of the big stock market boom pension funding doesn’t look all that great. Part of it has to do with states underfunding their obligations. For example, the payouts are now coming in fast and furious but those paying in are not covering the outgoing funds.

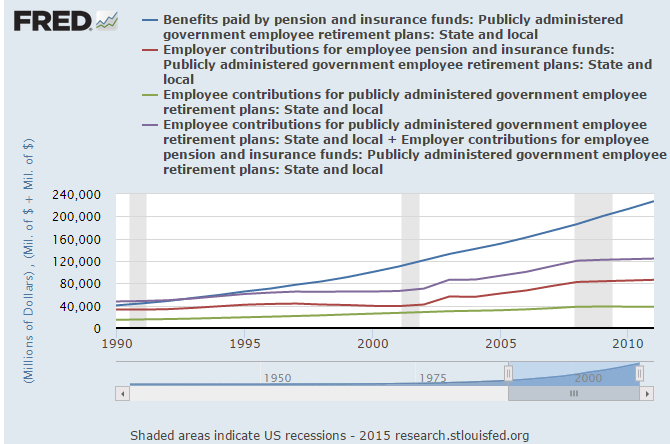

The analysis is easier to see when you break down revenues and expenses:

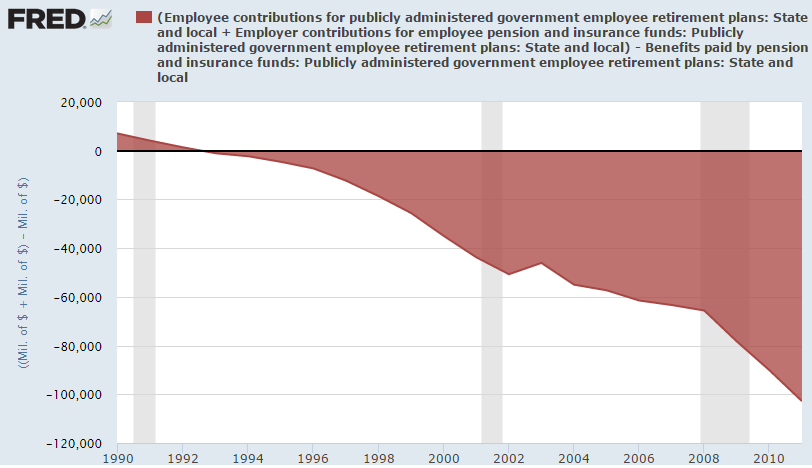

“(FRED, St. Louis Fed) Some cities and states, such as Detroit and Illinois, are struggling to fund their public-sector employee pensions. These crises may have seemed abrupt, but we can observe some structural causes using FRED. In the graph above, the blue line shows pension benefits paid to public-sector employees; the red and green lines show contributions from employers and employees. Adding the two revenue streams (red and green lines) creates the purple line. Note how the purple revenue line dipped below the blue payouts line in the mid-1990s and never fully rebounded. When the Great Recession hit in 2008, revenues dropped dramatically and payouts continued to rise. The graph below shows the resulting gap between pension payouts and contributions has increased markedly since the past recession.â€

In 2011 for the public sector, over $100 billion was paid out over what was collected through contributions. The chart is very clear. More is going out than coming in. And many pensions keep a large part of their funds in boring and safe funds so the returns have been capped in the face of the roaring stock market. Yet you don’t want to take giant risks when a large portion of your retirement pool is now drawing on pension assets. This is the standard advice given to most investors. When you are young, you want a large part of your asset allocation in stocks and less in bonds since you have plenty of time to ride the ups and downs of the stock market. As you near retirement, you want the bulk of your assets in bonds and less in stocks. You don’t have the flexibility at this point to ride any major changes to the stock market.

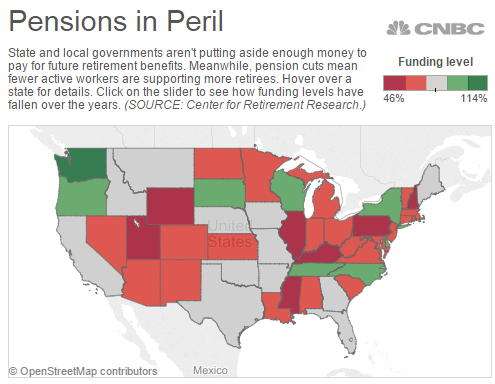

The charts above show the reckoning that is now happening with pensions. A large number of states are underfunded:

States like Illinois and Michigan have big problems. The math eventually catches up. This is why most of the retirement risk has been shifted to employees directly:

Going to defined contribution plans (i.e., 401ks) puts the retirement risk on employees. And many have not saved or are heavily underfunded (if funded at all). Over half of retirees rely on Social Security as their primary source of income. The retirement funding gap across the country is estimated to be at $4 trillion and that assumes the stock market continues to remain steady after the epic Bull Run starting in 2009.  What is certain is that pensions are in a losing battle now. How bad will it get? It really depends on the overall stock market performance and how well plans are funded. Some states are in better positions and some are deep in the red. Someone is going to pay for this. The young are making less and have even more limited retirement options. Is this the group expected to fund all these built in liabilities when they have massive debt in the form of student loans? Probably not but the pension problems are not going away anytime soon.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

taxedn2poverty said:

The States never have any trouble “putting aside” enough funds for pensions, they simply raise taxes on the private sector to give more to the public sector. It is not the State that is shouldering the burden, it is the taxpayer. It is beyond insanity to allow government employees at all levels to continue their unbridled rape of the private sector’s paycheck. Public employees receive without working, therefore it is a given that employees in the private sector work without receiving. There is no ‘disaster’ awaiting public pension funds, the disaster occurred when it was taken away from a tax productive private employee and given to a tax consuming public employee. That ‘disaster happens’ every payday! This most assuredly includes the military. How in hell can we continue to fund such overpriced weapons systems, of which a lot don’t work properly, [f-35 fighter aircraft], and then pay retirement for millions upon millions of soldiers from each generation to retire after only 20 years of service. And please spare me the poetic patriotic mealy mouth jargon of how much our military sacrifices so we can be free. I’ve heard enough of it. The government just spent 3.5 million to study why lesbians are obese. Did you get that, why lesbians are obese. There are tens of thousands of stupid programs such as the obesity study that gobble up taxpayers money at astounding rates. The government had already fleeced 2.5 trillion dollars from the private sector taxpayers by the end of June this year and they are still broke and running in the red with no curtailment of spending in sight. If the idiots had asked me why lesbians are fat, I could have told them the same reason I’m fat: I eat too damn much and exercise too little. Problem answered and no funds required. 40,000,000 people now work for the government, in the Federal, State, or local levels. 40,000,000! Couple that with 50,000,000 on food stamps, 100,000,000 not even in the workforce, 22,000,000 former soldiers, commonly referred to as veterans, holding their hands out for free medical, ptsd, and retirement benefits, not to mention taxpayer funded student loans, day care, sending rovers to Mars when we can’t get the potholes filled on our own streets, probes to Pluto when we can’t close our own borders and it is enough to make a sane person scream. But somehow or another, in the swampland vanity of our minds, if we can just jump on the next political carnival to elect a new President next year…well what the hell, we’ll all be living in Utopia! But in reality, we are a nation of soft shell, whimpering, undisciplined, self serving, spoiled rotten idiots of all races and both genders, being led by hardcore, ultra wealthy, psychotic political criminals, down an indignant, indefensible, self righteous, and well deserved path to national suicide. What damn good will a pension do anyone after we are invaded, defeated, and relegated to the junkyard of things that might have been history. Even after the collapse, not one Public Employee will ever admit that they took until nothing was left to take…and even then they wanted more, and will go to their graves swearing the taxpayers did not pay their fair share. Public employees, civilian and military are parasites that give no thought whatsoever to the unbearable pain they are inflicting upon the host animal: Taxpayers. Period.

July 14th, 2015 at 10:43 pm -

Mr Reynard said:

Soylent Green ??? Or Logan’s run ??

Whichever it will be ???

I take my punt on Logan’s Run !July 15th, 2015 at 12:03 am -

taxedn2poverty said:

The truth hurts, doesn’t it?

July 15th, 2015 at 8:13 am -

Sudsy said:

Spot on, taxedn2poverty, you hit it right on the nose.

July 19th, 2015 at 8:00 am -

political ranger said:

If your precious private sector paid their fair share of all the public services they consume, like hiways, police, port authorities, trade deals, then governments wouldn’t be in such poor shape.

Corporate welfare and tax holidays for the corporate sector costs our economy far, far more than the few pennies it costs to keep some broken down old soldier in his cups.

Greedy bastard!July 22nd, 2015 at 12:51 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â