Unwealthy in America: New study finds that Top 1 percent hold 37 percent of nation’s wealth. A quarter of US families feel they are under economic stress caused by the Great Recession.

- 0 Comments

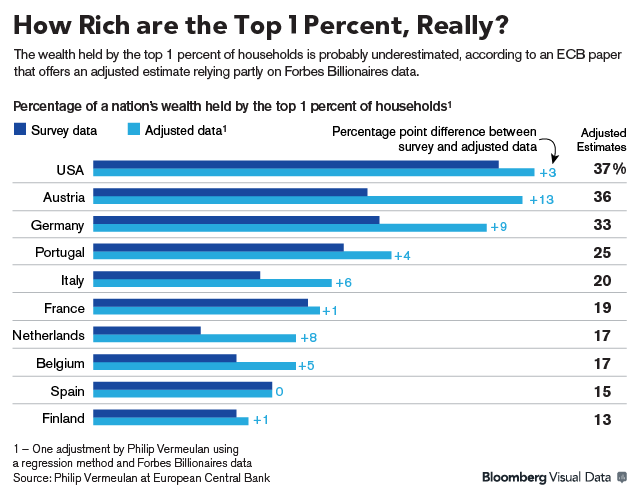

Wealth matters. Saving and investing are the cornerstone to having a long-term successful future. Yet for most Americans, the ability to gather and save wealth is slipping through their fingers like sand through an hourglass. A new study finds that the top one percent actually hold more wealth than we once thought. Why? First, there is underreporting and also, for the ultra-wealthy tax shelters and income sources are diverse making it harder to track. This isn’t your typical W-2 worker household. This data is transparent. A new study looking at Forbes information and other figures found that in the US, the top one percent hold a stunning 37 percent of all wealth available. This is 3 percent higher than previous data. We can also look at income figures and find that for the lower 80 percent of this nation, household income growth has been stagnant for more than a generation. Wealth inequality is going to happen but when things get this disjointed, you start seeing cracks in the system. For example, many retailers are finding tougher times ahead while ultra-luxury stores are doing exceptionally well since the top slice of the pie is grabbing a hold of more wealth. How else can you have a year where the stock market reaches a peak while 47 million Americans are on food stamps, another record that shouldn’t carry any pride with it? Let us take a look at wealth in America.

Wealth in America

Wealth is necessary for a financial future and a healthy retirement. For most workers, this is a slow methodical process of saving and investing. Yet most Americans because of stagnant income growth have been finding it harder to save money after all expenses are paid out. Inflation has a slow eroding power to it leaving many with weaker purchasing power. Being able to save is incredibly important but the current financial system is not helping people out. Take housing for example. This is the largest line item of wealth for regular families. Yet since the recession ended in 2009, Fed policy and banking initiatives have pushed large investors and hedge funds into crowding out regular families in the single family home sector. In other words, the one place most Americans used to build wealth was co-opted by large pools of money and Wall Street making it more expensive for regular families to buy thus stunting their road to building wealth.

A recent report found that we actually underestimate how much wealth the ultra-wealthy have. For example, in the US 37 percent of all wealth is held by the top one percent:

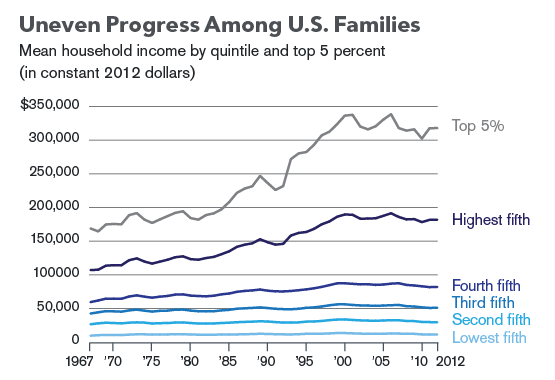

Other countries like Austria have even poorer reporting of wealth since many use offshore accounts that are tougher to track. The problem with wealth being held in so few hands is one of consumption. In the US, our economic engine is pushed by overall consumer spending. Our marquee companies are driven by consumer demand. Companies like Apple or Amazon depend on regular consumer spending. Yet consumer spending is hitting a snag because income growth is stagnant for most of the country:

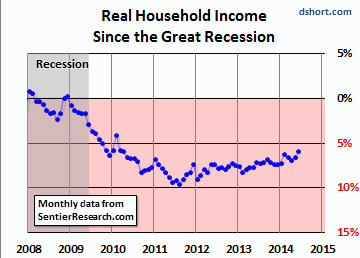

Real income growth for the bottom 80 percent of the country has simply not occurred since the 1980s. This is problematic. This is why inflation is a big deal even if official reporting has it low. Even if inflation is running at 2 or 3 percent, with stagnant incomes a slow erosion is unfolding. Income ties in directly with wealth building because you need to generate income to start saving. They go hand and hand. This is why we also have a looming retirement crisis on our hands. People simply did not save and prepare for retirement in large numbers. Take a look at real income growth since the recession ended:

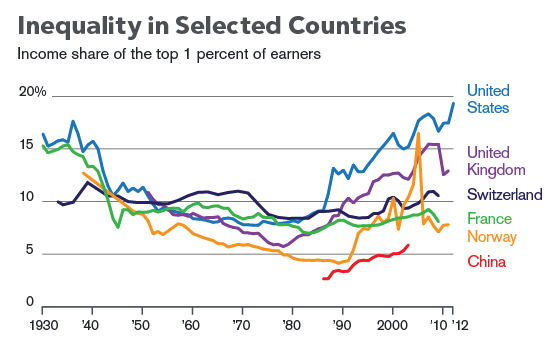

Instead of building wealth, many are fighting just to keep up. Real household income growth has not happened since the recession ended. Yet wealth continues to aggregate in fewer hands. The US has some incredible income inequality that was last seen during the 1920s:

In fact, income inequality today is even worse during the ostentatious and spendthrift Roaring 20s. This is why you have luxury automobiles and jewelers doing exceptionally well even though other consumer outlets are having a tough time. Study after study confirms this challenge:

“(Reuters) – A quarter of U.S. families feel they are under economic stress due to the aftershock of the Great Recession and most do not expect their wages to increase in the next year, according to a new Federal Reserve study released on Thursday.

In its first large-scale study of household finances, the U.S. central bank uncovered lingering effects of the sharpest economic downturn since the Great Depression, with 42 percent of respondents saying they had delayed major purchases and 18 percent saying they put off a major life decision, including buying a home or getting married, due to the crisis.

Thirty-six percent said they now planned to retire later, according to the online survey.â€

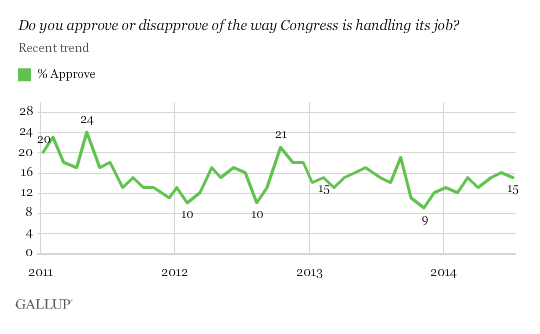

This all circles back to lower consumption and putting off bigger purchase. The Great Recession ended in 2009 officially but look at all the previous data. Many are still feeling the effects of the Great Recession because at least in their balance sheet, it is still going on. Wealth inequality is always going to be present but a large part of this recovery has focused on troubling aspects of our financial system. Many of the banks that led us into the Great Recession are the big winners from the bailouts and continue to expand their wealth. This isn’t free market competition where we reward the best and brightest, we are rewarding cronyism and those that can buy their way into selective legislation. It is no surprise that Congress has a record low approval rating:

Keep in mind the recession officially ended in 2009. People overall don’t mind seeing people become wealthy. In fact, that is deep in the spirit of American entrepreneurialism. But what is entrepreneurial with rewarding mega banks on Wall Street with bailouts and preferential treatment when they created products that harmed working class families? How is that free market competition? Unfortunately not much was fixed during the Great Recession and we continue on a path where low wage labor is pushed onto the public as if it was the only way forward. Since the system seems to continue on this road, wealth inequality is only going to get worse.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!