The growing gap in retirement savings: Half of American families have zero in retirement savings and most are worse off than they were in 2007.

- 2 Comment

While we have been on a strong bull market run since 2009, half of American families have nothing financially to show for it. The gap between the retirement ‘haves’ and ‘have-nots’ has grown since the recession ended. It is telling that half of American families have no retirement savings and many are going to rely on Social Security to get them by when they enter old age. Is this something we should worry about? I would argue that this is something that is incredibly important because being able to save and build up wealth is one way to establish a nest egg for old age. To build up a nest egg you need to have the ability to save money. The challenge is that many Americans are living paycheck to paycheck and don’t have the ability to put money aside.

The growing gap

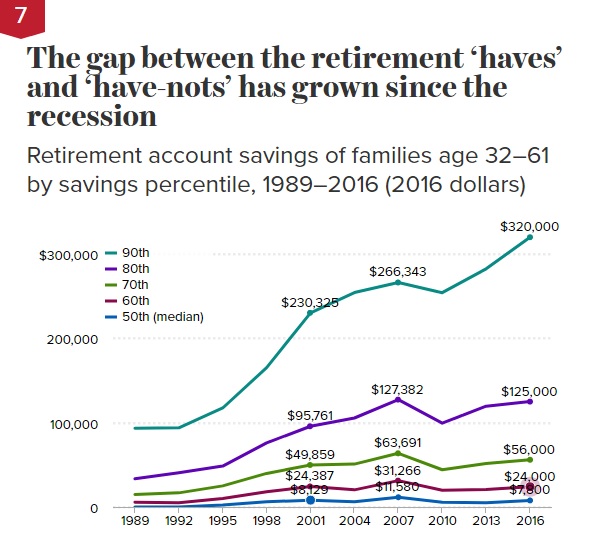

The Economic Policy Institute came out with some new data that highlights this growing gap in rather stark terms. Take a look at this chart showing the retirement account savings for US families:

The only tier that is better off since 2007 is the 90th percentile. The rest of the country is maintaining a flat rate of growth in retirement savings, and of course half of families that actually have zero in retirement savings. This is why many older retiring baby boomers are fully dependent on Social Security as their main source or retirement income. If Social Security were not there, many older Americans would be in abject poverty.

The above data is very telling because it highlights that even though we’ve been on an epic bull run since 2009, many people are simply not reaping any benefits from the market run. Sure, things have recovered if we only look at the stock indexes but adjusting for inflation people are way behind. And then you think of how many people are living paycheck to paycheck with no savings and you realize people are just treading water economically.

I’ve made this point before but this trend is going to continue because many young Americans are saddled with high levels of student loan debt so their first priority is to work and pay off their debt. Putting money away into a 401k is not on their to do list. We need to understand why the gap is growing and is only going to grow with the rising levels of debt: credit cards, student loans, auto, and mortgages.

When you look at this in context you realize that the retirement system is not working well for most workers. Decades after 401k plans came into existence and you realize that people are simply not putting away the necessary money to secure a nest egg into later years. That is problematic and we are seeing those issues now hitting older Americans as they try to live in their later years. At that stage, there is only so much you can do to get your savings up given that your peak earning years are long gone.

The gap is growing and is only going to grow if we continue on this path. Too much debt and not enough guidance is being provided to people so they can plan accordingly.     Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Tom said:

I’m amazed that the system has been kept going this long. Seems all conventional wisdom and legit math has been thrown out the window. I moved most of my retirement investments into conservative vehicles. It seemed logical and the common sense thing to do. I did miss out on the stock market rebound. Nothing was ever corrected/repaired/or fixed from 2008. Things were patched up with a lot of debt, printed money, gamed interest rates. I really don’t want to seewhat happens when things blow up. It will make 2008 look like “good times”

December 15th, 2019 at 2:44 am -

Roger Salyer said:

44% of all jobs in the US pay $18,000 per year or less. Kinda tough to save anything on those wages.

December 17th, 2019 at 2:15 pm