Retire Extremely Early: Dollar Cost Averaging and Maintaining a Positive Attitude in Tough Economic Times.

- 2 Comment

During trying times I think it is very easy for many to get pessimistic with all the negative news and let their ultimate goals slip away. Simple rules to live by include keeping debt to the lowest level possible and having clear cut goals of where you want to be in 5, 10, and even 20 years. Wherever you are in life it is never too early or too late to decide what you want out of your life. Money should be a method of achieving your goals and not the ultimate purpose. Unfortunately many Americans live their entire life waiting for that far off day in retirement only to realize that life has passed them by. Why not enjoy life right now as well? As you may already know, I am pretty conservative in my investing style and the current state of our economy has only highlighted the worst in investing habits for the public. We collectively as a nation have become a debtor nation and that is a sure way not to reach your goals.

There is a positive article about a couple who saved up a modest amount of money and retired at the very late age of 38. I think this story is a great read and I found it over at Minyanville.

I want to go through a few points in the article and demonstrate that you may not need as much as you think to achieve many of the things you desire for your life:

“At 55, Billy and Akaisha Kaderli have been retired for 18 years, enjoying extensive travel in Asia, South America and throughout the U.S.

Their getaway plan was crisp and simple: They started saving and investing early and avoided debt. Unlike some people with lofty goals, they stuck to the plan.

“We’re more concerned about running out of time to pursue our dreams of traveling than we are about running out of money,” Billy says.

The couple lived in Santa Cruz, California in their late 30s. He worked as a stockbroker and she owned and operated a restaurant overlooking the Pacific. Not exactly the traditional rat race life, but at 38 they decided they were working too many hours, paying too much of their income in taxes and not traveling enough.

By 1991, they’d stashed about $500,000, including a $100,000 gain from the sale of their house. The couple never paid much attention to “stuff” — cars, fancy clothes and country club memberships didn’t interest them — so they put what few household goods they had into storage and took the first step in fulfilling a lifelong ambition to see the world.”

First, it is absolutely critical to get yourself into the belief that debt will take away from you reaching your goals. This couple had an extremely clear vision of what they wanted to do. They wanted to travel the world. They realized that too much of their time was spent working away and that was conflicting with their goal. Of course, you need money to travel so they decided to delay gratification today for a life that is actually very fascinating and flat out fun. They are living their dream and it didn’t take that much money. With $500,000, they have managed to conservatively take out a bit of money each year to finance their travels:

The couple invests in index funds and benefited from the 1990s boom. They try to limit withdrawals to about 3% of the gains each year. The money is taxed at the 15% capital gains rate – not the much higher tax rates of 25% to 35% on earned income. They haven’t touched their Roth IRAs because they’d get whacked with a penalty for early withdrawal.

The couple tries to limit living expenses to about $24,000 a year – not an impossible goal in parts of Asia and Mexico. But recently they’ve been hit with unexpected costs: a new laptop computer to update their website and dental work for Akaisha.”

You may be saying, “$24,000 a year?! There is no way I can live on that much.” You’ll be surprised that in some parts of the world including South America $24,000 will go a very long way even with our declining dollar. Plus, you need to realize that the cost of living for housing and other items is much lower if you are actually living in these areas instead of stopping in tourist areas where prices are inflated. Now I know many people will not want to travel and simply want more time for themselves, but really this is a crucial exercise in determining how much money you need to live on your most basic needs. Sometimes having this minimalist approach frees you up from the slavery of debt.

Have you really thought about what you want out of life? Even taking mini trips during the year can help you out and jolt your brain into figuring out why it is that you are trying to be financially prudent. I would venture to guess that you do not want money simply to say you have it but the freedom that it can offer once you get there. Sometimes the biggest perk of saving is that it keeps you from buying useless things that fill your life up because you are pushing off confronting the existential question of what kind of life do you want for yourself. Here is a basic step:

“The how is so basic many people overlook, or ignore, it: Develop a saving and investing plan in your 20s, stick to it and don’t go into debt. If you’re younger than 30, save at least 10% of your gross income. Boost your savings to 15% if you’re over 30 and raise the percentage with each pay increase. Take the money off the top each month. If you don’t, you’ll quickly discover that expenses rise to consume available income.”

I think many financial articles do have salient advice. But what they miss is the psychological component of money. That is, people sometimes do not dig deep enough to figure out why they are saving the money for. What is the point or impetus to save if you have no long term goals or passion? In fact, the current credit debacle played on this psychological fear; that is people went into massive debt without looking at their ultimate financial goals. Buying a home and hoping it keeps going up is not a long term plan. Yet many in our country felt this was the main priority and unfortunately leveraged themselves to the point that all other life plans were put on hold.

First let us assume the most basic premise. Let us say that you can survive at a basic level on $20,000 a year. How much money will you need for this? Well if we assume a 5 percent return then we need a nest egg of $400,000.

$20,000/(5 percent return) = $400,000

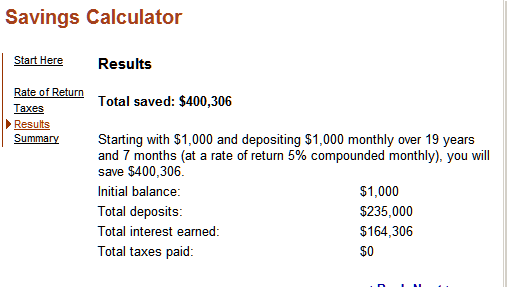

You can play around with the numbers and adjust the percentage point or nest egg. The point of this is that you may not need as much as you may think. Now how quickly can you get to this point? If you start out with $1,000 in savings and save $1,000 per month you will have a $400,000 nest egg in 19 years:

Dollar Cost Averaging

Of course I am being extremely conservative in the rate of return above. The point of this is getting started now is the most important thing you can do because of the impact of dollar cost averaging and compound returns. First, the market is most likely to face harder times this year. That is why I do not recommend people putting their money in all at once. If you have $10,000 to invest, I would find conservative investment vehicles (I’ve mentioned a few on this site) and put in $1,000 a month until you finish the amount and keep the rest in a liquid and FDIC insured account. This way, if the market does correct you can pick up shares at a lower price which will balance itself out in the end.

$1,000 a month especially in a 401K/403B is not much especially since you are taking it out before taxes are taken out. If you gross $4,000 a month this is 25 percent of your income. Keep in mind that this will also force you to live modestly which will help if you are planning on living on a smaller sum of money. Normally in our lives we have to balance out time or money. Usually we have to choose between one or the other. Hopefully you’ll be able to realize that money itself is only a tool in helping you have a much more fulfilling life.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Roman said:

Very interesting but will that be enough for retirement?

April 19th, 2008 at 11:28 am -

George said:

Saving 10% (or even 15%) understates the possibilities. Keep in mind that

money saved is money not spent — it requires being able to live on less

money thus lowering the amount needed to be saved. How long does it take

to save 1 years expenses:saving 10% -> 9 years (since only spending 90% of income)

saving 20% -> 4 years (spending 80% of income)

saving 30% -> 2.3 years

saving 50% -> 1 yearMay 9th, 2008 at 7:09 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!