The systematic financial pillaging of the middle class – Millionaires don’t feel rich unless they have $7.5 million while 45 million Americans live on food stamps. Another 50 percent cannot come up with $2,000 in the next 30 days.

- 13 Comment

For over 30 years the debilitating shrinkage of the middle class has been papered over with access and use of debt. Debt in every form; mortgage debt, credit card debt, auto loans, and student loans. Yet debt is not wealth. Americans are facing a financially nightmare where 1 out of 3 has no savings. This should come as a little surprise since the per capita income in the country is $25,000. Many workers are simply getting enough out of their stagnant paychecks to pay the monthly bills. Of course much of the real wealth has been systematically looted through bailouts and crony capitalism. There was a time when the government and even Wall Street benefitted by a growing U.S. middle class. Now all you hear from banking executives is how much cheaper it is to outsource American jobs at the same time their pay keeps soaring. Why don’t we outsource their job? The problem of course is a deep capture of our political system and a perfect fusing of Wall Street and the government. The middle class is slowly floating away as inflation created by the Fed bailouts of the too big to fail banks causes more and more financial pain.

The economy that debt built

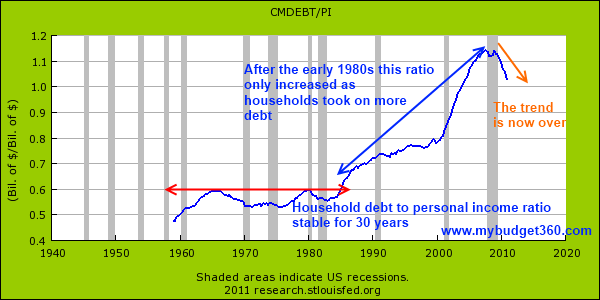

I wanted to examine the growth of personal income in relation to household debt. If we setup a ratio between the two we see that from the 1950s to the early 1980s the ratio was rather stable. Even while debt went up, so did incomes at a relative level. This all changed in the early 1980s:

Just like a person can go out and buy a McMansion with a giant mortgage, lease a European luxury car, and go into $100,000 of student loan debt the good times are felt only shortly. The bill eventually does come and it is coming in full to the American public. Yet the middle class only expanded because of access to debt. So as this access is shunted the American middle class has now faced over a decade of lost returns in wages. No growth. The reason so many people are losing their homes is because they simply do not have the income to sustain their purchases of the years when debt was handed out like candy. The big banks still have access to this debt machine courtesy of the Federal Reserve. Yet the middle class is now being thrown to the wolves to support the too big to fail. Why doesn’t the media after four years examine deeply what we have gotten for the trillions of dollars thrown at the banking sector?

Stock distributions

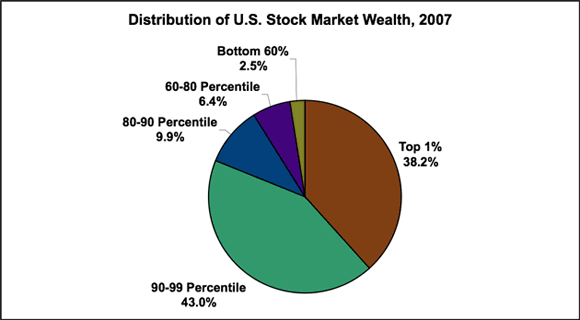

Stock wealth is a good indicator of wealth in a nation. Someone can own a nice home, a fancy car, and all the goodies in their home but have zero wealth and even a negative net worth. But with 1 out of 3 Americans with no savings and 50 percent of Americans unable to come up with $2,000 in the next 30 days, very few can be said to have wealth. At this point it is useful to examine who owns the stocks in America:

Source:Â Economic Policy Institute

The top 1 percent in our country control over 38 percent of all stock wealth. The top 10 percent control over 81 percent of all stock wealth. In the end, stocks are something the middle class by definition do not participate in with any significant vigor. For those with a sizeable portfolio you are in the upper-class simply by definition. At some point people have lost perspective. There was a study conducted recently that found for millionaires to feel wealthy they need $7.5 million. Have these people lost perspective that 45 million Americans are on food stamps? Or what about the 23 million underemployed in the country? Or the fact that half of the country couldn’t come up with $2,000 in 30 days. This group has bought into the Wall Street propaganda machine of the poor financial CEO only making enough to fuel 20 yachts. So yes, the bailouts were justified in their mind.

The gap only grows

What made our country grow from the 1950s to 1960s in a healthy manner was a shared growth in real personal income without relying too heavily on debt. This was shared prosperity. Nothing like that has occurred over time. The data is what it is and the gap is obviously present unless you choose to ignore it:

Again you can go back to the 1980s to see the start in this income divergence. Since that time the bottom 80 percent has been sacrificed while the top 1 percent has seen accelerated growth of their wealth. Now what exactly happened over this time? First there was massive financial de-regulation. This allowed for the junk bonds of the 1980s, the S&L Crisis, the tech bubble, and finally our historic housing bubble. Yet while the middle class got taken for a ride after each bubble burst, the financial sector simply received a bailout each time. The returns from government bailouts are guaranteed so this is why Washington D.C. is filled with banking lobbyists. It is the best return you can get when you can steal the taxpayer blind.

The wealth inequality in our nation is a consequence of this de-regulated two-tier system of crony capitalism. As the middle class has seen their wealth and jobs being stripped from their overworked hands, the top 1 percent has enriched themselves with every subsequent bailout. As we all know through the parroted financial media, stocks over the long-run return 8 percent.  Yet what if you have no savings as many Americans do? What about the fact that this does not factor in the reality of selection bias when all we see is companies that continue to survive (i.e., no failed companies in the S&P 500 right now). So you see what you want to see. And the most important key ingredient is government backed taxpayer bailouts for the ultra wealthy. They can’t lose but the charts above show that this has come at the expense of the middle class. No one is begrudging say a Netflix that is providing an actual service and making fantastic sums of money. Good for them. But what we have is the financial sector simply looting the wealth of middle class Americans and providing no service other than stealing their money for bailouts. Then you have the too big to fail making billions on onerous fees like overdrafts which directly hurt the poor the most.

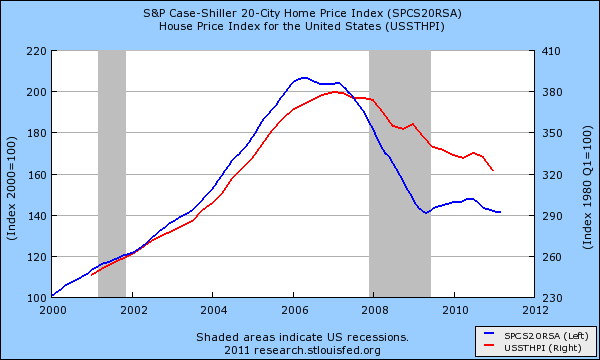

Americans that do have a tiny bit of wealth have it in their homes. Yet as we all know the housing market isn’t exactly doing that well right now:

Didn’t the bailouts have a premise of helping middle class homeowners? Of course not. The money has been diverted for banks to speculate in global stock markets while they completely ignored the housing market. The new world of crony capitalism, where the connected win even if they lose.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!13 Comments on this post

Trackbacks

-

Dumbfounded said:

It is simply a time to get real. Stop living in the fantasy of Granite Expectations. We must learn to expect and spend much less. This goes for the rich and the government. And of course vote.

June 15th, 2011 at 7:59 pm -

Kreditanstalt said:

The “wealth” that you claim “the banksters” have stolen was never there in the first place. House “values” cannot be worth; they are often illiquid anyway. If everyone owns the same assets, the same funds, the same SS system, the same IRAs, the same mutual funds – how can everyone simultaneously realize this “wealth” absent wholesale selling? Which crashes any market. In short, it’s a Ponzi scheme writ large, but it didn’t have to be…

…Because the middle classes didn’t have to borrow. Didn’t have to take up credit offers. Could have saved, inveted wisely in rel assets and looked to the future we now see. Lived within their means. Could have used their noggins and figured out that unprecedented growth rates could never continue and, without them, no one had any chance of cashing out before the Ponzi went bust… The middle classes are the architects of their own demise: the banking system only provided the drugs.

June 16th, 2011 at 7:13 am -

Warren Raftshol said:

The erosion of wage share by inflation is little understood or comment on. The focus on employment levels distorts the picture because employment remains high even after wage share has fallen to a low level. For a Goodwin model simulation of this go to http://johanraft.wordpress.com/2011/06/12/what-if-paul-volcker-didnt-fight-inflation/

June 16th, 2011 at 7:14 am -

kenny said:

Seniors will be the sacrificial lamb in this fiasco and then our children will be slaves to the elites, while they continue to eat caviare and squab under glass and the sheeple eat dog food……..bah,bah,bah……when do we say enough is enough and do something about this bulls__t

June 16th, 2011 at 7:39 am -

Blake said:

John Steinbeck says the following in the remaining few pages of the Grapes of Wrath, Chapter 29:

-No work till spring. No work.

-And if no work–no money, no food.

-Fella had a team of horses, had to use ’em to plow an’ cultivate an’ mow, wouldn’t think a turnin’ ’em out to starve when they wasn’t workin’.

-Them’s horses–we’re men.

The women watched the men, watched to see whether the break had come at last. The women stood silently and watched. And where a number of men gathered together, the fear went from their faces, and anger took its place. And the women sighed with relief, for they knew it was all right–the break had not come; and the break would never come as long as fear could turn to wrath.

there’s a reason for martial musicJune 16th, 2011 at 3:51 pm -

tyler said:

I’m gonna send this to every Republican I know just for laughs. I’m expecting responses to range from, ain’t America a great place, anyone can grow up and be rich if they work hard enough. To their classic line of the top one percent pay forty percent of all taxes. They don’t address the structural imbalances in our society. The sad part, every Republican I know is middle class at best and their oblivious to the fact that this article is about them. Brainwashed.

June 16th, 2011 at 5:04 pm -

Davidus Romanus said:

It all started with the Federal Reserve and Fractional Reserve Banking. Eliminate those two and we will return to prosperity.

June 17th, 2011 at 4:18 am -

CLARENCE SWINNEY said:

ONCE MORE I THANK YOU

YOU ARE SUPERB

HAPPY FATHERS DAY TO ALL

olduglymeanhonest political historian

lifeaholics of america

Best Advice ever for me

Workaholic

Minister Dad: “Son, work for a life not just a living”June 17th, 2011 at 8:45 am -

Dave In Iowa said:

Once again, any financial chart shows dramatic swings about 1980.

Thanks Ronnie

Rot in hell.June 19th, 2011 at 5:38 am -

MAbanak said:

I’m afraid Kreditanstalt got it right. The middle classes are the architects of their own demise: the banking system only provided the drugs.

June 19th, 2011 at 6:46 am -

Gail Ralya said:

There ARE middle class people (earning $25,000 per capita) who have not succumbed to temptations of credit, saved a part of every paycheck AND have a sizeable stock portfolio. This financial philosophy was learned from our Depression-experienced parents and never forgotten. (Thanks, Dad!) You must take responsibilty for saving for a rainy day. It’s raining now.– Republican

June 19th, 2011 at 12:14 pm -

laura m. said:

Voting is a rigged game, since all politicians work for the banking elite. Most American’s have no idea what’s going on. Kenny youre right, once the middle call is gone, the country is gone forever.

June 19th, 2011 at 3:13 pm -

Bob Lince said:

The 7.5 mil to feel rich, is that net worth or yearly income?

Trying to understand the household debt to personal income ratio. Say in 1960 it was ~ .6. Does that mean a household then, with a 10k yearly income had a total 6k balance due on its mortgage, car payment, credit card (if they had one), installment plans, etc? Or is the household debt figured some other way…e.g. yearly debt service?

Thank you in advance.

June 27th, 2011 at 8:47 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!