Stock Market Casino Royale – S&P 500 is overvalued by 100 Percent – Earnings do not Justify Current S&P 500 Levels. Financial Markets setting up for Another Correction.

- 2 Comment

When I look at the S&P 500 like most people do, you would expect that this wide cross-section of companies in the U.S. would reflect an accurate measure of the true health of industries in our economy. Yet the S&P 500 is fully disconnected from any historical measures of valuations. It is startling to see people talk about the wild swings in the stock market as if this were somehow standard in a regular market. The S&P 500 fell by a stunning 58 percent from the peak in summer of 2007 to the low in March of 2009. But from March of 2009 to February of 2010 the market has rocketed back up by 63 percent. This kind of massive market volatility is not indicative of a healthy stock market. This is a symptom of a system that is having a really hard time valuing assets since much of the toxic financial assets are still lurking in the murky black box of many financial institutions.

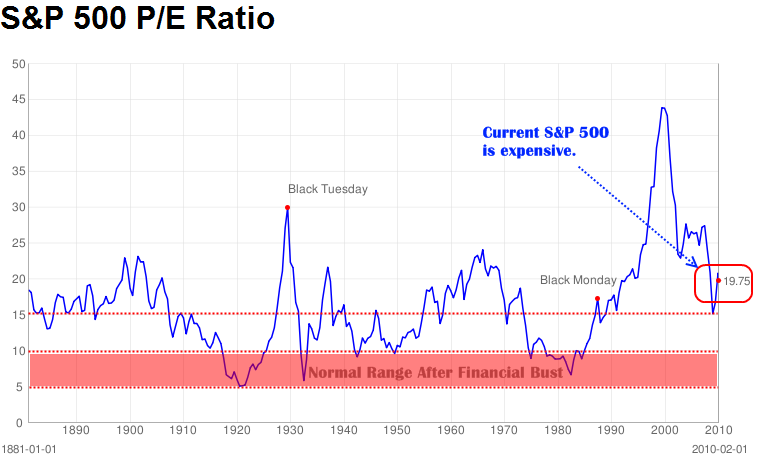

Let us first look at the S&P 500 price to earnings ratio (adjusted for inflation):

Source:Â Robert Shiller, www.multpl.com

130 years of data and each major financial crisis has sent the PE ratio falling between the 5 and 10 range. This crisis has kept PE ratios elevated to the point that the S&P 500 is still valued at twice of what it should be if we use moderate historical valuations. And if we measure the bubble via earnings, valuations during this bubble got even more out of line compared to those prior to the Great Depression. Yet in this crisis, valuations never made it down to a more realistic level. This is endemic of our current financial system where market alchemy is suddenly supplanting any rational analysis of earnings and actual potential growth.

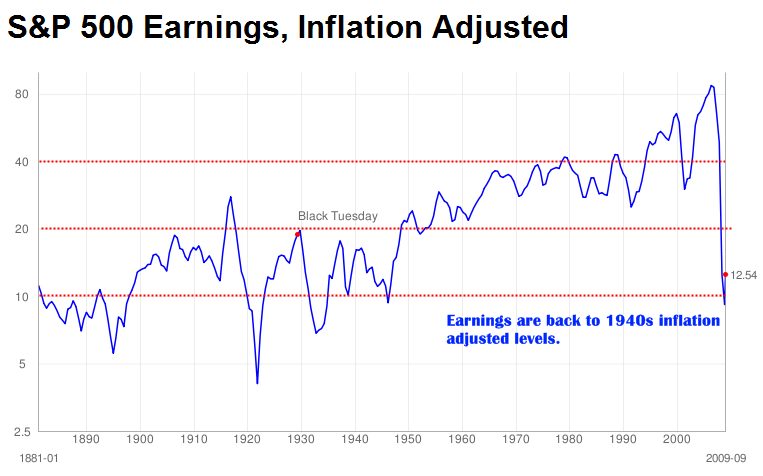

Take a look at inflation adjusted earnings:

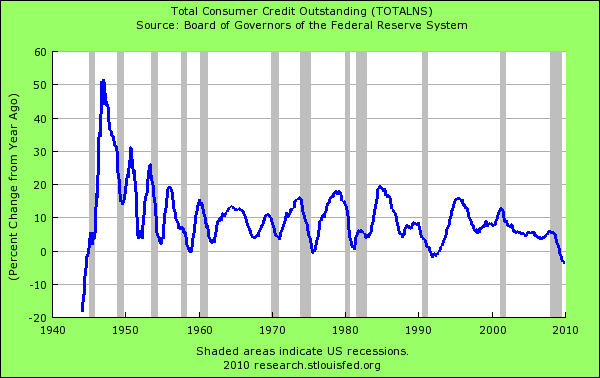

Earnings have collapsed during this market turmoil yet the market is up some 63 percent. What is the rally based on? A lot of the rally is based on easy money flowing into financial institutions that are using their black box to make trades and maneuver around accounting rules to make out with billions in profits while the real economy is mired in real fundamental problems. And this is easy to see since all you need to do is look at how consumer credit has contracted over the crisis:

Now ask yourself the following question; if we are a consumption based society and a large part of our consumption is fueled by debt, doesn’t a massively contracting credit market mean people are spending less? Of course. The above chart merely reflects what average Americans are dealing with. They are adjusting their household budgets to reflect stagnant wages or lost jobs. They are battling with the reality that their homes are not worth what they once were during the halcyon days of the bubble. Yet the stock market has rallied as if we are back to the heyday of 2007.

This rally is really something to behold:

The only other time we saw such a sharp drop and rally was during the Great Depression. Yet the depression dragged on for over a decade and here we are less than one year from the bottom of this market correction and all of a sudden we expect the market to be valued at these levels with no justification from actual earnings? It just doesn’t make any financial sense. We are back to seeing bubble like behavior.

Middle class Americans are largely not participating in this rally. Clearly banks aren’t lending anymore even though they clamored for additional funds to provide credit to Americans. The home loans banks are making are all backed by the U.S. government which only adds further fuel to the flame. If you really want to see what sector by and large has benefitted the most from this rally, just look at the financial sector:

While the S&P 500 is up 63 percent and that in itself is stunning, the financial sector index is up a stunning 173 percent in this same period. Have the banks really gotten that much better? Is credit really flowing from their doors? Not really but banks have managed to take taxpayer money and funnel it back into the stock market that is largely becoming more and more like a casino. The structure is setup for quick profits even if it means long-term destruction for our economy. Why try giving a boring 30 year fixed mortgage and earn a modest fee, even though the client will be better off in the long run when you can dish out a toxic mortgage with a high commission but will eventually lead the borrower to ruin? That is the structure of our current financial system and nothing has really changed even though we have seen the most volatility since the Great Depression.

The current stock market valuation tells us that the stock market will hit another correction. Short of incomes going sky high or earnings doubling each subsequent quarter, at a certain point valuations need to come back down to Earth. Ironically the low reached in March of 2009 actually reflected a more sensible valuation of the economy. Right now the S&P 500 is betting that things are back to the good old days but clearly this is not the case. We should now be absolutely cautious when people try to value stocks or assets on potential values and not what reality is currently reflecting.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

2 Comments on this post

Trackbacks

-

Ed said:

Very well written. The morons and con artists on Wall Street are laughing all the way to the bank at the expense of the American taxpayer.

February 3rd, 2010 at 12:50 pm -

Nancy S. said:

People are too optimistic. This recovery makes for great news, but isn’t real. How many companies do you know are hiring people? Profits are being made by cutting costs, not by growth in sales…

March 14th, 2010 at 9:47 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!