The Middle Class Financial Compact Being Washed Away – Income Dilution and the Saving Disparity. 57 Million Households Live on $52,000 Per Year or Less.

- 7 Comment

The middle class is finding itself struggling to keep what was once seen as staples of a burgeoning working class in our country. Part of this battle has come from a system that has rewarded easy finance on the backs of the working class. Take for example residential real estate. For decades, this was probably one of the most boring and dull sectors of the economy. Residential real estate, if you were lucky, only tracked the overall inflation rate. That was the case until the banking system figured out a way to securitize bread and butter mortgages and turn them into securities for global consumption. Yet that game is now coming to a quick end. The middle class are literally being squeezed out of their homes. Healthcare costs are also cutting deeper into the wallets of most American families and many are finding that they have no coverage as unemployment is still at record levels. This decade will be a struggle for the middle class to save and prosper.

What constitutes “middle class†in the United States? If we go by the median household income the figure is roughly $52,000 per year. Some 57 million households live on $52,000 or less per year. This is based on 2008 Census data so it is very likely that figure is down to $50,000. In fact, 38 million households are receiving food assistance so some are below the poverty line.

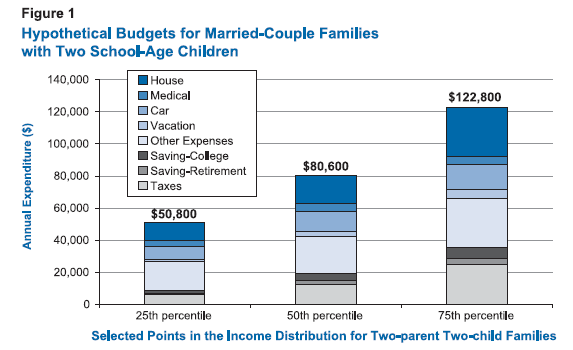

Let us look at how much income is used up by breaking down a few hypothetical budgets:

Source:Â U.S. Department of Commerce

The biggest line item for most American families is housing. When housing prices expanded into a massive bubble, more Americans to keep up with the middle class ideal took on more and more mortgage debt. But without growing incomes they were seeing more of their money being funneled into servicing the mortgage debt. With the advent of interest only and negative amortization loans, the process of building equity never took place and in some cases actually grew the initial mortgage balance. Instead of saving, many middle class families saw their net worth retreat backwards. This was one really new facet in this current economic crisis. Traditional mortgages were once seen as a forced savings account because every month a portion of the principal was paid off. Once you reached the later years of the mortgage, more and more went to paying off the mortgage. That was not the case with some of the debt we saw in the last decade.

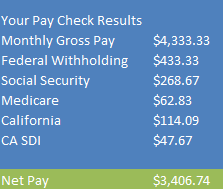

Part of the two income trap is hidden in more troubling ways. Take for example automobile costs. Most Americans with a two income household have two cars. Let us assume that both cars were bought for $20,000 each and carry a $300 monthly payment. So $600 a month right? Wrong. What about fuel? Add $100 to $200 per month depending on how much you drive. Car insurance? This will be roughly $100 per month. Car service? Try another $50 to $100 per month. So in total, many families are spending $600 to $900 per month on car costs. And people aren’t taking much home after taxes:

So the take home pay for the middle class family is $3,400 if they live in California. Subtract that $900 in auto costs and you are now down to $2,500. In places like California where the median home price went up to $500,000 any middle class family stood no chance at buying a home. Well, they were able to buy but holding on to the home was another story. Yet people bought at these peak levels and that is why we are seeing such large number of foreclosures in the state but also in other states. Even last month the number of foreclosure filings in California was near record levels. The middle class is finding it tougher and tougher to keep their head above water.

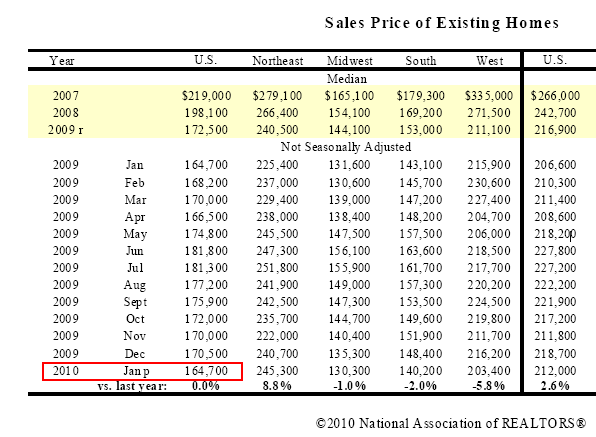

Let us run the numbers if someone were to buy a home:

The latest home price for existing home sales in the U.S. is $164,700 for the median. It is interesting to note that we are now back to January of 2009 levels and for 2009, prices did go up but went full circle back. Let us assume this family uses a FHA backed loan and is only required to put 3.5% down:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $5,764

Mortgage payment (PITI):Â Â Â Â Â Â Â Â Â Â $1,098

So take that $2,500 left over and now subtract this amount. $1,402 is what is left over. This is the amount of money left over for food, healthcare (one illness and that is it with no insurance), and other daily good costs. What about retirement savings? That has to come from here as well. The money can go quickly. What about cells phones? Utility bills? Quickly that number dwindles. And keep in mind this is household income. As we now know many families are seeing one of their incomes disappearing and people are having a hard time finding work:

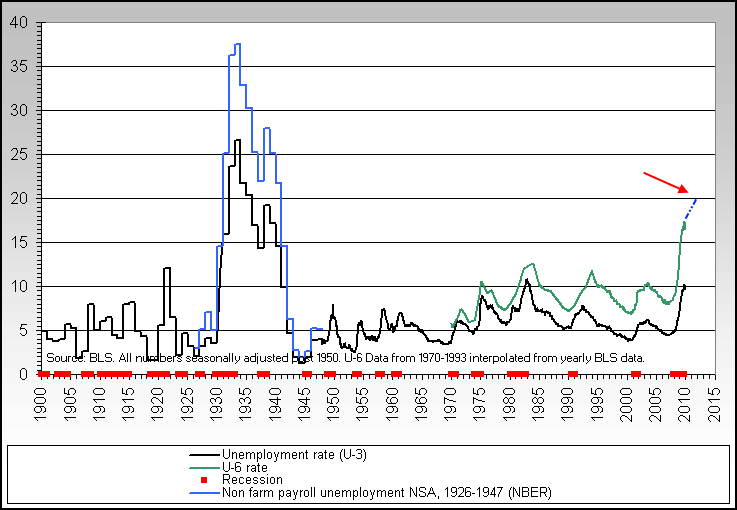

Source:Â Itulip

When I look at the above chart it doesn’t take a rocket scientist to figure out that many people are still in the throngs of the recession. The talk of recovery is muted by the reality of the numbers and all the average American will see is a recovery on Wall Street but in terms of their pocket book, little is funneling to them. I’ve heard from people across the country looking for work and being unable to find anyone hiring. And if they do find something, the wages are much less than what they once earned. This isn’t reflected in the data. How many people that are now marked as fully employed are in jobs that now pay less than what they once had? That is why problems even in credit cards are filtering all the way to the bottom of the bank balance sheet. People are relying on credit cards as their last lifeline and many banks are now shutting these off.

What was once thought of as middle class security is now heavily at risk:

-Secure job   [no longer]

-Steady home values [no longer]

-Access to affordable education [costs are outpacing inflation]

-Healthcare costs are skyrocketing with an aging population [just look at your insurance premiums]

The middle class is really coming under an onslaught of issues. What we do in terms of financial reform and also, how we view our compact with our nation are going to be really important going forward. But if the only sure thing is protecting banks from failure, then we are seeing the fruits of that decision playing out.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

BillK said:

“38 million households are receiving food assistance”

Not quite.

As at Nov 2009, 38 million individuals get food stamps.

About 17.5 million households.March 4th, 2010 at 3:25 am -

dblzedd said:

The systematic and near total destruction of the middle-class is the most positive political development in years in the US. This element of the American society is the most brainwashed, indoctrinated bunch of idiots, obedient to power, obsessed with privilege and comfort and so terribly compromised politically, that no meaningful reforms will every emerge from this social layer. The middle class is historically, the single biggest obstacle to revolution and usually the primary source of its betrayal. They like to lament the greed and incompetence of the governing economic, political and cultural elites who threaten their incomes, savings and privileges, yet line up to take the well paying jobs working for them in government, corporations and other institutions. They are worst that prostitutes as they would stab anyone in the back for a pat on the head or a few more crumbs from the masters tables. They take their clues from the upper classes, adopting their values and obsessions as their own, ultimately defending the interests of the these classes against all others.

&%#)&*@ the middle class…I look forward to seeing them starve and penniless as the sheriff reposes their cardboard shitboxes. Only then will they see, and even then they will want, more than anything, to be let back in beg for scraps.

“To possess what you do not possess, you must go by way of dispossion” TS Eliot

March 5th, 2010 at 5:36 am -

ALK said:

You give the median household income at $52,000, but the graph from the Dept of Commerce shows that the median household income for a family with two adults and two children is $80,600. When you did your two income family with two cars example, you started with the $52,000 figure ($4,333.33 a month). You should have started with $6,716.67 a month for the two income family. The $52,000 figure includes a lot of single people households, so is not relevant to your example.

March 5th, 2010 at 8:07 am -

Jenna's Bush said:

“When housing prices expanded into a massive bubble, more Americans to keep up with the middle class ideal took on more and more mortgage debt. ”

But too much of this “ideal” involved keeping up with the Joneses, installing granite countertops and stainless steel appliances, along with buying SUVs and taking fancy vacations. No one forced them to cash-out their equity to purchase these things

March 5th, 2010 at 9:37 am -

NOTaREALmerican said:

Come-on here… We all know that the middle-CLASS isn’t just about money, it’s about ability. The REAL middle-CLASS are the people that are successful, and know that America is the best country in the entire universe. The rest are just a bunch of unemployed losers – who doubt America – and should stop living off of welfare and get a job (they’re just a bunch of welfare queens).

If you admit you’re a unemployed loser you’re not a REAL American; you’re actually nothing but one of “those people”.

You figure it out.

March 5th, 2010 at 11:21 am -

Humble Income, Humble Abode said:

“When housing prices expanded into a massive bubble, more Americans to keep up with the middle class ideal took on more and more mortgage debt. ”

This is a self-inflicted problem. No one held a gun to their heads to buy a McMansion they obviously couldn’t afford. No one in their right mind should buy anything who’s affordability hinges solely upon

the expectation of ones’ income increasing in the future. This goes not only just for individuals, but for companies and governments as well – spending “anticipated revenue” before said revenue materializes is foolish. Same goes for anticipated increases in income. IMHO,30-year mortgages should be illegal – if you can’t pay off your home in 5 years, 10 at the MOST, you are buying too much home. I paid mine off in 18 months (and my $20k a year income is consiere “lower middle class”, at best). If everyone simply bought what they could afford, we wouldn’t be in this mess. Instead,we have a gov’t spending our unborn grandchildrens` “anticipated tax revenue”, and a nation of house-debtors dragging us frugal folks down into the pit with them.March 5th, 2010 at 4:08 pm -

JP Merzetti said:

I’d say it’s an important point that median household income doesn’t really buy a ticket for middle class anymore. And therein likes the problem.

Middle class tickets have been purchased for some time now, on credit, not on earnings.

That this has driven the sorry shadow economy is no surprise. Just randomly scanning media advertising tells us all we really need to know about the tantalizing little angel whispers reverberating through the sensibility of the populace.As more folks wise up (a dozen times bitten, a hundred times shy?) we’ll no doubt see a new trend of discontinuing conspicuous consumption….no more keeping up with Joneses.

It’ll be a matter of just keeping, period. (home, family, a car, the dog, and sanity…)Real middle class, as we used to know it….has probably scampered like a frightened rabbit upwards into the top two quintiles (the top 40%) leaving what’s left of the bottom 60 floundering like catfish on a Mississippi levee…..high and dry.

Of course, most of the bottom area of that segment are all probably trying to sustain lifestyles of the rich and famous…so the scramble continues.

It isn’t just a lame thing that real home economy has been hit in the teeth with income stagnation (or worse.)

It’s this weird thing….that great social shame seems to beget the impoverishment of non-aquisition in such a consumerist society.

As if we had to shop like Titans just to keep the whole GDP going.March 13th, 2010 at 5:53 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!